Summary PBOC fixed USD/CNY at the highest level since December 14. Bank Indonesia delivered a larger than expected 50 bp to 5.25%. Bulgarian Prime Minister Boyko Borissov survived a second no-confidence vote this year. Turkish President Recep Tayyip Erdogan was re-elected but with sweeping new powers. Saudi Arabia, Kuwait, and UAE are reportedly in talks to help stabilize Bahrain. The South African Reserve Bank basically ruled out further easing. Brazil government cut the inflation target to 3.75% +/- 1.5 percentage point for 2021. Stock Markets In the EM equity space as measured by MSCI, Mexico (+3.8), Colombia (+2.9%), and the Russia (+2.3%) have outperformed this week, while China (-3.5%), Chile (-2.9%), and

Topics:

Win Thin considers the following as important: 5) Global Macro, Brazil, Bulgaria, China, emerging markets, Featured, Indonesia, newslettersent, Saudi Arabia, South Africa, Turkey

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Summary

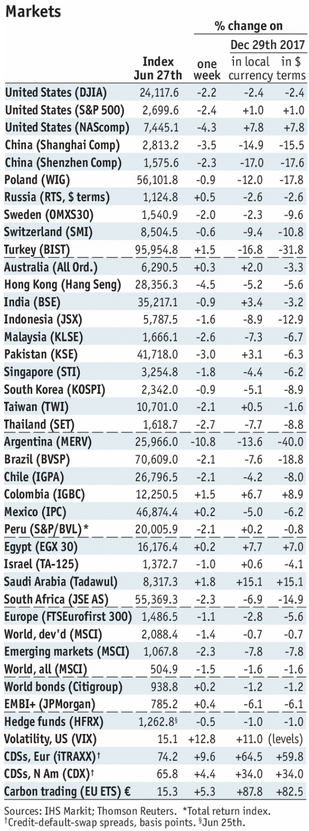

Stock MarketsIn the EM equity space as measured by MSCI, Mexico (+3.8), Colombia (+2.9%), and the Russia (+2.3%) have outperformed this week, while China (-3.5%), Chile (-2.9%), and Thailand (-2.0%) have underperformed. To put this in better context, MSCI EM fell -1.7% this week while MSCI DM fell -0.6%. In the EM local currency bond space, Brazil (10-year yield -25 bp), Mexico (-21 bp), and Peru (-13 bp) have outperformed this week, while Turkey (10-year yield +44 bp), Indonesia (+25 bp), and Argentina (+24 bp) have underperformed. To put this in better context, the 10-year UST yield fell 5 bp to 2.85%. In the EM FX space, TRY (+2.1% vs. USD), MXN (+1.8% vs. USD), and RUB (+0.5% vs. USD) have outperformed this week, while ARS (-6.4% vs. USD), CLP (-2.2% vs. USD), and ZAR (-1.9% vs. USD) have underperformed. To put this in better context, MSCI EM FX fell -1.0% this week. |

Stock Markets Emerging Markets, June 27 |

ChinaPBOC fixed USD/CNY at the highest level since December 14. Despite rising concerns that China is purposely devaluing the yuan, we believe the recent weakness simply reflects broad-base EM FX weakness. To keep things in perspective, note CNY remains one of the top performers in EM at -2% YTD. IndonesiaBank Indonesia delivered a larger than expected 50 bp to 5.25%. Most analysts expected 25 bp, though a handful looked for 50 bp. Though inflation remains low, the bank had hiked twice already to help support the rupiah. Governor Warjiyo said the move was meant to keep ahead of the curve. He added that the hikes will be supported by intervention in the FX and bond markets in order to ensure sufficient liquidity. We expect more hikes in H2. BulgariaBulgarian Prime Minister Boyko Borissov survived a second no confidence vote this year. The opposition called the vote over what it sees as the government’s failure to curb crime and boost the nation’s defense capabilities. The vote was 131-104 without any abstentions to reject the motion. This should allow the government to proceed with plans to adopt the euro. TurkeyTurkish President Recep Tayyip Erdogan was re-elected but with sweeping new powers. He won with 53% of the vote vs. 31% for runner-up Muharrem Ince of CHP. Under the new system, the post of Prime Minister was abolished. The President will be able to issue decrees without parliamentary approval, and the cabinet will consist of presidential appointees rather than elected lawmakers. Saudi ArabiaSaudi Arabia, Kuwait, and UAE are reportedly in talks to help stabilize Bahrain. Saudi press reports that the countries will finalize a stabilization program “soon.” Bahrain’s central bank reiterated its commitment to the peg. Prime Minister Khalifa Bin Salman Al Khalifa has set up a committee to help balance the budget, which also includes the Finance Minister and central bank chief. South AfricaThe South African Reserve Bank basically ruled out further easing. It noted that it has little room for further interest rate cuts unless the inflation outlook improves. SARB was in a very modest easing cycle, cutting 25 bp last July and then another 25 bp in March. Balance of risks are now clearly to the upside for rates but we see steady rates at July 19 meeting. Much will depend on the rand in H2. BrazilBrazil government cut the inflation target to 3.75% +/- 1.5 percentage point for 2021. There had reportedly been a split in the government, with Treasury wanting to reduce it to 3.75% while the Planning Ministry wanting to keep it steady at 4%. The targets for 2019 and 2020 are 4.25% and 4% +/-1.5 percentage points, respectively. This compares to the 2018 target of 4.5% +/- 2 percentage points. |

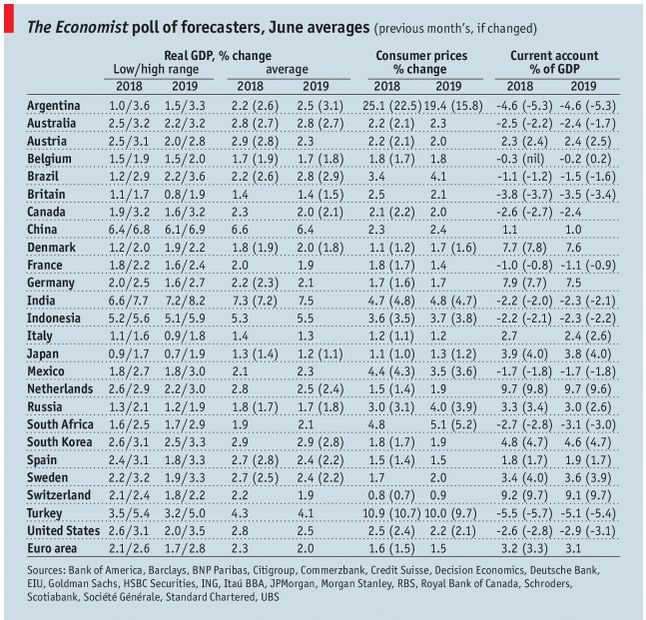

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, June 2018 Source: economist.com - Click to enlarge |

Tags: Brazil,Bulgaria,China,Emerging Markets,Featured,Indonesia,newslettersent,Saudi-Arabia,South Africa,Turkey