Overview: A nervous calm hangs over the markets as the US goes to the polls. The proximity of the presidential contest warns that the results may not been known as soon as people hope. Indeed, many fear the voting simply begins the next phase of the contest, with premature declarations of victory and disputes over votes. The dollar is in mostly narrow ranges today, but the Antipodeans and Scandis are the strongest, and the Reserve Bank of Australia kept rates on...

Read More »Eurobonds Behind Euro$ #5’s Collateral Case

The bond market is allegedly populated by the “smart” set, whereas those trading equities derided as the “dumb” money (not without some truth). I often wonder if it’s either/or. The fixed income system just went through this scarcely three years ago, yet all signs and evidence point to another repeat. So, how smart can Eurobond agents really be if they’ve gone and done it again? What is it? Let’s roll the clock back to the landmine of 2018. Collateral shortage,...

Read More »As The Fed Seeks To Justify Raising Rates, Global Growth Rates Have Been Falling Off Uniformly Around The World

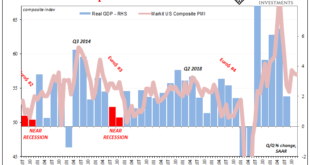

Sentiment indicators like PMI’s are nice and all, but they’re hardly top-tier data. It’s certainly not their fault, these things are made for very times than these (piggy-backing on the ISM Manufacturing’s long history without having the long history). Most of them have come out since 2008, if only because of the heightened professional interest in macroeconomics generated by a global macro economy that can never get itself going. What PMI’s do have going for them is...

Read More »FX Daily, January 21: It is the ECB’s Turn but Little New to be Said or Done

Swiss Franc The Euro has fallen by 0.06% to 1.0761 EUR/CHF and USD/CHF, January 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 and NASDAQ gapped higher yesterday to record-levels, and the reflation theme lifted Asia Pacific shares for the third session today. South Korea, Taiwan, and China led the advance. Europe’s Dow Jones Stoxx 600 gapped higher and is consolidating, seemingly waiting for...

Read More »FX Daily, November 23: Markets Look Past Near-Term Challenges

Swiss Franc The Euro has risen by 0.08% to 1.0806 EUR/CHF and USD/CHF, November 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: News that the AstraZeneca vaccine was 70% effective but could be enhanced by changing dosage is lifting spirits and boosting equities. Japan’s markets were closed for a national holiday, but all the equity markets in the region advanced and many by more than 1%. Strong export figures...

Read More »FX Daily, November 20: US Treasury-Fed Dispute Spurs Handwringing but Immediate Market Impact was Exaggerated

Swiss Franc The Euro has fallen by 0.14% to 1.080 EUR/CHF and USD/CHF, November 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: News that the stimulus talks between the House Democrats and Senate Republicans was the excuse traders were looking for to extend the US equity gains yesterday, but shortly after the close, confirmation that Treasury was not going to agree to extend several Fed facilities sent stocks...

Read More »FX Daily, April 30: ECB Takes Center Stage

Swiss Franc The Euro has fallen by 0.38% to 1.0545 EUR/CHF and USD/CHF, April 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities continue to recover even as deep economic contractions are reported. Yesterday, the US said Q1 GDP contracted at an annualized pace of 4.8%, while the eurozone reported today that output fell 3.8% quarter-over-quarter in Q1. Hong Kong and South Korea were closed, but the rest...

Read More »FX Daily, March 30: Monday Blues

Swiss Franc The Euro has fallen by 0.36% to 1.0553 EUR/CHF and USD/CHF, March 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk appetites remain in check as the spread of the coronavirus is leading to more and longer shutdowns. Asia Pacific equities fell with Australia, the notable exception. Its benchmark rallied a record 7%, encouraged by additional stimulus measures. Led by financials, following new...

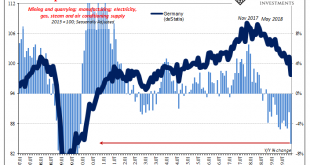

Read More »As the Data Comes In, 2019 Really Did End Badly

The coronavirus began during December, but in its early stages no one knew a thing about it. It wasn’t until January 1 that health authorities in China closed the Huanan Seafood Wholesale Market after initially determining some wild animals sold there might have been the source of a pneumonia-like outbreak. On January 5, the Wuhan Municipal Health Commission issued a statement saying it wasn’t SARS or MERS, and that the spreading disease would be probed. In other...

Read More »FX Daily, December 3: US Brandishes Tariff Weapon and Weakens Animal Spirits

Swiss Franc The Euro has fallen by 0.29% to 1.0946 EUR/CHF and USD/CHF, December 3(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Asia Pacific equities mostly declined in sympathy with yesterday’s large sell-off in the US and Europe. China and Taiwan were the notable exceptions, while Australia’s 2.2% decline, following the central bank meeting that resulted in what many are seeing as a hawkish hold, led the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org