I will begin my remarks with an overview of the situation on the financial markets, before giving an update on the status of the reforms regarding reference interest rates. And in closing I would like to say a few words about our branch office in Singapore, which is celebrating its fifth anniversary. Situation on the financial markets Let me start with the developments on the financial markets. The first half of 2018 was characterised by a return of volatility on the markets, as well as price movements shaped by the continuing normalisation of monetary policy in the US. The higher volatility followed a prolonged phase of exceptionally low levels, and was driven by the marked correction on global equity markets in

Topics:

Andréa Maechler considers the following as important: 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

I will begin my remarks with an overview of the situation on the financial markets, before giving an update on the status of the reforms regarding reference interest rates. And in closing I would like to say a few words about our branch office in Singapore, which is celebrating its fifth anniversary.

Situation on the financial markets

Let me start with the developments on the financial markets.

The first half of 2018 was characterised by a return of volatility on the markets, as well as price movements shaped by the continuing normalisation of monetary policy in the US.

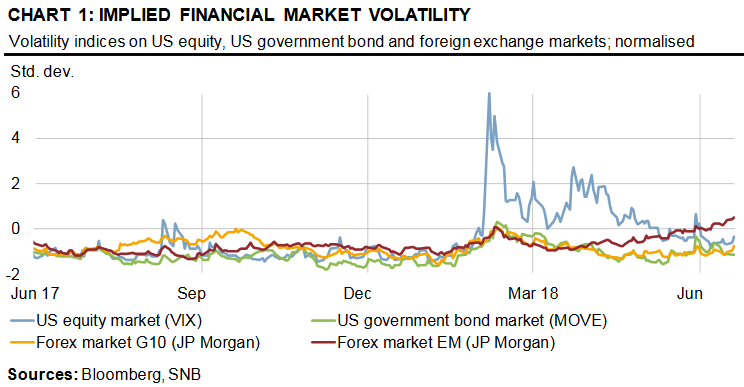

| The higher volatility followed a prolonged phase of exceptionally low levels, and was driven by the marked correction on global equity markets in February. Furthermore, uncertainty has repeatedly been fuelled by concerns over increasing global trade conflicts and mounting geopolitical tension. The most pronounced fluctuations were to be found on the equity markets, whereas the impact on risk sentiment in other asset classes was modest (cf. chart 1). In the second quarter, the focus shifted increasingly to concerns regarding the euro area, with risk premia rising considerably at times amid the difficulties in forming a government in Italy and the vote of no confidence held in Spain. At regional level, various asset classes were affected by a flight to safe havens. However, the situation has calmed down again slightly of late with the formation of a new government in Italy. Contagion effects at the global level remained relatively limited.

As the tightening in US monetary policy continued, the divergence between the US Federal Reserve’s stance and that of the central banks in the other advanced economies became more pronounced. This also influenced developments on the global financial markets. The yield on 10-year US Treasuries rose markedly, and in April climbed back above 3% for the first time since 2014. The interest rate differential between the US and the euro area thus widened: while yields in the US reflected the positive momentum in the economy, economic data in the euro area were slightly weaker and, together with increased political uncertainty, this weighed on government bond yields. Although the reversal in interest rates in the US initially had a relatively modest impact on emerging economies, the markets in these countries have come under pressure in the first half of this year as a result of the stronger US dollar and the rise in long-term interest rates in the US. In certain countries, risk premia were additionally pushed higher by macroeconomic and political factors. |

Implied Financial Market Volatility 2017-2018 |

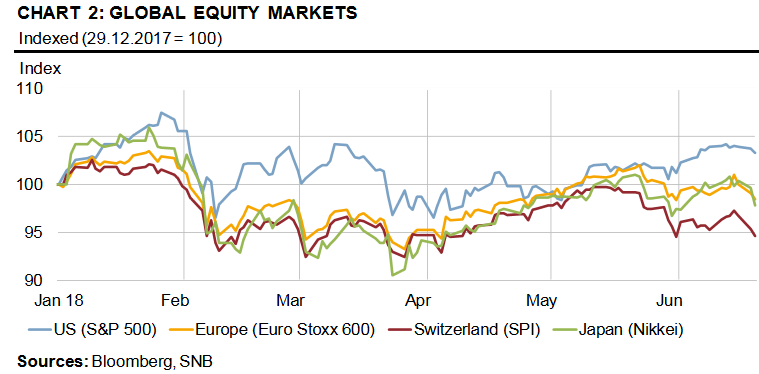

| Against this backdrop, the performance on global equity markets was mixed. In the US, the S&P 500 was able to more than recoup the losses suffered in the first quarter, and has gained around 3% in the year to date. It was buttressed in particular by US companies continuing to post solid earnings growth in the first three months of the year. In Europe and Asia, following an interim correction, the increase in uncertainty in the euro area and the renewed escalation of the trade dispute between the US and China has recently weighed on share prices. The Euro Stoxx 600 and Japan’s Nikkei thus lost around 2% each. Given the high weighting of defensive stocks, the broad Swiss equity market index, the SPI, had previously been unable to profit to the same degree from the recovery in risk sentiment, and remains down around 5% (cf. chart 2). |

Global equity markets 2018 |

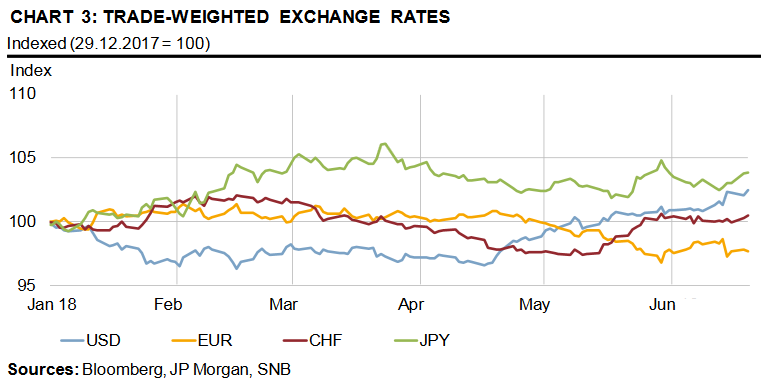

| At the beginning of the year, the foreign exchange market was dominated by the weakening of the US dollar, with a correction only coming in the course of the second quarter owing to markedly rising US interest rates. The euro was initially largely stable until impacted by weaker economic data in the euro area and political uncertainty surrounding the formation of a government in Italy. Given the heightened uncertainty worldwide, the yen was in demand and appreciated as a result (cf. chart3). |

Trade-Weighted exchange rates 2018 |

The situation on the global financial markets is currently somewhat volatile again. The ‘Goldilocks’ environment for the markets that was still prevailing at the start of 2018 –namely stable economic momentum coupled with low inflation rates and persistently low financial market volatility– has deteriorated slightly over the past six months in light of the aforementioned events. Political developments, increasing protectionist tendencies and challenges arising from the ongoing norm alisation of monetary policy in the advanced economies have the potential to trigger further tension on the global financial markets.

Status of reference interest rate reforms

I would now like to address the progress that has been made with regard to reforming reference interest rates. Since the UK Financial Conduct Authority announced nearly a year ago that it would not guarantee the continuation of Libor beyond 2021, there have been increasing efforts at both international and national levels to find a replacement. The key forum in this respect in Switzerland is the National Working Group on Swiss Franc Reference Interest Rates, which is open to representatives from all major stakeholders such as banks and other financial market participants as well as the ir respective industry associations. In October 2017, the working group recommended the Swiss Average Rate Overnight (SARON) as the alternative to the Swiss franc Libor. The primary focus at present is on the implications of the changeover to SARON for the derivatives and capital market and the loan and deposit market.

SARON has already gained in importance as a reference interest rate, and now forms the basis of a corresponding yield curve. Although the outstanding volume on the newly established Overnight Index Swap (OIS) market, which uses SARON, is still modest, it has been rising steadily in recent months. Going forward, this curve could serve for the pricing of Swiss franc loans, as is currently the case with Libor. This would improve the environment for replacing Libor.

All market participants must ensure that they are well prepared for the probable discontinuation of Libor from the end of 2021. Responsibility for a smooth transition lies with the private sector. Among the issues to be resolved are the treatment of existing Libor-linked contracts and the design of SARON-referenced products. The SARON yield curve should also be developed further, with more players participating in this market segment. These challenges should thus be prioritised accordingly. This also means that viable solutions must be developed quickly and the necessary framework established. The SNB will continue to support the efforts of the National Working Group in a coordinating role, while also running the latter’s technical secret ariat.

Singapore branch office celebrates fifth anniversary

In closing, I would now like to say a few words about our branch office in Singapore. At our news conference in June 2013, the SNB announced that its newly opened Singapore office would commence operations the following month. Five years on, this is a good opportunity for us to take stock.

Singapore is the SNB’s first and only branch office outside Switzerland. The team currently has nine members of staff, and their primary task is to ensure the efficient management of the SNB’s currency reserves in the Asia-Pacific region. It is well known that the SNB’s currency reserves have risen substantially as a result of the monetary policy measures aimed at countering the strength of the Swiss franc. We therefore felt it appropriate to expand our investment universe, in particular also in the high-growth region of Asia. The portfolio managers at our Singapore branch now manage bonds and stocks worth some CHF90 billion, the key investments being denominated in yen, Australian dollars, South Korean won, Chinese renminbi and Singapore dollars.

Having a presence in Asia is also highly beneficial when it comes to implementing monetary policy on the foreign exchange market. Currency trading is known for being a round-the-clock business with no such thing as opening hours. Our branch in Singapore is able to ensure the seamless continuation of foreign exchange market coverage when it is night in Switzerland.

Having a local SNB presence in Asia has also proved to be very advantageous with regard to monitoring and analysing developments on the financial markets. This provides us with a deep understanding of the market and economic environment in the Asia-Pacific region, which is becoming ever more significant for the global economy.

Tags: Featured,newsletter