Forthcoming slower US Q1 GDP can be considered temporary and technical.The Bureau of Economic Analysis will release the preliminary estimate of Q1 GDP growth on 27 April. Currently Q1 growth is tracking around 2% q-o-q (annualised), a deceleration from 2.9% in Q4-2017. We think this slowdown is transitory and does not reflect the underlying growth trend; we expect some solid catch-up in Q2.We are marking up our Q2 growth forecast to 3.6% from 3.0%, as we expect both investment and consumption to be at full steam. We are encouraged by the ongoing improvement in the US energy sector, which should provide further impetus to Q2 investment. We are also taking note of the solid growth in commercial and industrial bank lending in recent weeks, breaking a period of tepidness, which is likely to

Topics:

Thomas Costerg considers the following as important: Macroview, US GDP growth, US Q1 GDP

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Forthcoming slower US Q1 GDP can be considered temporary and technical.

The Bureau of Economic Analysis will release the preliminary estimate of Q1 GDP growth on 27 April. Currently Q1 growth is tracking around 2% q-o-q (annualised), a deceleration from 2.9% in Q4-2017. We think this slowdown is transitory and does not reflect the underlying growth trend; we expect some solid catch-up in Q2.

We are marking up our Q2 growth forecast to 3.6% from 3.0%, as we expect both investment and consumption to be at full steam. We are encouraged by the ongoing improvement in the US energy sector, which should provide further impetus to Q2 investment. We are also taking note of the solid growth in commercial and industrial bank lending in recent weeks, breaking a period of tepidness, which is likely to echo more solid investment. Meanwhile, we think consumption should show a solid pick-up in Q2, especially as household incomes grew strongly in Q1 after the tax cuts, while consumer credit remains abundant.

We think part of the likely Q1 softness will be the result – once again – of statistical issues with residual seasonality (see also ‘Chart of the Week – Statistical issues’). The good news is that the likely slowdown in Q1 GDP growth was not reflected in either employment data or business surveys.

However, there remains some uncertainty about the H2 2018 outlook. While we keep our optimism for now, we note that the ‘policy risks’ have risen, particularly on the back of the heightened US trade rhetoric. We will monitor business surveys closely to see whether confidence is ultimately affected.

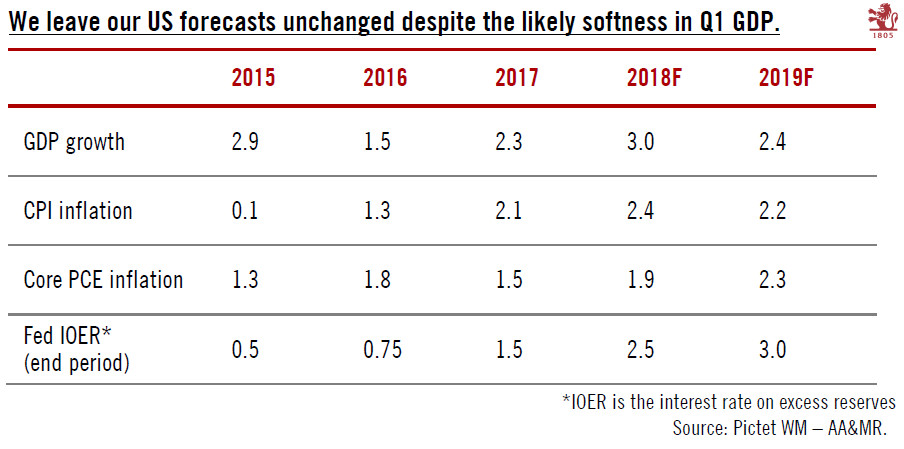

Our full-year US growth forecast remains at 3.0%. We still expect a total of four Fed rate hikes this year, with the next one likely at the June meeting.