After a difficult start to the year, we remain neutral on prospects for developed market investment grade credits for the coming 12 months.Although US investment grade (IG) and euro IG have posted a negative total return so far this year, credit continues to offer interesting yield pick-up for investors (especially in euro).Overall, we are neutral on prospects for US and euro IG over the coming 12 months. We see US and euro credit yields rising due to higher sovereign yields (especially for German Bunds) and slightly wider spreads.Two opposing forces will be behind this spread widening. On the one hand, solid fundamentals and expectations of rising profits, especially in the US thanks to the tax reform, should push down credit spreads. On the other, rising USD hedging costs has led

Topics:

Laureline Chatelain considers the following as important: credit spreads, German Bund yield, high-yield bonds, investment grade outlook, Macroview, US Treasury yield

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: Happy Days Are Here Again!

Joseph Y. Calhoun writes Weekly Market Pulse: The Real Reason The Fed Should Pause

Joseph Y. Calhoun writes Weekly Market Pulse: No News Is…

Joseph Y. Calhoun writes Weekly Market Pulse: Opposite George

After a difficult start to the year, we remain neutral on prospects for developed market investment grade credits for the coming 12 months.

Although US investment grade (IG) and euro IG have posted a negative total return so far this year, credit continues to offer interesting yield pick-up for investors (especially in euro).

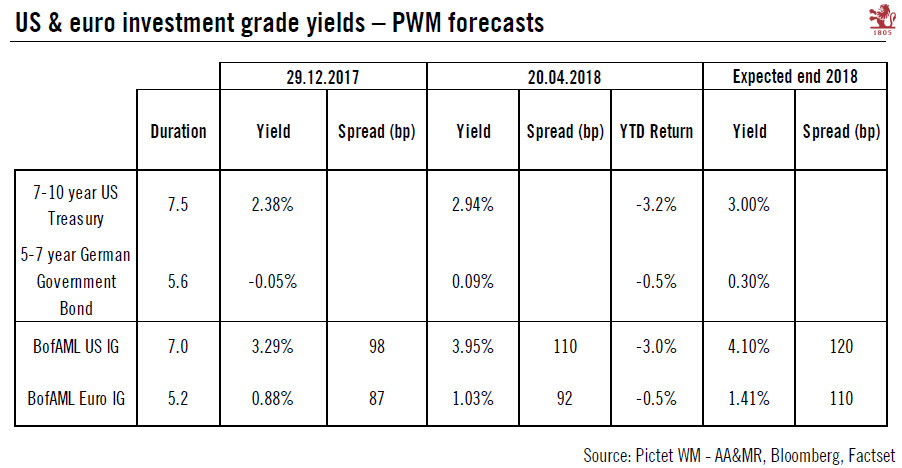

Overall, we are neutral on prospects for US and euro IG over the coming 12 months. We see US and euro credit yields rising due to higher sovereign yields (especially for German Bunds) and slightly wider spreads.

Two opposing forces will be behind this spread widening. On the one hand, solid fundamentals and expectations of rising profits, especially in the US thanks to the tax reform, should push down credit spreads. On the other, rising USD hedging costs has led foreign investors to reduce their buying of US IG. These investors could look for alternatives in the euro credit space, leading to wider US spreads and tighter euro ones. But as euro IG remains distorted by the European Central Bank (ECB) purchases, the ECB’s exit from quantitative easing (QE) could impact euro IG spreads negatively, which come move closer to US levels.

We expect the US Treasury (7-10 years) yield to move up from 2.9% currently to about 3.0% by end-2018 and the German equivalent from 0.1% to about 0.3%. We believe that the rise of the US Treasury and German Bund yields should push US and euro IG yields higher. Slightly wider spreads should also put upward pressure on IG yields. Finally, investors should keep in mind that credit offers an interesting yield pick-up thanks to the additional spread over government bonds it offers. For this reason, as part of a diversified strategic asset allocation, it makes sense to have investments in credit as this spread always translates into higher coupons than those offered by safe-haven bonds.