The contours of the investment climate are unlikely to change based on next week’s economic data from the US, Japan, or Europe. The state of the major economies continues to be well understood by investors. Growth in the US, EU, and Japan remains solid, and if anything above trend, as the year winds down. The incremental data will likely show that the eurozone economic momentum is intact with the November flash PMI. Japan’s October trade balance is expected to be little changed, but strong imports and exports are consistent with a revival of trade activity seen this year. The US durable goods orders, stripped of aircraft and defense orders, to get the underlying signal, are expected to have risen around 0.6% in

Topics:

Marc Chandler considers the following as important: Brexit, ECB, EUR, Featured, Federal Reserve, FX Trends, GBP, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The contours of the investment climate are unlikely to change based on next week’s economic data from the US, Japan, or Europe. The state of the major economies continues to be well understood by investors.

Growth in the US, EU, and Japan remains solid, and if anything above trend, as the year winds down. The incremental data will likely show that the eurozone economic momentum is intact with the November flash PMI. Japan’s October trade balance is expected to be little changed, but strong imports and exports are consistent with a revival of trade activity seen this year. The US durable goods orders, stripped of aircraft and defense orders, to get the underlying signal, are expected to have risen around 0.6% in October, which would be just below this year’s average (0.8%), but follows three consecutive months of more than 1.2% increases.

Instead of focusing on latest iterations of high frequency data, investors will likely focus on policy developments. Here, US tax reform and the minutes/record from the latest FOMC and ECB meetings standout. In the UK, Brexit and the budget are the focus.

United StatesUS tax reform made important progress last week. The House of Representative approved its version. The Senate Finance Committee approved its version. The next step is a vote on the Senate floor. This could come after the return from the Thanksgiving break, after which there are a dozen legislative sessions before next month’s holiday break. However, we are skeptical that the bill can pass in its current form. The regressive nature of the proposals and the divisive inclusion of the repeal of the individual mandate for the Affordable Care Act will produce at least three defections from the Republican Party. Indeed, nearly 2/3 of the economists polled by Reuters (November 13-17) were not confident that tax reform would pass this year. Many who think it might be passed next year seem to expect a scaled-down version that may rely on temporary cuts more than reform per se. If the tax bill falters on the floor of the Senate, as we think likely, the stock market may be vulnerable to disappointment and volatility would likely increase. Bond yields may ease, and with the short-end anchored by the expected path of Fed policy, the yield curve may flatten further. In the currency market, on a purely directional basis, the yen is the most sensitive to US 10-year yields (past 60-day correlation 0.94). The Swiss franc (0.86) is followed by the Australian dollar (0.81) and the Norwegian krone (0.80). The correlation between the 10-year yield and euro (and Swedish krona) lag behind but is still robust at 0.76, while the Canadian dollar’s correlation is a touch lower at 0.74. Sterling is the outlier with a correlation of 0.18 over the past 60 sessions. The Federal Reserve and the ECB release the minutes/record of their most recent meetings. The FOMC meeting was as much of a non-event as its meetings can be, with no forecast updates, press conference, or new initiatives. Perhaps the most interesting thing about the November 1 FOMC meeting is that Powell knew he would be nominated to be the next Chair, though Yellen apparently did not. A debate over the extent that the Fed’s reduction of the balance sheet will tighten financial conditions has emerged. Many argue that the $450 bln reduction of the Fed balance sheet envisioned by the end of next year is tantamount to 100 bp hike in the Fed funds rate. We respectfully demur. The difference in views stems from a disagreement on how the asset purchases worked. Given that US Treasury yields fell on the announcement and rose on the actual purchases underscores, in our mind, the important of the signaling channel for impact as opposed the material impact. This is not so much a resurrection of the debate over flows (purchases) versus stock (holdings) as it is an appreciation of the significance of official communication. In recent speeches, central bank officials seemed to acknowledge this and give credence to our emphasis. That said, where we do agree is that investors may be underestimating the extent of Fed tightening in 2018. This is not because of the balance sheet effects, but because we expect the Fed to raise rates two or three times in 2018, while the market has a little more than one discount. A Reuters survey found that most economists it surveyed expect the Fed to hike rates twice next year, which is somewhere in between what the market is discounting and what the Fed’s forecasts suggest. |

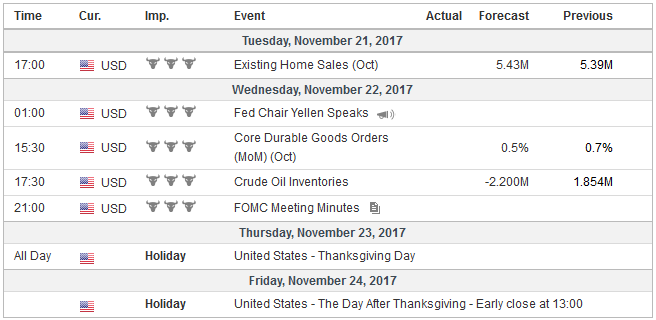

Economic Events: United States, Week November 20 |

EurozoneThe ECB’s meeting’s October 26 meeting was more significant. It announced the extension of its asset purchases through September 2018 at half the current 60 bln euro monthly pace. There are two debates that investors may look at the record to shed light. First, the ECB left the end date of its program open-ended. Some officials wanted to provide a date certain that it would end. The position is understandable. Growth remains above trend, and the threat of deflation has been extinguished. However, tactically it would be a mistake. It would minimize the central bank’s options. It would likely produce an undesirable impact in the market by increasing interest rates, and thus undermining the ongoing operation. One thing we do not think has been fully taken into account is that when the ECB meets in the June and July next year, the balance sheet may have begun shrinking. The cause of this would not be the scarcity of securities that some are focused on, but rather starting in the middle of next year, the TLTROs (long-term borrowings) can begin being repaid early without penalty. New lending is growing slowly, and negative rates still associated with dominating short-term and intermediate-term rates, we suspect some banks will want to return the undesired and costly liquidity. The ECB charges 40 bp on deposits. The German curve is negative through seven years, and the French curve is negative through five. Spain, Portugal, and Italy offer negative rates out through three years. One of the reasons that the ECB shied away from calling its announcement tapering is that its extraordinary policies have not changed. Its negative deposit rate remains. It will continue to fully meet all demand at its refi operations conducted at zero interest rates. The second debate may have been over linking these measures to some inflation. This issue can be expected to get more airtime next year. |

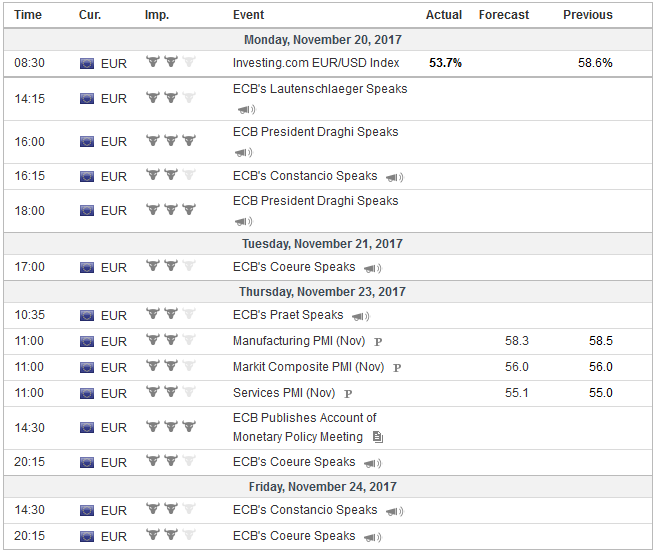

Economic Events: Eurozone, Week November 20 |

United KingdomPolitical drama may be most profound in the UK. Two issues dominate. The budget and Brexit. Chancellor of the Exchequer Hammond will make his budget statement on Wednesday. Expectations are rightfully low. The Chancellor had to quickly backtrack from his March initiative to raise the National Insurance contribution of some self-employed people. He is likely to be particularly cautions this time. His tenure may depend on it. The revised forecasts of the Office of National Statistics do not give Hammond much room to maneuver even if he was so inclined. Growth forecasts have been revised lower, and as a consequence, the projected deficit is larger than previously anticipated. Brexit continues to be vexing. For the past eight months, UK officials appear to have struggled to get their heads around the legal fact that once Article 50 was invoked, the power of the agenda and negotiations shifts to the EU. EU has clearly demanded that progress is made on three separate issues to move forward on the terms of the new relationship. The three issues are the rights of EU citizens in the UK, the Irish border, and the UK’s willingness to make good its past financial commitment to the EU. EU Council President Tusk gave the UK a two-week deadline to make progress, or he will not endorse the beginning of the next phase of negotiations at the December heads of state summit. The pressure is on the UK to take action. Reports suggest a mini-cabinet meeting of key Brexit ministers on Monday may be a potential turning point and poses a risk for a spike in sterling volatility. There are rumors that a significant cabinet shakeup also may be announced shortly. Sterling has been in a roughly $1.30-$1.33 trading range for the past two months. It has been confined to a range against the euro. The euro has traded largely between GBP0.8750 and GBP0.9050. Perhaps what Churchill once said about Americans-that they could be counted on to do the right thing, after the alternatives have been exhausted, might apply to the UK here. Anything that suggests the UK and/or the EU is moving away from the brink may be seen as sterling positive. We think an upside break should be respected. |

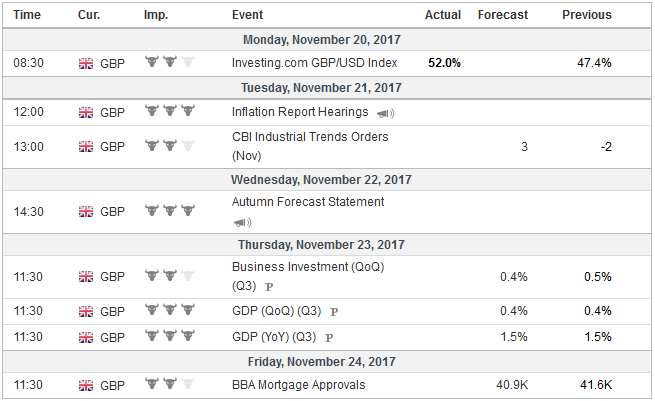

Economic Events: United Kingdom, Week November 20 |

Switzerland |

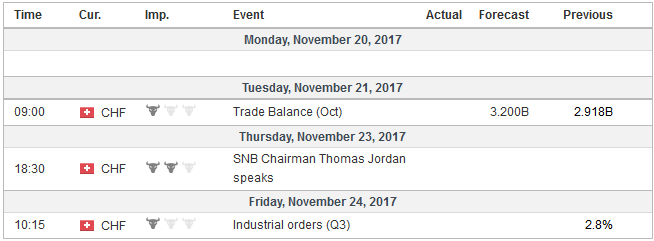

Economic Events: Switzerland, Week November 20 |

Tags: #GBP,#USD,$EUR,Brexit,ECB,Featured,Federal Reserve,newsletter