Tax reform could help sluggish demand for corporate loans, but unlikely to be a game changer when it comes to business investment.A key question for the 2018 US outlook, and beyond, is whether US firms will finally open their purses and invest more after years of frugality. Investment is key to sustaining the current expansion. Recent buoyant business surveys like the ISM manufacturing index seem to point that way. However, a chasm has opened between what firms are saying and what they do. Recent solid investment data has been mostly concentrated in the energy sector. To track what firms do, we like to look both at commercial and industrial (C&I) bank lending and demand for bank loans, as contained in data in the Federal Reserve’s senior loan officer survey. The news is not good on either

Topics:

Thomas Costerg considers the following as important: Macroview, US Chart of the week

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Tax reform could help sluggish demand for corporate loans, but unlikely to be a game changer when it comes to business investment.

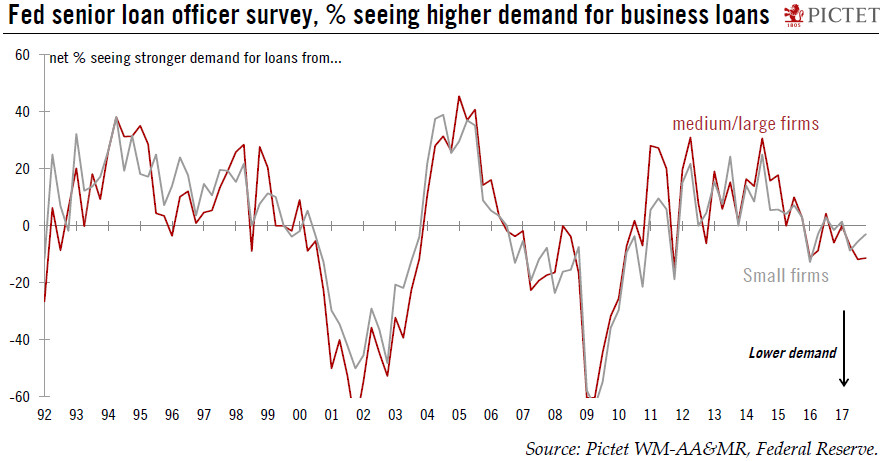

A key question for the 2018 US outlook, and beyond, is whether US firms will finally open their purses and invest more after years of frugality. Investment is key to sustaining the current expansion. Recent buoyant business surveys like the ISM manufacturing index seem to point that way. However, a chasm has opened between what firms are saying and what they do. Recent solid investment data has been mostly concentrated in the energy sector. To track what firms do, we like to look both at commercial and industrial (C&I) bank lending and demand for bank loans, as contained in data in the Federal Reserve’s senior loan officer survey. The news is not good on either front. C&I bank lending has been sluggish lately. Total C&I loans fell by USD 3.9bn in October after a rise of USD11.5bn in September. Y-o-y growth dropped to 1.1% in October, the slowest rate since April 2011.

The latest data from the Fed’s senior loan officer survey suggests slow lending is mostly due to firms being reluctant to borrow rather than to lenders reluctant to lend. Indeed, the net percentage of loan officers seeing stronger demand remained in negative territory in Q3 2017 for both small firms and medium-sized/large firms. Bank loans are particularly critical for investment by small firms, who may not have access to capital markets (where financial conditions remain very loose).

While accelerating global growth is a tailwind for the US economy, the still-slow underlying investment picture remains a source of fragility worth noting. While tax reform could help the corporate investment picture, it is unlikely to be a major game changer, in our view. We will monitor lending data closely.