Greater visibility on the ECB’s plans for dealing with the overhang of non-performing loans would help banks and the euro area recovery.The ECB has become under renewed pressure over its recent guidance on non-performing loans (NPL) and its plan to force banks to increase provisions against bad loans. The backlash, including at this week’s European parliament hearing of Danièle Nouy, Chair of the Supervisory Board, was fuelled by various gripes, including whether the ECB has gone beyond its mandate on this issue. But Nouy argues that today “is the right time” to tackle NPL amid a strong recovery.Some confusion remained over the extent to which stricter rules would apply to existing or new NPL only. The ECB plans to give banks seven years to cover secured loans and two years for unsecured

Topics:

Frederik Ducrozet considers the following as important: Banks non-performing loans, ECB bad-loans reduction, ECB guidelines, ECB monetary policy, Europe chart of the week, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Greater visibility on the ECB’s plans for dealing with the overhang of non-performing loans would help banks and the euro area recovery.

The ECB has become under renewed pressure over its recent guidance on non-performing loans (NPL) and its plan to force banks to increase provisions against bad loans. The backlash, including at this week’s European parliament hearing of Danièle Nouy, Chair of the Supervisory Board, was fuelled by various gripes, including whether the ECB has gone beyond its mandate on this issue. But Nouy argues that today “is the right time” to tackle NPL amid a strong recovery.

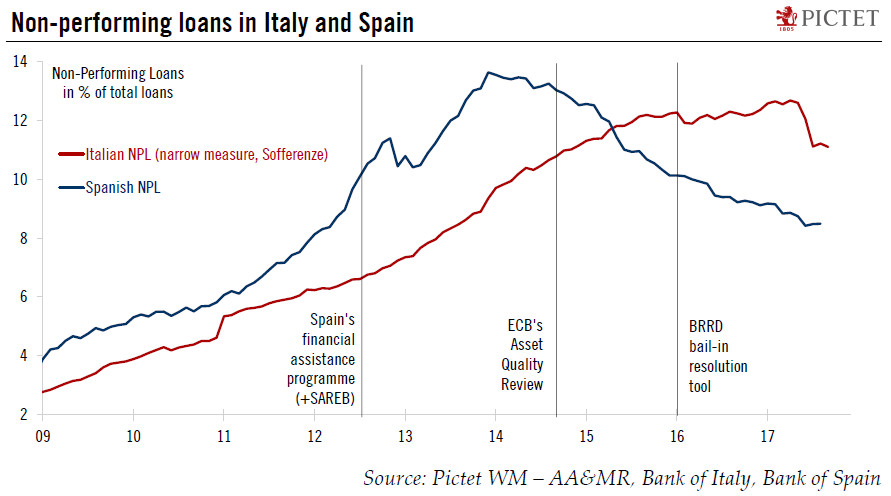

Some confusion remained over the extent to which stricter rules would apply to existing or new NPL only. The ECB plans to give banks seven years to cover secured loans and two years for unsecured loans, and Nouy clearly stated that stricter provisions would only apply to new NPL, including existing loans that would become non-performing from January 2018. Meanwhile, the ECB will stick with its case-by-case approach to legacy debt ahead of possible changes to be announced next year. Needless to say, the market’s focus remains on Italy and its large stock of NPL.

Subtleties aside, we struggle to understand why the single banking regulator would not be in charge of tackling NPL. Arguably, the ECB is facing a trade-off between its support for bank lending and the necessity to strengthen banks’ balance sheets to cope with future crises. This trade-off is consistent with cautious implementation of NPL rules, with Nouy hinting at possible “delays and improvements”. Perhaps more importantly, our impression is that a comprehensive strategy is still lacking that would provide banks with greater visibility about future regulatory constraints. Such visibility could be the game-changer for a sustained recovery in Italy and beyond.