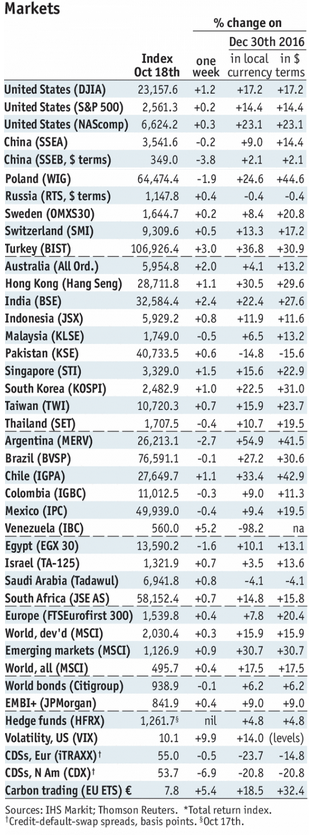

Stock Markets EM FX ended the week on a soft note. Indeed, nearly every EM currency was down for the entire week, led by ZAR, BRL, and TRY. While higher US rates will pressure EM FX as a whole, we think heightend political risk will continue to hit these three currencies particularly hard, plus perhaps MXN too. Stock Markets Emerging Markets, October 21 Source: economist.com - Click to enlarge Korea Korea reports trade data for the first 20 days of October Monday. It then reports Q3 GDP Thursday, which is expected to grow 3.0% y/y vs. 2.7% in Q2. The economic outlook is solid, while price pressures remain low. For now, the BOK can take a wait and see approach and keep rates steady well into 2018. Singapore

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX ended the week on a soft note. Indeed, nearly every EM currency was down for the entire week, led by ZAR, BRL, and TRY. While higher US rates will pressure EM FX as a whole, we think heightend political risk will continue to hit these three currencies particularly hard, plus perhaps MXN too. |

Stock Markets Emerging Markets, October 21 Source: economist.com - Click to enlarge |

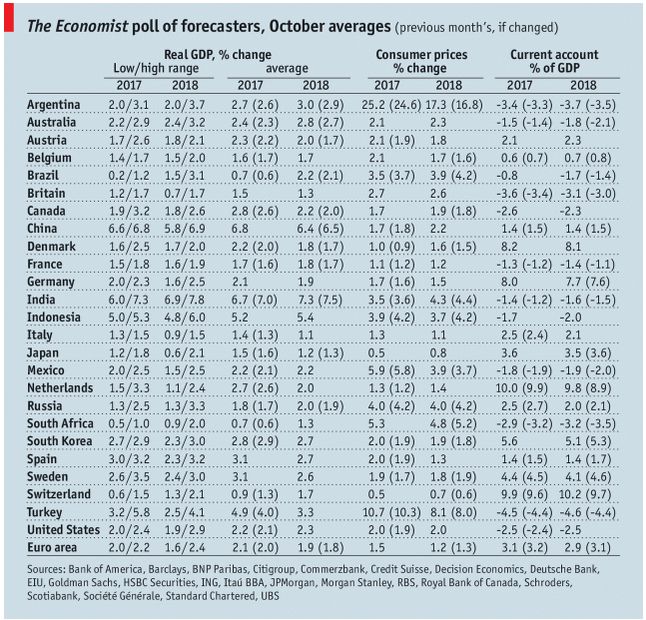

KoreaKorea reports trade data for the first 20 days of October Monday. It then reports Q3 GDP Thursday, which is expected to grow 3.0% y/y vs. 2.7% in Q2. The economic outlook is solid, while price pressures remain low. For now, the BOK can take a wait and see approach and keep rates steady well into 2018. SingaporeSingapore reports September CPI Monday, which is expected to remain steady at 0.4% y/y. The MAS just left policy unchanged at this month’s meeting. While it tweaked its forward guidance slightly, the MAS will find it hard to tighten at the next meeting in April if price pressures remain so low. Singapore then reports September IP Thursday, which is expected to rise 10.4% y/y vs. 19.1% in August. Q3 unemployment will be reported Friday and is expected to remain steady at 2.2%. TaiwanTaiwan reports September IP Monday, which is expected to rise 4.5% y/y vs. 3.25% in August. The economic outlook is solid, but there are no price pressures to speak of. CPI rose only 0.5% y/y in September. The central bank does not have an explicit inflation target, but we think low readings will allow it to keep policy steady well into 2018. HungaryHungary central bank meets Tuesday and is expected to keep rates steady. It just loosened policy at its September meeting, and is unlikely to move again until the December meeting. The economy remains robust, and so we think any further easing is risky as price pressures in the region are picking up. MexicoMexico reports mid-October CPI and August GDP proxy Tuesday. Inflation appears to be topping out, but recent peso weakness is the wild card. We think Banxico would prefer not to hike again, but the exchange rate may force its hand. Next policy meeting is November 9, our base case now is no change then. Mexico then reports September trade data Thursday. South AfricaSouth African Finance Minister Gigaba presents the government’s medium-term budget policy statement Wednesday. The budget outlook has deteriorated, and so the government is under pressure to present some steps to address this. We do not expect a strong effort, and so the rating agencies are likely to downgrade South Africa after the reviews November 24. BrazilCOPOM meets Wednesday and is expected to cut rates 75 bp to 7.5%. IPCA inflation was 2.5% y/y in September, right at the bottom of the 2.5-6.5% target range. Price pressures are picking up, and so we see one last 50 bp cut at the December 6 meeting for a terminal SELIC rate of 7%. Brazil then reports September current account, FDI, and central government budget data Thursday. TurkeyCentral Bank of Turkey meets Thursday and is expected to keep rates steady. Inflation was 11.2% y/y in September, well above the 3-7% target range. Yet the bank will be under great pressure not to tighten any further. We expect further erosion of confidence in the nation’s institutions as a result. RussiaCentral Bank of Russia meets Friday and is expected to cut rates 25 bp to 8.25%. A small handful of analysts look for a 50 bp cut. Inflation was 3% y/y in September well below the 4% target. While a bigger move is possible, we think the bank will play it safe with a 25 bp cut and follow up with another cut at its next meeting December 15. ColombiaColombia central bank meets Friday and is expected to keep rates steady at 5.25%. The bank remained on hold in September as inflation ticked higher to 4% y/y. However, official comments suggest this is just a pause in the cycle. The next meeting after this one is November 24. Timing of the next cut will be very data dependent. |

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, October 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin