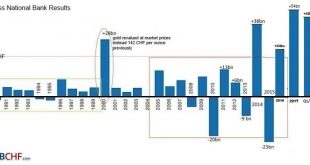

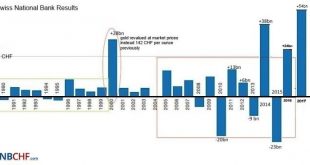

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in...

Read More »Federal Council appoints Martin Schlegel as new Alternate Member of the SNB Governing Board

Martin Schlegel - Click to enlarge At its meeting of 4 July 2018, the Federal Council appointed Martin Schlegel as the new Alternate Member of the Governing Board of the Swiss National Bank (SNB), following the proposal of the SNB’s Bank Council. He will take up the position of Deputy Head of Department I as of 1 September. Martin Schlegel is currently Head of the SNB’s branch office in Singapore. Having graduated...

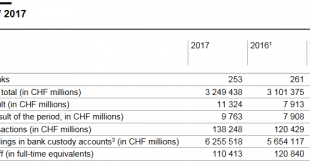

Read More »Banks in Switzerland 2017, Results from the Swiss National Bank’s data collection

Summary of the 2017 banking year Of the 253 banks in Switzerland, 229 recorded a profit in 2017, posting a total profit of CHF 10.3 billion. The remaining 24 institutions recorded an aggregate loss of CHF 0.5 billion. The result of the period for all banks was CHF 9.8 billion. The aggregate balance sheet total rose by 4.8% to CHF 3,249.4 billion. On the assets side, domestic mortgage loans continued to advance, by...

Read More »Swiss National Bank commits to FX Global Code and supports establishment of foreign exchange committee

The Swiss National Bank (SNB) has signed a Statement of Commitment to the FX Global Code (“Code”), thereby demonstrating that its internal processes are consistent with the principles of the Code. It also expects its regular counterparties to adhere to the Code and comply with the agreed rules of conduct. Published on 25 May 2017, the Code outlines principles of good practice developed by central banks and market...

Read More »SNB Statement on the outcome of the popular vote of 10 June 2018

The Swiss National Bank (SNB) has acknowledged the outcome of the popular vote on the sovereign money initiative. The SNB has a constitutional and statutory mandate to pursue a monetary policy serving the interests of the country as a whole. It is charged with ensuring price stability while taking due account of economic developments. The adoption of the sovereign money initiative would have made it considerably more...

Read More »Results of the 2017 survey on payment methods

In the autumn of 2017, the Swiss National Bank (SNB) conducted a survey on payment methods for the first time. The aim of the survey is to obtain representative information on payment behaviour and the use of cash by house holds in Switzerland, and to ascertain the underlying motives for this behaviour. As part of the survey, around 2,000 people resident in Switzerland were interviewed to obtain information on their...

Read More »SNB loses 6.8 billion in Q1/2018

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the...

Read More »SNB reports a profit of CHF 47.6 billion for Q1 2018

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in...

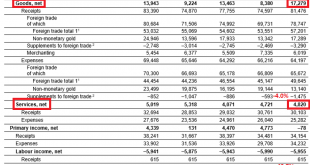

Read More »Swiss Balance of Payments and International Investment Position: Q4 2017 and review of the year 2017

Q4 2017 In the fourth quarter of 2017, the current account surplus amounted to CHF 20 billion, or CHF 2 billion less than the year -back quarter. Lower receipts from investment income resulted in a slight expenses surplus on primary income (labour and investment income), which had shown a receipts surplus in the corresponding quarter of 2016. Moreover, the expenses surplus on secondary income (current transfers) rose....

Read More »SNB Monetary policy assessment of 15 March 2018

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org