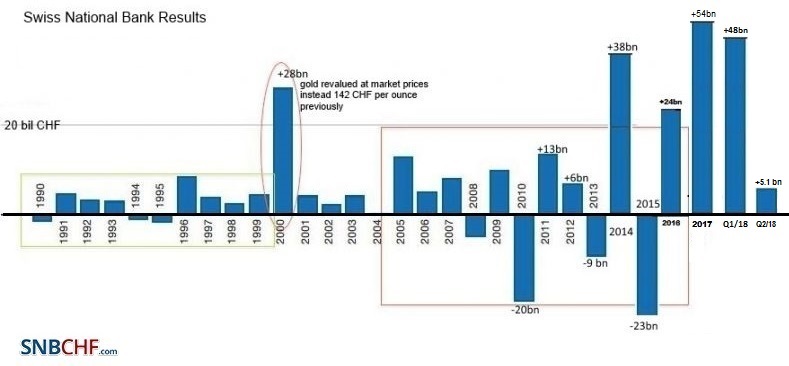

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the good years of the credit cycle now. Franc will rise again with crisis or inflation With a new financial crisis or a with a big rise of inflation, the run into the Swiss franc will start again. And this at an exchange rate that is not digestible for the SNB. We considered that after an inflationary

Topics:

George Dorgan considers the following as important: 1) SNB and CHF, Featured, newsletter, SNB balance sheet, SNB equity holdings, SNB Gold Holdings, SNB Press Releases, SNB profit, SNB results, SNB sight deposits, Swiss National Bank

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The increasing volatility of SNB EarningsAnnual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit CycleThis trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the good years of the credit cycle now. Franc will rise again with crisis or inflationWith a new financial crisis or a with a big rise of inflation, the run into the Swiss franc will start again. And this at an exchange rate that is not digestible for the SNB.

And this will lead to a massive SNB loss around 150 billion CHF. |

SNB Results Longterm Q2 2018 |

Some extracts from the official statement.

|

Income statement, 1 January–30 June 2018 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||

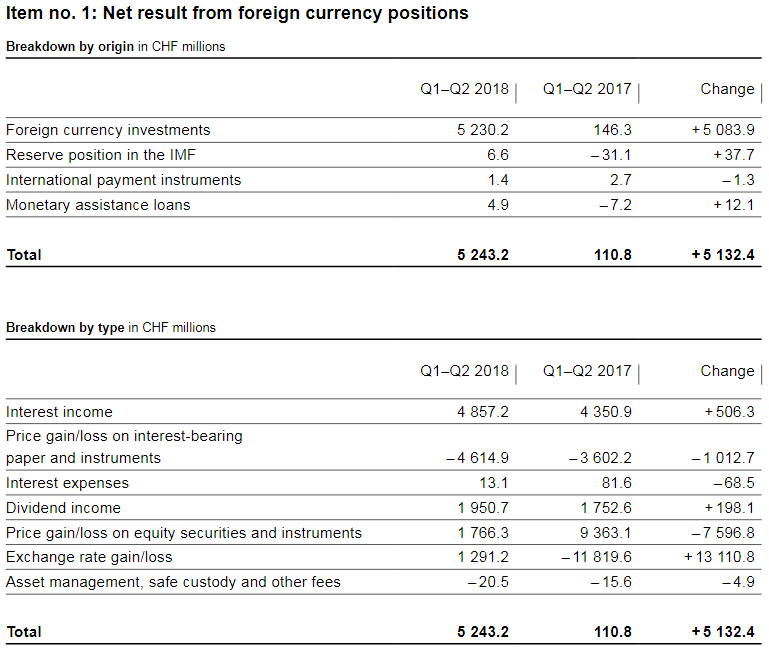

Profit on foreign currency positions

|

SNB Profit on Foreign Currencies Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||

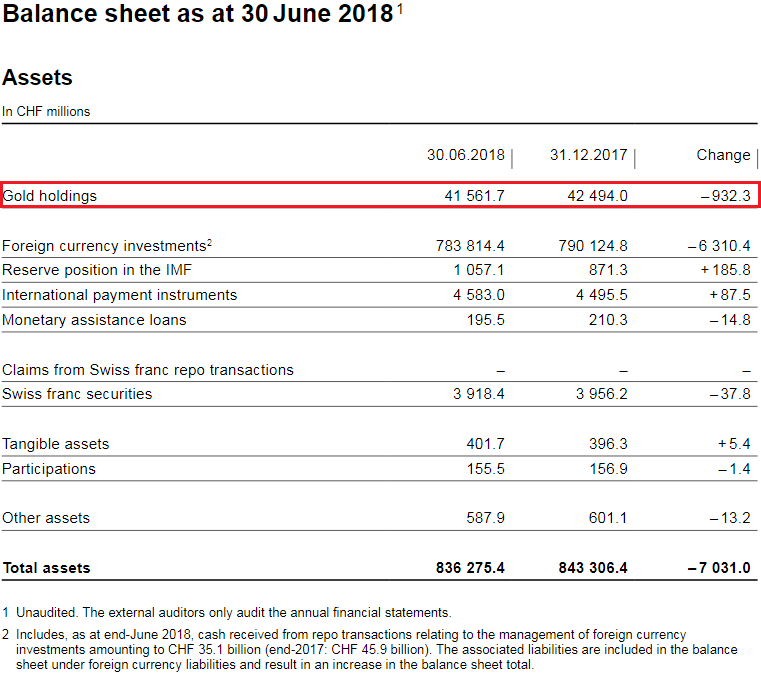

Valuation gain on gold holdings

Percentage of gold to balance sheetThe percentage of gold compared to the total balance sheet is falling.

Balance Sheet The balance sheet has expanded by over 68.3 bn. francs by 8.81%.

|

SNB Balance Sheet for Gold Holdings for Q1-Q2 2018 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||

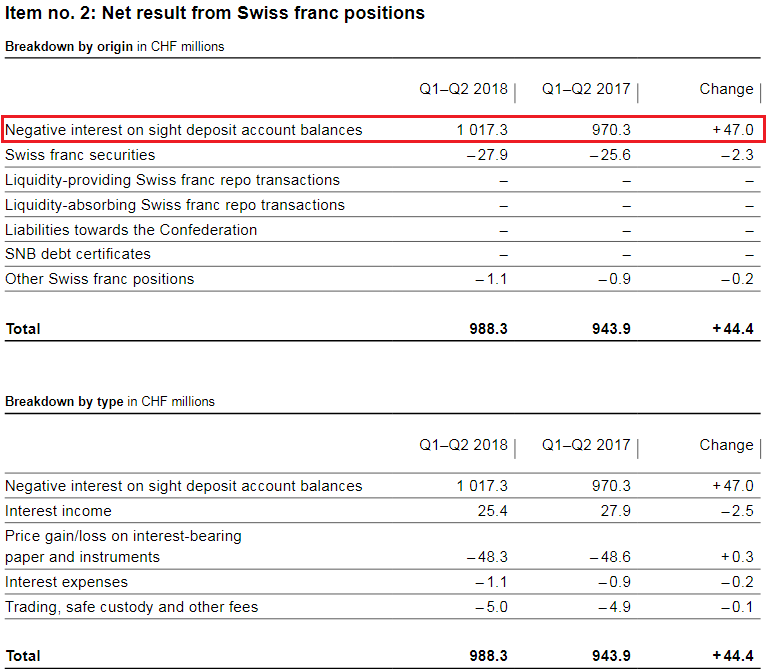

Profit on Swiss franc positionsThe SNB maintains its profitability, last but not least, thanks to the reduction of the profitability of banks. When too many funds arrive on their accounts, they must deposit them on their sight deposit account at the SNB.

Negative Interest ratesFurthermore, the SNB harms the Swiss economy, when it reduces the profits of Swiss banks by negative interest rates. But with this measure she maintains her own profitability.

|

SNB Result for Swiss Franc Positions for Q1-Q2 2018 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||

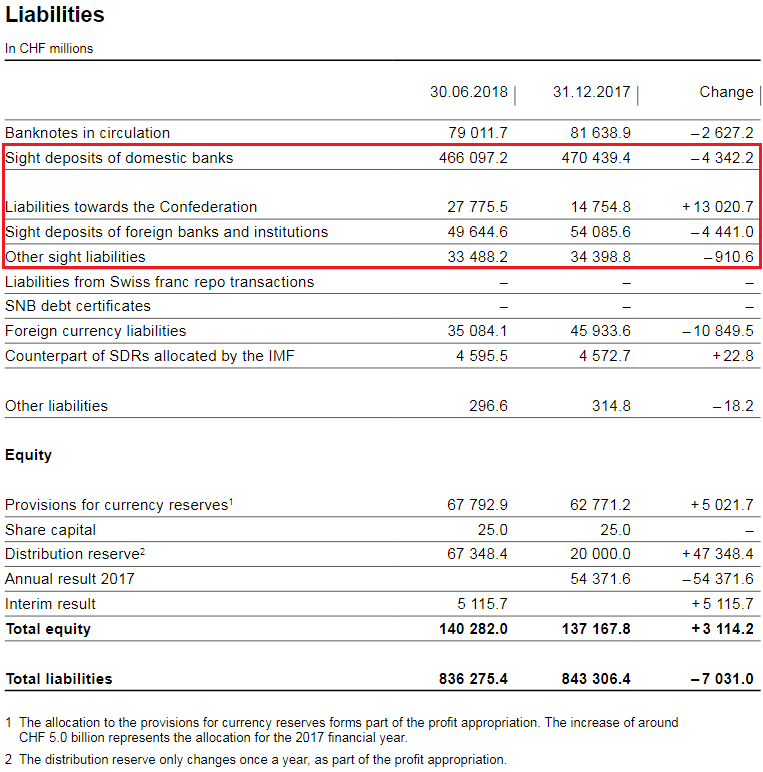

SNB LiabilitiesElectronic Money Printing: Sight Deposits Sight deposits is the biggest part of SNB interventions.

Paper Printing Banknotes in circulation: -2.6 bn francs to 79 bn. CHF

Provisions for currency reserves

|

SNB Liabilities and Sight Deposits for Q1-Q2 2018 Source: snb.ch - Click to enlarge |

Tags: Featured,newsletter,SNB balance sheet,SNB equity holdings,SNB Gold Holdings,SNB profit,SNB results,SNB sight deposits,Swiss National Bank