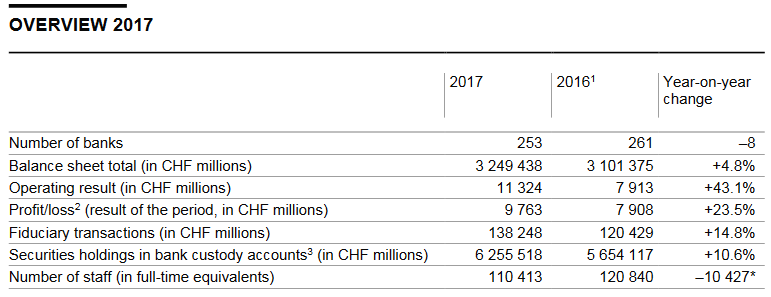

Summary of the 2017 banking year Of the 253 banks in Switzerland, 229 recorded a profit in 2017, posting a total profit of CHF 10.3 billion. The remaining 24 institutions recorded an aggregate loss of CHF 0.5 billion. The result of the period for all banks was CHF 9.8 billion. The aggregate balance sheet total rose by 4.8% to CHF 3,249.4 billion. On the assets side, domestic mortgage loans continued to advance, by 2.7% to CHF 974.7 billion, while on the liabilities side, customer deposits recorded a slight increase overall (1.0% to CHF 1,788.1 billion). Customer holdings of securities in bank custody accounts rose by 10.6%, attaining a new record level at CHF 6,25 5.5 billion. Fiduciary funds administered by banks

Topics:

Swiss National Bank considers the following as important: 1) SNB and CHF, Featured, newslettersent, SNB Press Releases

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Summary of the 2017 banking yearOf the 253 banks in Switzerland, 229 recorded a profit in 2017, posting a total profit of CHF 10.3 billion. The remaining 24 institutions recorded an aggregate loss of CHF 0.5 billion. The result of the period for all banks was CHF 9.8 billion. The aggregate balance sheet total rose by 4.8% to CHF 3,249.4 billion. On the assets side, domestic mortgage loans continued to advance, by 2.7% to CHF 974.7 billion, while on the liabilities side, customer deposits recorded a slight increase overall (1.0% to CHF 1,788.1 billion). Customer holdings of securities in bank custody accounts rose by 10.6%, attaining a new record level at CHF 6,25 5.5 billion. Fiduciary funds administered by banks were up by 14.8% or CHF 17.8 billion, at CHF 138.2 billion. Against the backdrop of regulatory requirements, the big banks transferred in-house services, together with the staff concerned, to services companies within their groups. Since these companies do not have a banking licence, the staff who work for them are not included in the bank statistics. This led to a significant reduction in staff numbers at banks in Switzerland, falling by 10,427 to 110,413 staff in terms of full-time equivalents. In the domestic component, the total number of staff decreased by 7,822 to 93,554 ( –7.7%), while the number abroad declined by 2,605 to 16,858 ( –13.4%). |

Overview 2017 |

Income statement

Of the 253 banks covered in 2017, 229 reported a profit. The aggregate profit amounted to CHF 10.3 billion. The remaining 24 institutions recorded an aggregate loss of CHF 0.5 billion. The result of the period across all banks was thus CHF 9.8 billion, an increase of CHF 1.9 billion over 2016.

The gross result from interest operations decreased marginally in 2017 by CHF 0.1 billion to CHF 24.0 billion, while the increase in interest income (CHF 1.3 billion to CHF 41.8 billion) was slightly less than that recorded in the case of interest expense (CHF 1.4 billion to CHF 17.8 billion). Having declined in the previous years, there was an increase of CHF 0.8 billion in the result from commission business and services to CHF 21.7 billion. The result from trading activities and the fair value option rose by CHF 1.6 billion to CHF 7.7 billion. The other result from ordinary activities item was down by CHF 2.3 billion to CHF 9.0 billion. Operating expenses, which comprise personnel expenses as well as general and administrative expenses, decreased in total across all banks, by CHF 2.0 billion to CHF 44.0 billion. The decline in both the other result from ordinary activities item and operating expenses was linked to the transfer of in-house services by big banks.

In 2017, the operating result amounted to CHF 11.3 billion (2016: CHF 7.9 billion). The profit/loss (result of the period) item is calculated by adding extraordinary income (CHF 1.4 billion) and changes in reserves for general banking risks (CHF –0.6 billion) to the operating result, and then deducting extraordinary expenses (CHF 0.1 billion) and taxes (CHF 2.2 billion). In 2017, the result of the period came to CHF 9.8 billion, or CHF 1.9 billion more than in 2016.

Balance sheet

In 2017, the aggregate balance sheet total for all banks in Switzerland rose by 4.8% or CHF 148.1 billion to CHF 3,249.4 billion. The largest increases in absolute terms were registered by the big banks (7.7% or CHF 111.6 billion), cantonal banks (4.0% or CHF 22.1 billion), branches of foreign banks (22.9% or CHF 17.4 billion) and Raiffeisen banks (4.6% or CHF 10.0 billion) As in 2016, the strongest decline was recorded by the foreign-controlled banks ( –6.8% or CHF –16.8 billion).

Overall, liquid assets decreased by 1.8% (CHF –9.1 billion to CHF 511.4 billion). This was due, above all, to developments abroad (CHF –8.1 billion to CHF 51.5 billion), and in particular to the decline in sight deposits with foreign central banks (CHF– 7.8 billion to CHF 49.7 billion).

Domestic mortgage loans continued to rise (2.7% or CHF 25.3 billion) and reached CHF 974.7 billion. As a result they remained the largest item on the assets side with a share of just under 30% of the balance sheet total. Although stocks of domestic mortgage loans remained virtually unchanged in the big banks category, at CHF 260.5 billion, all other categories registered an increase. The largest advances in absolute terms were recorded for cantonal banks (3.8% or CHF 13.2 billion), Raiffeisen banks (4.4% or CHF 7.2 billion) and other banking institutions (4.3% or CHF 2.4 billion).

Other loans, which are reported in the balance sheet under amounts due from customers, rose by CHF 52.6 billion to CHF 625.9 billion, an increase of 9.2%. While amounts due from customers outside Switzerland were up by CHF 54.3 billion to CHF 469.5 billion, amounts due from domestic customers fell by CHF 1.8 billion to CHF 156.4 billion.

Amounts due in respect of customer deposits registered an overall increase of 1.0% to CHF 1,788.1 billion, taking their overall share in the aggregated balance sheet total to around 55%. Domestic customer deposits were up CHF 57.6 billion to CHF 1,193.4 billion, while foreign customer deposits were CHF 40.5 billion lower, at CHF 594.7 billion. A factor contributing to this divergence was a big bank’s transfer of financing transactions to Switzerland from abroad, accounting for around CHF 17 billion.

Employment

In terms of full-time equivalents, the number of staff at banks in Switzerland fell by 10,427 to 110,413 (–8.6%). In the domestic component, the total number of staff decreased by 7,822 to 93,554 (–7.7%), while the number abroad declined by 2,605 to 16,858 (–13.4%). This significant decline was attributable in particular to the fact that, against the backdrop of regulatory requirements, the big banks transferred service operations including the attendant staff to service companies within their groups.

Further information

The Banks in Switzerland 2017 report and the Overview of reporting banks in Switzerland 2016/2017 can be downloaded from the website of the Swiss National Bank (SNB) at www.snb.ch, Statistics, Reports and press releases, Banks in Switzerland.

The data, as well as the explanatory notes including information on the methodological basis, are published on the SNB’s data portal, data.snb.ch. Users can retrieve data in the form of configurable tables and can access comprehensive datasets.

The printed version of the report may be obtained from the SNB library.

Tags: Featured,newslettersent