By Ronan Manly, BullionStar Much is written in the precious metals world about gold’s characteristics, and how the behaviour of the gold price allows gold to play the role of unique financial asset that retains its purchasing power over time, acts as a safe haven, diversifies risk, and provides hedging benefits. However, much of the material written in this area skips over an explanation of how the simple yet powerful...

Read More »Big Macs, Swiss Francs and Euros

Adjusted for GDP, The Economist’s Big Mac Index suggests that the Swiss Franc is 9 percent over valued relative to the US Dollar while the Euro is 17 percent under valued.

Read More »Fearing Confiscation, Japanese Savers Rush To Buy Gold And Store It In Switzerland

Japan has pushed further away from being the nation that embraces “Krugman Era” economics and deeper into the new “Bernanke Era” economics of helicopter money. As a result Japan’s citizens have been on a blitz to save what little purchasing power they still possess, before hyperinflation finally arrives. The gold price is up double digits in the past month and as we said last night, something big is coming as Japan...

Read More »Offshore Bullion Storage or 3 eggs?

What does one hundred trillion dollars buy you? How about a mansion in every country, an airplane at every airport and a private island in every ocean? How about 3 eggs? When Zimbabwe issued its infamous 100 000 000 000 000 dollar bill, it could buy 3 eggs on the day it was issued. A few days later, it could only buy one egg. Hyperinflating Currencies Unbacked fiat/paper/credit, and nowadays electronic currency, has a poor track record. After studying this list of 609 defunct...

Read More »Financial Revolution: ECB Blames You For Negative Interest Rates

Just after sunrise on April 19, 1775, a large contingent of British military troops arrived to the town of Lexington, Massachusetts. They were under orders to search for and confiscate all weapons and munitions from the colonials– something the British army had done countless times before. In many ways it was a routine operation. And yet, that morning, roughly 80 local militiamen stood blocking their path. Paul Revere had ridden through Lexington only hours before to warn residents of the...

Read More »The Bull Market in Stocks May Be Done

It has come to my attention that, perhaps, the great stock bull market is done. To most people, a bull market is good, and its end is bad. After all, a rising market signifies a healthy economy. Investors are making money. And it seems to prove that the free market is validated, able to deliver miracles despite Obamacare. Share prices are connected to business productivity, aren’t they? In a free market they are, of course. However—and this cannot be said too often—we don’t have a free...

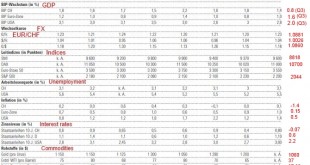

Read More »Economic Forecasts: Swiss Banks were too Optimistic

Our analysis of the forecasts of economic data for 2015 shows that the Swiss banks were too optimistic for most data. US growth, the oil price, inflation and interest rates were far lower in 2015 than they expected. The forecast errors for stock indices and unemployment, however, were smaller. In December 2014, the Neue Zürcher Zeitung (NZZ) published the forecasts of the leading Swiss banks for the year 2015. UBS, Credit Suisse, Julius Bär, die ZKB, Raiffeisen, Pictet und J. Safra...

Read More »Interest – Inflation = #REF

I have to admit that I derive some pleasure in taking on hoary old myths. For example, some economists assert that the interest rate you see on the Treasury bond is not real. You see, it’s only nominal. To calculate the real rate, they say you must adjust the nominal rate by inflation. Real Interest Rate = Nominal Interest – Inflation It seems to make sense. Suppose you have enough cash to feed your family for 2,000 days. Then the general price level increases by 15%. You still have the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org