The Oppressed U.S. Taxpayer This year, Americans’ day of tribute to their federal overlords falls on April 18. As calculated by the Tax Foundation, the average American will work from January 1 to April 24 (Tax Freedom Day) to pay his share of taxes to all levels of government with some $3.3 trillion to be forked over to the federal government and $1.6 trillion to state and local jurisdictions. [1] Image via forbes.com While any talk of tax cuts are verboten on the Democratic...

Read More »Swiss Farm structure census 2015: Farms: between decline and stability

Sorry, I've looked everywhere but I can't find the page you're looking for. If you follow the link from another website, I may have removed or renamed the page some time ago. You may want to try searching for the page: Searching for the terms %3Futm+source%3Dfeedburner%26utm+medium%3Dfeed%26utm+campaign%3DFeed%3A+SnbChf+%28SNB+%26+CHF%3A+The+Swiss+National+Bank+and+Swiss+Franc+Blog%29%26utm+content%3DGoogle+UK ...

Read More »Swiss Labour Force Survey 2015: Large increase in labour market participation of 55 to 64 year-olds

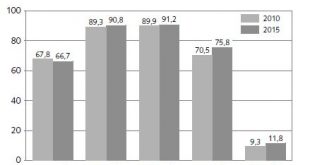

19.04.2016 09:15 – FSO, Labour Force (0353-1603-90) Swiss Labour Force Survey 2015 Large increase in labour market participation of 55 to 64 year-olds Neuchâtel, 19.04.2016 (FSO) – In 2015 the average age of the economically active population was 41.6 years (+0.7 years compared with 2010). The ageing of the economically active population is associated with an increased labour participation of 55 to 64 year-olds: between 2010 and 2015 the economic activity rate of this age group rose by...

Read More »Malaysia CDS Spike After Abu Dhabi Puts Scandal-Ridden 1MDB In Default, Funds hidden in Switzerland

Over the better part of the past year, we’ve documented the curious case of 1MDB, Malaysia’s government investment fund founded in 2009. It’s a long and exceptionally convoluted story that doesn’t exactly lend itself to a concise summary but suffice to say that the development bank was something of a black box right from the beginning and in 2013, some $680 million allegedly tied to 1MDB ended up in Malaysian PM Najib Razak’s personal bank account just prior to an election. There are any...

Read More »US Economy – Ongoing Distortions

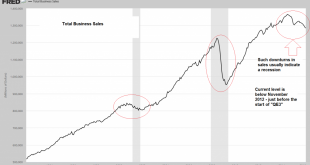

Business under Pressure A recent post by Mish points to the fact that many of the business-related data that have been released in recent months continue to point to growing weakness in many parts of the business sector. We show a few charts illustrating the situation below: A long term chart of total business sales. The recent decline seems congruent with a recession, but many other indicators are not yet confirming a recession – click to enlarge. Wholesale inventories to sales...

Read More »Stunning results achieved by Grail’s Free Portfolio in just two Months!

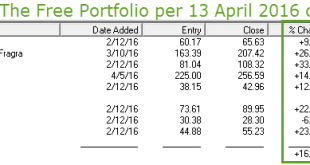

I am very pleased to report that the Free Portfolio in its deadline week exceeded my target of 15%, having reached a return of 16.84%, helped by a gain of 2.7%! The purpose of the portfolio was to give readers irrefutable evidence of the unique power of the Grail Equity Management System (GEMS) to generate high returns with no more risk than the S&P 500. High Return: This graph shows that the mother portfolio has a margin of safety vis-à-vis the index of 23.1%, Low Risk: The...

Read More »Panama Papers Names Revealed: Multiple Connections to Clinton Foundation, Marc Rich

There has been much confusion, at time quite angry, how in the aftermath of the Soros-funded Panama Papers revelations few, if any, prominent U.S. name emerged as a result of the biggest offshore tax leak in history. Now, thanks to McClatchy more U.S. names are finally being revealed and it will probably come as little surprise that many of the newly revealed names have connection to both Bill and Hillary Clinton. Connections to Bill and Hillary Clinton As McClatchy writes, donors to...

Read More »Emerging Markets: Preview of the Week Ahead

EM ended last week on a firm note. Given the absence of any Fed-specific risks or any major US data releases, that firmness could carry over into this week. The failure to reach an agreement in Doha by oil producers is weighing on some countries through lower oil prices, but the global liquidity story ultimately remains risk-supportive for the time being. China data last week was also helpful for market sentiment. Specific country risk remains in play. The Brazil impeachment process...

Read More »Monetary Metals Report: Gold – Silver Opposites

What Differentiates Gold from Silver? Well that was an interesting week. Gold went down over thirty bucks and silver went up over thirty cents. How much longer can this silver rally continue in the face of gold’s non-participation? Will speculators really be comfortable bidding silver up to $20 while gold sits at $1200? Do the fundamentals support a higher silver price? Gold, active June futures contract over the past week – click to enlarge. How is silver different from gold? Aside...

Read More »FX Daily, April 18: Doha Failure Sets Tone

Oil producers failed to reach an agreement yesterday at the meeting in Doha. That is the main spur to today’s activity. It is not that the outcome was a surprise. One newswire poll found around half of the respondents thought an agreement was elusive. Although not oil experts by any stretch, we too thought political considerations made it unlikely that Saudi Arabia would be willing to sacrifice market share to its rival Iran. We also understood why Iran could not accept a freeze on...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org