What Differentiates Gold from Silver? Well that was an interesting week. Gold went down over thirty bucks and silver went up over thirty cents. How much longer can this silver rally continue in the face of gold’s non-participation? Will speculators really be comfortable bidding silver up to while gold sits at 00? Do the fundamentals support a higher silver price? Gold, active June futures contract over the past week – click to enlarge. How is silver different from gold? Aside from being a lot cheaper per ounce, and the fact that an ounce of silver is almost twice as bulky as an ounce of gold, there are two differences. One is that Silver has industrial demand. While virtually every ounce of gold ever mined in history is still in human hands, some silver is consumed. Gold is too expensive to put into most products except in minute quantities (though it is in the iPhone). Most of what goes into electronics is recycled, as circuit boards are equivalent to good ore. As industrial demand falls (witness the collapse in the price of shipping), this component of silver demand falls with it. Silver, active May futures contract over the past week – click to enlarge. Smartphone sales may be strong, but silver is used in everything from cars to washing machines.

Topics:

Keith Weiner considers the following as important: Featured, Gold and its price, newsletter, Precious Metals

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

What Differentiates Gold from Silver?

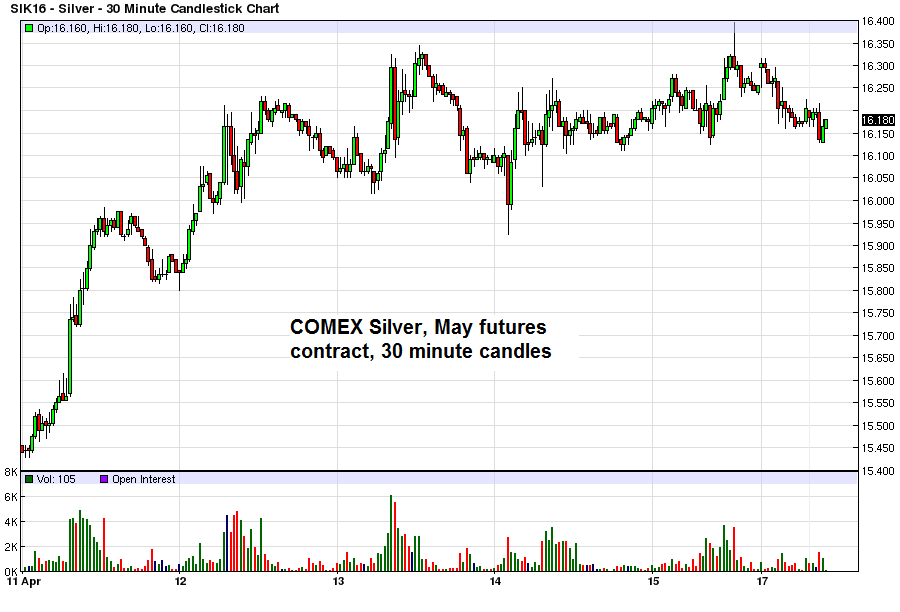

Well that was an interesting week. Gold went down over thirty bucks and silver went up over thirty cents. How much longer can this silver rally continue in the face of gold’s non-participation? Will speculators really be comfortable bidding silver up to $20 while gold sits at $1200? Do the fundamentals support a higher silver price?

Gold, active June futures contract over the past week – click to enlarge. |

|

How is silver different from gold? Aside from being a lot cheaper per ounce, and the fact that an ounce of silver is almost twice as bulky as an ounce of gold, there are two differences. One is that Silver has industrial demand. While virtually every ounce of gold ever mined in history is still in human hands, some silver is consumed.

Gold is too expensive to put into most products except in minute quantities (though it is in the iPhone). Most of what goes into electronics is recycled, as circuit boards are equivalent to good ore. As industrial demand falls (witness the collapse in the price of shipping), this component of silver demand falls with it.

Silver, active May futures contract over the past week – click to enlarge. |

|

Smartphone sales may be strong, but silver is used in everything from cars to washing machines. The drop in industrial demand is surely the main culprit in the rise in the gold-silver ratio, predicted and chronicled in this Report for years.

The other is that silver is more the money of the people. If you work for wages and want to set aside something out of your weekly paycheck, with silver you can get a big coin or two. This is metal you can heft. With gold, it would either be a tiny wafer and for this you would pay a huge manufacturing premium.

Or else it would be a digital gold credit in an account, which may not have the same satisfaction (or risks) as metal in your hand. It is this sort of demand that has been anemic in both metals for years (notwithstanding demand for certain silver coins). For now, people are content to be creditors to the government and the banks (or else don’t really understand what it means to hold dollars).

When this demand returns in earnest, we don’t think it will be in silver only. When the next wave of dollar-phobia returns, it will likely drive people into both metals. If it turns out to be only one metal, then it will not be silver.

Fundamental Developments – Gold Nearly at Fair Price

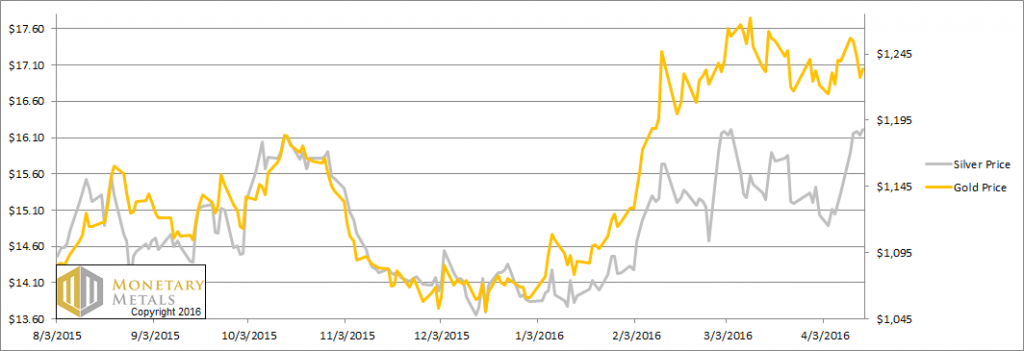

Let’s look at the only true picture of supply and demand fundamentals. But first, here’s the graph of the metals’ prices.

Gold and silver prices since August 2015 – click to enlarge. |

|

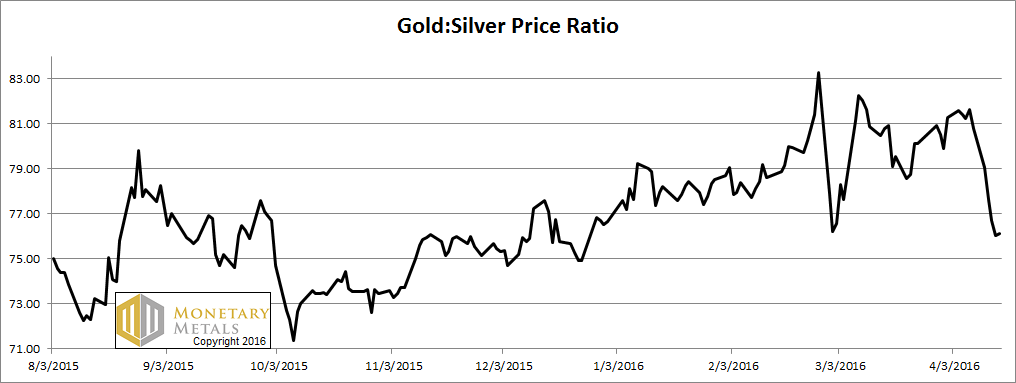

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was down 6% this week.

Gold-silver ratio – click to enlarge. |

|

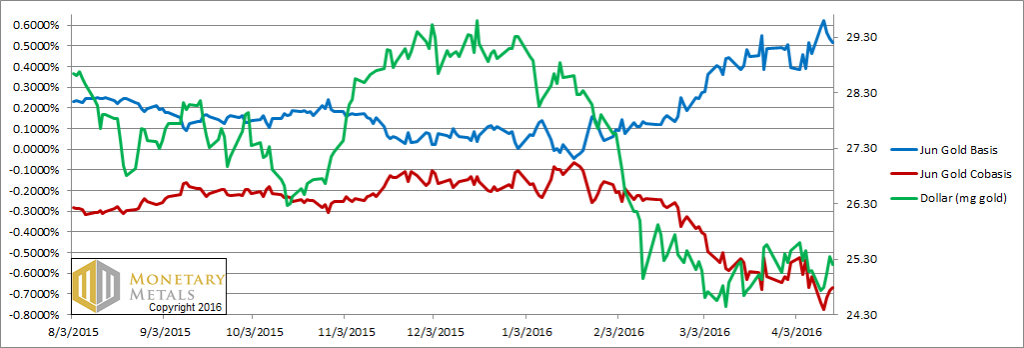

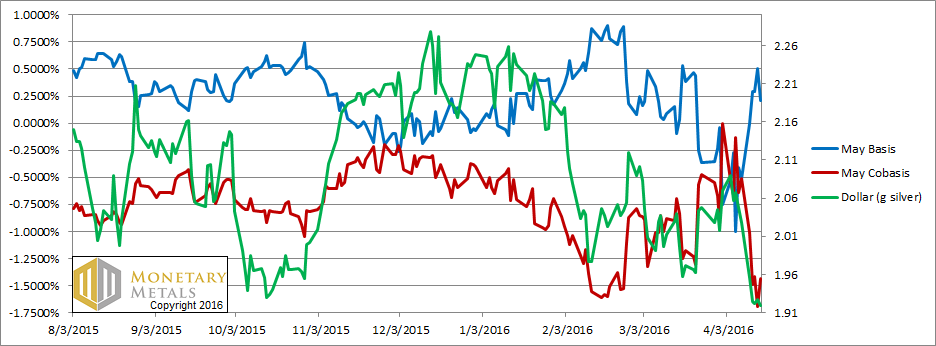

For each metal, we will look at a graph of the basis and co-basis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and co-basis in red.

Here is the gold graph.

Gold basis and co-basis and the dollar price – click to enlarge. |

|

Look at that. The June gold contract is now offering 50 basis points (annualized) to anyone who wishes to carry it. That is, to buy gold and sell it forward. This just about matches the two-month LIBOR rate, and is a marked change from the recent past.

What a change. Compare to the Report from 18 October. We showed a December gold basis of around -15 bps (which was then the same time to expiration). Or 14 February, with an April basis barely above zero. The last two months have seen a skyrocketing in gold. Not the price, but in the basis.

We would not precisely say that gold is now abundant in the market, but we wouldn’t say it it is exactly scarce either. Our calculated fundamental gold price dropped $60 this week. It is still $25 over the market price, but that’s hardly a significant difference. Gold is almost fairly priced today.

Now let us turn to silver.

Silver basis and co-basis and the dollar price – click to enlarge. |

|

First, let’s note the dog that did not bark in the night. We have not yet had to switch from May to July contracts. Normally, the unbridled selling of the contract before expiry causes the basis to fall off the bottom of the chart, and often temporary backwardation readings as well. So we are forced, generally before now, to switch to the next contract to get a good picture. Not so today. We still have a good signal that shows the market action clearly.

And what is that action? As price of silver rises (shown as a drop in the price of the dollar, measured in silver terms) the metal becomes less scarce. Only a few short weeks ago, we were speculating on the possibility of the silver co-basis to rise above zero, called backwardation. But since then, the price has risen about a buck twenty.

Our calculated fundamental price did rise a bit this week, but it is a buck twenty below the market price (not directly related to our comment about imminent May silver backwardation, but not entirely unrelated either).

Charts by: BarChart, Monetary Metals

Dr. Keith Weiner is the president of the Gold Standard Institute USA, and CEO of Monetary Metals. Keith is a leading authority in the areas of gold, money, and credit and has made important contributions to the development of trading techniques founded upon the analysis of bid-ask spreads. Keith is a sought after speaker and regularly writes on economics. He is an Objectivist, and has his PhD from the New Austrian School of Economics. He lives with his wife near Phoenix, Arizona.