It is never easy, but the week ahead may be particularly difficult for market participants. It will first have to respond to weekend developments. First, the front page of the NY Times on Saturday was a report that the Saudi Arabia warned the US if a bill making its way through Congress that would allow it (Saudi Arabia) to be held responsible in American court for the terrorist strike on 9/1, the sheikdom would forced to sell its Treasury holdings, and other US assets, which otherwise...

Read More »Weekly Speculative Positions: Yen Speculators Continue to Press

Speculators were undeterred by the threat of BOJ intervention. In the CFTC reporting period ending April 12, speculators boosted their net and gross long yen positions to new record highs. The bulls added 2k contracts to their gross long position to give them 100.1k yen futures contracts. The bulls, who had tried picking a bottom over the past two reporting periods, gave up and reduced their gross short position by 4.1k contracts to 33.9k. The resulted in a 6k increase in the net long...

Read More »FX Weekly: The Dollar’s Technical Condition Remains Vulnerable

The US dollar turned in a mixed performance last week, which given the softer than expected inflation, retail sales data, and industrial output figures, coupled with the poor technical backdrop, could be a signal that its decline in recent months has run its course. The dollar-bloc continued its advance, led by the Australian dollar’s nearly 2% gain. Higher commodity prices (the sixth weekly advance for the CRB Index in the last eight week) may have helped. The persistent strength...

Read More »Double Whammy Economics

Consumer Ambivalence Photo credit: Pixelrobot What’s up with U.S. consumers? They seem to have come to their senses at the worst possible time. They can no longer be counted on to push economic growth up and to the right. Specifically, they’re not spending money on stuff.A little public service on etymology: “Double whammy” was reportedly first used in a 1941 Oakland Tribune article related to boxing. It means a devastating blow, setback or catastrophe. In today’s economy, it often...

Read More »SDR Does Not Stand for Secret Dollar Replacement

At the IMF/World Bank meetings this week, Chinese officials are again pushing for greater use of the IMF’s unit of account, Special Drawing Rights. It is China’s turn as the rotating host of the G20, which gives it greater influence over its agenda. For its part, the IMF is concerned about global financial stability and must be open-minded. It wants to strengthen the financial system. It is only prudent to examine all reform ideas. Last September, the IMF agreed to include the yuan...

Read More »Weekly Emerging Markets: What has Changed

Bank Indonesia will use the 7-day reverse repo rate as its new benchmark policy rate The ruling party in South Korea unexpectedly lost parliamentary elections The Monetary Authority of Singapore eased monetary policy to recession settings Turkey has nominated its next central bank chief The Brazilian special lower house committee voted 38-27 in favor of impeachment The first round of Peru’s presidential election was inconclusive In the EM equity space, Brazil (+5.4%), UAE (+4.9%), and...

Read More »Why All Central Planning Is Doomed to Fail

Positivist Delusions [ed. note: this article was originally published on March 5 2013 – Bill Bonner was on his way to his ranch in Argentina, so here is a classic from the archives] We’re still thinking about how so many smart people came to believe things that aren’t true. Krugman, Stiglitz, Friedman, Summers, Bernanke, Yellen – all seem to have a simpleton’s view of how the world works. A bunch of famous people with a simpleton view of how the world works…who not only seriously think...

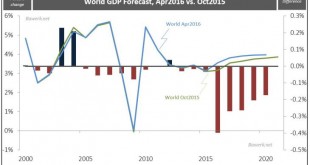

Read More »Circulus in probando

In the latest semi-annual Keynesian incantation spewed out by the world’s best pseudo-scientists, we learn that growth has been too slow for too long and that in itself is the cause of slow growth. First, they promote debt-funded consumption because spending – money supply/credit and velocity – is equivalent to nominal GDP growth, and as long as you have nominal GDP growth you can always add more debt to the existing stock ad infinitum. That obviously came crashing down in 2008. At that...

Read More »FX Daily, 04/15: Better Chinese Data Fails to Deter Pre-Weekend Profit-Taking

China’s slew of economic data lends credence to ideas that the world’s second-largest economy may be stabilizing. However, the data failed to have a wider impact on the global capital markets, including supporting Chinese equities. In fact, the seven-day advance in the MSCI Asia-Pacific Index was snapped with a fractional loss today. European shares are also lower on profit-taking, breaking a five-day advance. Commodities, including oil, copper, nickel and zinc are also trading off....

Read More »BOE and Brexit

No one can feign surprise that the Bank of England kept policy steady. Nor was the 9-0 vote truly surprising, though there had been some speculation of a couple of dovish dissents. Nevertheless, there are two important takeaways for investors. First, the BOE recognized what many in the market have already accepted; namely that the economy has lost some momentum. Growth for Q1 is estimated at 0.4%, which represents a some moderation. Over the past four quarters, the UK has averaged...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org