The Japanese yen is recovering from two-day two percent decline. The yen is the strongest of the majors today, rising about 0.6%. The greenback initially extended its gains marginally in early Tokyo before the selling pressure emerging. The price action reinforces the importance of the JPY109.50 resistance area. The Nikkei initially moved higher and filled the gap created by the sharply lower opening on May 3, following disappointment with the BOJ lack of action at the end of the...

Read More »65-Year-Old Swiss Native Lost His Life’s Savings For Failing To File A Form to the US

By all accounts Bernhard Gubser was living the American Dream. Born in Switzerland he moved to the Land of the Free in the early 1980s to work at an international shipping company based in Laredo, Texas. Eventually Mr. Gubser worked his way up to be President of the company and began traveling around the world to expand the business. He became a naturalized citizen of the United States in the 1990s, something that would eventually cost him $1.35 million. As a Swiss native, Gubser had a...

Read More »The World’s 100 Most Influential Hacks, Yahoos and Monkey Shiners

Hacks and Has-Beens NORMANDY, France – What has happened to TIME magazine? Henry Luce, who started TIME – the first weekly news magazine in the U.S. – would be appalled to see what it has become. Time cover featuring the sunburned mummy heading the globalist IMF bureaucracy (which inter alia advocates that governments should confiscate a portion of the wealth of their citizens overnight, even while its own employees don’t have to pay a single cent in taxes). Once you see the list of the...

Read More »FX Daily May 11: A Few Thoughts from Asian Business Trip

Sometimes the mountain looks clearer from the plain the summit to paraphrase a American-Lebanese poet. The dollar appears to have entered a new phase on May 3. On that day, it reversed higher against the euro, yen, and sterling for lows not seen in a while. It is tempting to construct a fundamental narrative for the change. However, the usual drivers are noticeable by their absence. The US economic data has been mixed, including the employment report that often sets the tone for...

Read More »The Twilight Of The Gods (aka Central Bankers)

The current financial market volatility increasingly reflects loss of faith in policy makers. Celebrity central bankers are learning that they must constantly produce new miracles for their followers. First, the measures implemented since 2009 created an artificial stability and an asset price boom in many markets. But the absolute rate of GDP expansion and level of price changes is inadequate to solve global debt problems. Second, new initiatives seem the risky response of clever...

Read More »Reality is a Formidable Enemy

Political Correctness Comedy How to most effectively create a “safe space” on campus Cartoon by Nate Beeler We have recently come across a video that is simply too funny not be shared. It also happens to dovetail nicely with our friend Claudio’s recent essay on political correctness and cultural Marxism. Since this is generally a rather depressing topic, we have concluded that having a good laugh at it might not be the worst idea. It is especially funny (or terrifying, depending on...

Read More »Gold Is Slowing

A Loss of Momentum Photo credit: R.P. Visual The price of gold moved down slightly this week, while that of silver dropped more substantially—1.9%. We don’t see much decrease in the enthusiasm yet from this minor setback. This was a shortened week due to the May Day holiday outside the US. Let’s look at the only true picture of supply and demand fundamentals. Gold and silver prices. First, here’s the graph of the metals’ prices. Gold and silver prices – click to enlarge....

Read More »Why is Freddie Mac Reporting a Loss?

A Sudden Turn for the Worse Freddie Mac HQ – a strange time for posting losses Photo via nytstyle.com Freddie Mac posted a loss of $354 million this quarter, versus a $2.16 billion gain the previous quarter. Fannie Mae did slightly better with net earnings of $1.1 billion, which were still substantially down from $2.5 billion the previous quarter though. Instead of delving into the entrails of the financial statements, I would like to ask a broader question: Why is Freddie reporting...

Read More »St. Louis Fed Slams Draghi, Kuroda – “Negative Rates Are Taxes In Sheep’s Clothing”

“At the end of the day, negative interest rates are taxes in sheep’s clothing. Few economists would ever claim that raising taxes on households will stimulate spending. So why would they think negative interest rates will?” Those are the shocking words of St.Louis Fed Director of Research Christopher Waller whose brief note today will be required reading for everyone at The Bank of Japan, The ECB and every other central banker on the verge of NIRP… If you pick up any principles of...

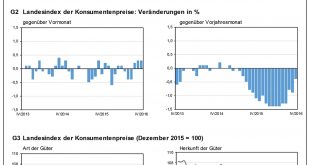

Read More »Swiss Consumer Price Index in April 2016: Consumer prices increase by 0.3%

09.05.2016 09:15 – FSO, Prices (0353-1604-90) Swiss Consumer Price Index in April 2016 Consumer prices increase by 0.3% Neuchâtel, 09.05.2016 (FSO) – The Swiss Consumer Price Index increased by 0.3% in April 2016 compared with the previous month, reaching 100.4 points (December 2015=100). Inflation was -0.4% in comparison with the same month in the previous year. These are the findings of the Federal Statistical Office (FSO). Download this press release (pdf, 129 KB) Bericht CD Bund...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org