Summary More than $10 trillion of government bonds now trade at negative yields. And another $10 trillion or so worth of U.S. stocks trade well above their long-term average valuations. And there’s more than $200 trillion of debt in the world. All of this sits on the Fed’s financial applecart. Does Janet Yellen dare upset it? Blame “Brexit” BALTIMORE – The U.S. stock market broke its losing streak on Thursday [and...

Read More »FX Daily, June 20: Brexit not the main Swiss Franc Driver

On the Swiss Franc Recently I enumerated the different drivers for the continuing strength of the franc. Most commentators mentioned Brexit fears, but I insisted on the low rate and yield environment in the United States after the last Non-Farm Payroll report and the FOMC. Today’s jump in sterling after changed Brexit bets confirmed my view. This anticipation of an Anti-Brexit vote was not followed by a franc decline...

Read More »If Sterling has Not Peaked, It has Come Pretty Close

Summary Today’s sterling rally is the largest since 2008. The rally began with the murder of UK MP Cox. Risk-reward favors a near-term pullback. Sterling is recording its daily advance since 2008 today. It is up about 2.3%. The ostensible driver is the weekend polls suggesting that, as we suspected the murder of the UK MP acting as a catalyst of sorts for public opinion. The odds makers in the betting houses...

Read More »Bullard’s New Paradigm and the Federal Reserve

Summary There is much to like in Bullard’s new paradigm. The problem is that it does not reflect the Federal Reserve’s view or approach. Policy emanates from the Fed’s leadership, but be confused by the noise. The dot plot the recent FOMC meeting was curious. We noted right away that inexplicably there was one official that apparently anticipated one hike this year and then no hikes in 2017 or 2018. There was...

Read More »Gold and Brexit

Summary The pain of negative yields and social chaos will be very long lasting and very good for gold. So, gold must go up, but Brexit is not one of the reasons why it should. This tells me that in the short term there will likely be a correction in the gold price, creating an opportunity to trade Going Up for the Wrong Reason Gold is soaring. It should—and a lot—but in my view not for the reason it is. Indeed gold...

Read More »A Market Ready to Blow and the Flag of the Conquerors

Summary The U.S. is too big, too varied, too much of everything. You can’t fix a single view of it, even in your mind. But now our problems, challenges, and discontents are big. They are national and international. We cannot see them. We cannot understand them. Instead, we draw their measure from the news media – based on a flag that flutters and sags, depending on which way the wind is blowing. Bold Prediction...

Read More »How the Welfare State Dies

Summary People have become used to the idea that the State is their sugar daddy. Many apparently believe that it has some undisclosed, infinite stash of resources at its disposal which it can shower them with at will. The reality is unfortunately different. Hollande Threatens to Ban Protests Brexit has diverted attention from another little drama playing out in Europe. As of the time of writing, if you Google...

Read More »Down Go the Hopes and Dreams of Three Generations

Summary On Wednesday, Janet Yellen pressed on the broken buttons again. After the two day FOMC meeting, the Fed Chair announced they’d continue pressing the federal funds rate down to just a ¼ to ½ percent – effectively zero. What type of insanity is this? If she keeps it up, and whole thing doesn’t implode, the yield on the 10-Year Treasury note could also slip below zero…along with the hopes and dreams of three...

Read More »FX Weekly Preview: It is All about Europe

Major data this week: German Constitutional Court ruling on OMT. UK referendum. EMU flash PMI. ECB TLTRO II launch. Yellen testifies before Congress, RBI Rajan to step down in early Sept. The Chair of the Federal Reserve testifies before Congress on Tuesday and Wednesday. Given the recent FOMC meeting and Yellen’s press conference, it is unlikely new ground will be broken. It is difficult for the market to price out...

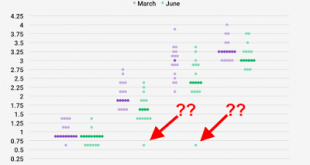

Read More »Weekly Speculative Postion: After Jo Cox Speculators Bought Sterling Futures with Both Hands

Sterling In the days ahead of the murder of Jo Cox, a UK member of parliament, apparently for her support for remaining in the EU, speculators in the futures market scooped up sterling. They added 25.4k sterling contracts to lift the gross long position to 61.7k contracts. This is the second largest long speculative position after the mid-March holdings of 62.9k long contracts. In the previous CFTC reporting...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org