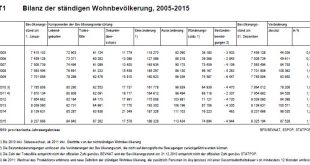

21.04.2016 09:15 – FSO, Demography and Migration (0353-1604-10) Provisional results on population change in 2015 The population is growing and ageing: Grew by 1.1% in 2015 Neuchâtel, 21.04.2016 (FSO) – Switzerland’s population grew by 1.1% in 2015. This trend is the result of net migration and natural growth which are both positive. The population continues to age, in particular Swiss nationals. These are some of the provisional results from the Federal Statistical Office’s Population and...

Read More »2.8% rise in Swiss health expenditures 2014: Are they costs or income?

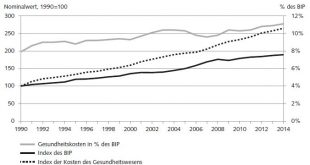

21.04.2016 09:15 – FSO, Health (0353-1604-20) Health care costs and financing 2014: provisional data Health costs increase to CHF 71.2 billion Neuchâtel, 21.04.2016 (FSO) – Total health care expenditure in 2014 amounted to 71.2 billion, a 2.8% increase compared with the previous year. Growth was therefore below the five year trend. The percentage of gross domestic product spent on health care rose to 11.1%. These are the findings of the Federal Statistical Office’s (FSO) provisional...

Read More »The Shocking Reason For FATCA… And What Comes Next

Politicians around the world are working hard to build this emerging prison planet. But it’s still possible to escape. We recently released a video to show you how. Click here to watch it now. If you’ve never heard of the Foreign Account Tax Compliance Act (FATCA), you’re not alone. Few people have, and even fewer fully grasp the terrible things it foreshadows. FATCA is a U.S. law that forces every financial institution in the world to give the IRS information about its American...

Read More »Is the Stock Market Overvalued?

Dismal Earnings, Extreme Valuations The current earnings season hasn’t been very good so far. Companies continue to “beat expectations” of course, but this is just a silly game. The stock market’s valuation is already between the highest and third highest in history depending on how it is measured. Photo credit: Kjetil Ree Corporate earnings are clearly weakening, and yet, the market keeps climbing. The rally is a bit of a “all of worry” type of phenomenon actually, since many of...

Read More »Status of 9/11 Bill and the Saudi Threat

There continues to be much discussion among investors of New York Times report last weekend in which a Saudi official threatened to sell $750 bln of US Treasuries and assets if a bill that would allow families of victims to sue the Saudi government for involvement in the 9/11 terrorist strike. The bill, formally known as the Justice Against Sponsors of Terrorism Act, enjoys bipartisan support. The bill is cosponsored by two Republicans but is also supported, for example, by the two...

Read More »Fighting Recessions with Hot Air

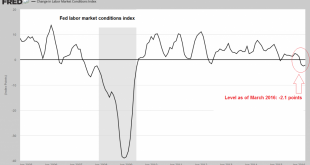

“Prepping” for Recession GUALFIN, Argentina – Stocks are going up all over the world. Meanwhile, it appears to us that the U.S. economy is going down. Go figure. For instance, a labor-market index created by Fed economists… and closely watched by Fed chief Janet Yellen… has fallen for three straight months. It’s the first time that’s happened since 2009. In spite of relatively strong payrolls data, the Fed’s labor market conditions index doesn’t look so hot – click to enlarge. And...

Read More »FX Daily April 21: Bulls’ Charge Stalls, while Greenback Consolidates Losses

The US dollar has been largely confined to yesterday’s ranges against the major currencies. China’s yuan slipped lower for the first time in four sessions, while the Shanghai Composite fell 2.3%, the most since the end of February. While a few equity markets in Asia managed to follow suit after US equity market gains carried the S&P 500 above 2100 since last November, small gains in Tokyo (0.2%), Australia (0.5%) were sufficient to keep the MSCI Asia-Pacific Index flat. European...

Read More »Making Sense of China’s Gold Fix and Hungary’s Dim Sum Offering

Earlier today, China launched its first gold fix. It will offer a fixing twice a day going forward yuan. The Shanghai Gold Exchange established the fix the same way it is done in London and New York, by prices submitted by financial institutions. In China’s case, 18 institutions, including two foreign banks, participate in the process. The key question for investors is if there is some larger implication of this development that they should be aware? China is the world’s largest...

Read More »Some Thoughts on US Fiscal Policy

The US presidential selection process is well underway, and yet there has been no coherent discussion of fiscal policy. In part, this is because it does not appear particularly urgent. The US deficit peaked in 2009 at 10.1% of GDP. Last year it stood at what for most OECD countries an enviable 2.6%. This year and next it is forecast by private sector economists to reach 2.9%. There are many who arguethat monetary policy has been as accommodative as possible. With the expansion entering...

Read More »FX Daily April 20: Markets Build on Yesterday’s Dramatic Recovery

Global capital markets staged an impressive recovery after the initial reaction to the failure to freeze oil output sent reverberations through the oil markets, commodities, and Asian equities. The sharp reversal begun in Europe and extended in North America has been sustained. Oil prices remain firm. Perhaps the realization that the labor dispute in Kuwait has reduced output by as much as 60% (to 1.1mln barrels a day) helped underpin prices. The fall in output may be of greater immediate...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org