Swiss growth was disappointing at the end of 2016 and in the first half of 2017. Consequently, GDP growth this year is likely to be just 1.0%, its lowest level since 2012. However, a wide set of statistics are already painting a considerably more positive picture of strengthening growth as we approach the end of 2017. Of particular note is the increasing contribution of manufacturing to real GDP growth. Switzerland’s...

Read More »Increasingly optimistic on Swiss outlook

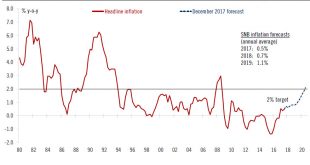

The SNB left its monetary policy unchanged, and sees the Swiss franc as highly valued. However, we expect a first rate hike to open in Q4 2018.At its December meeting, the SNB left its accommodative monetary policy unchanged. The interest rate on sight deposits was maintained at a record low of -0.75% and the SNB reiterated its willingness to intervene in the foreign exchange market if needed.The SNB’s monetary policy assessment reflected an improvement in the outlook since its September...

Read More »Fed’s enthusiasm on tax cut plans remains limited

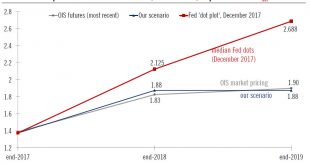

The Fed hiked rates 25bps at its 13 December meeting, as widely expected. We are keeping our scenario unchanged and we expect two rate hikes next year.The 13 December Fed decision – and Chair Yellen’s last press conference – was much as expected. The Fed hiked rates 25bps, bringing the interest rate on excess reserves to 1.5%. Meanwhile, Fed officials maintained their rate-hiking forecasts for next year: three rate increases, according to the ‘dot plot’.Chair Janet Yellen was cautious about...

Read More »House View, December 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationEconomic and earnings growth continue to offer good momentum and the possibility of upside surprises for 2018, so we remain overweight DM equities.However, uncertainties over other key aspects of the outlook mean that investors may be unwise to lower their defences. We are keeping tail risk mitigation in portfolios.EM equities should continue to perform in 2018, but the leadership could shift from growth...

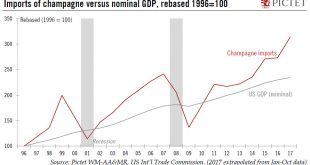

Read More »Effervescence, not exuberance

Despite the length of the current expansion, we believe US growth still has some way to go. But there are signs the economy is becoming bubbly.The key debate right now among economists revolves around how further will the expansionary phase of the US business cycle go. We are already over 100 months into the current phase (it started in July 2009), making it the third-longest period of post-World War II expansion. The longest was 119 months, between April 1991 and February 2001. Our view is...

Read More »Euro Area Forecast to Grow 2.3percent in 2018

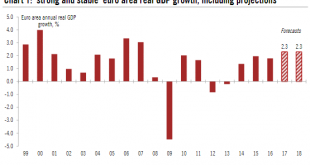

We have upgraded our growth projection for this year and next. There are upside risks to our forecast that the ECB will start hiking rates in Q3 2019. Taking account of stronger growth momentum, the carryover effect and upward revisions to past data, we have upgraded our euro area annual GDP growth forecasts to 2.3% both in 2017 and 2018. Our forecasts remain consistent with a very gradual slowdown in the quarterly...

Read More »Oil market tilted towards oversupply

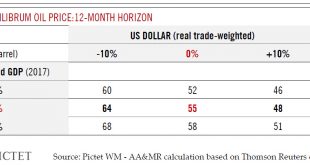

The same discipline shown by OPEC and Russia in 2017 will be required to support prices at their current level. After the 30 November agreement between OPEC and Russia to extend oil production cuts until the end of 2018, it is worth looking again at the balance between oil supply and demand. The most recent data indicate that without continued willingness from OPEC to limit supply, the market will be naturally tilted towards oversupply in 2018 and 2019. Non-conventional production, in...

Read More »The Swiss economy is gaining momentum

Leading indicators are running at multi-year highs, suggesting that underlying momentum is strengthening and becoming more broadly based. Owing to weak GDP momentum in late 2016 and the first half of the year, the Swiss economy is likely to see relatively weak growth in 2017. Part of the weakness in GDP figures was due to specific factors. However, leading indicators, notably consumer confidence, manufacturing PMI and the KoF economic indicator are...

Read More »ECB preview: close to target…by 2020

At the 14 December meeting, attention will be focused on the ECB staff forecasts and any changes in communication on plans for unwinding QEs. The main talking points ahead of the ECB’s last policy meeting this year on 14 December are the new staff projections for growth and inflation as well as forward guidance on asset purchases. We expect higher oil prices to push ECB staff forecasts for inflation higher, to 1.4% in 2018 and 1.6% in 2019. A lower...

Read More »Slow wage growth to keep Fed on prudent normalisation track

But latest employment report shows the US economy remains in fine fettle. The November employment report revealed another ‘Goldilocks’ set of conditions for investors: employment growth remained firm, especially in cyclical sectors like manufacturing and construction. At the same time, wage growth stayed soft – which means the Federal Reserve is unlikely to shift its current prudent communication on interest-rate hikes (although it is still very...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org