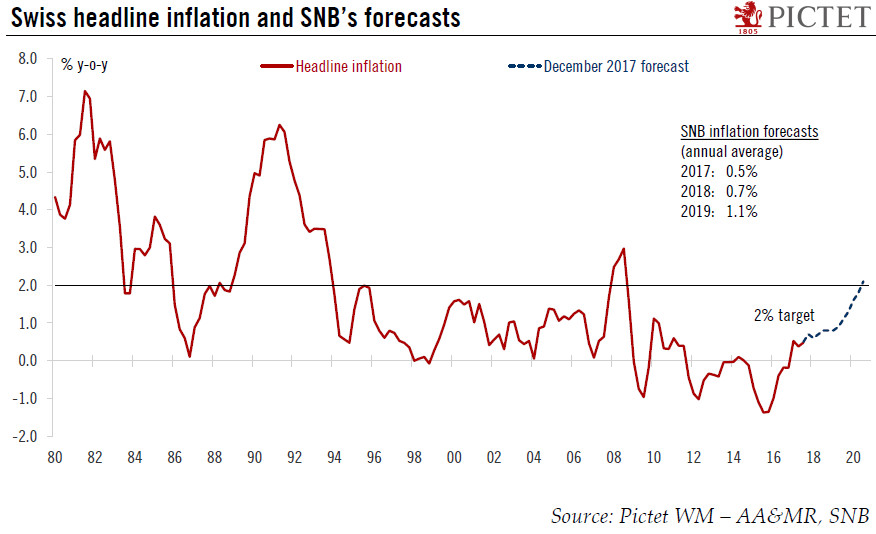

The SNB left its monetary policy unchanged, and sees the Swiss franc as highly valued. However, we expect a first rate hike to open in Q4 2018.At its December meeting, the SNB left its accommodative monetary policy unchanged. The interest rate on sight deposits was maintained at a record low of -0.75% and the SNB reiterated its willingness to intervene in the foreign exchange market if needed.The SNB’s monetary policy assessment reflected an improvement in the outlook since its September meeting, but remained rather cautious on the currency, mentioning that the Swiss franc is “highly valued” and that the situation on foreign exchange markets is still fragile.Inflation forecasts were revised up. Importantly, the last data point (Q3 2020) was fixed at 2.1%, above SNB’s definition of price

Topics:

Nadia Gharbi considers the following as important: Macroview, SNB December meeting, SNB monetary policy, Swiss monetary policy, Swiss outlook

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The SNB left its monetary policy unchanged, and sees the Swiss franc as highly valued. However, we expect a first rate hike to open in Q4 2018.

At its December meeting, the SNB left its accommodative monetary policy unchanged. The interest rate on sight deposits was maintained at a record low of -0.75% and the SNB reiterated its willingness to intervene in the foreign exchange market if needed.

The SNB’s monetary policy assessment reflected an improvement in the outlook since its September meeting, but remained rather cautious on the currency, mentioning that the Swiss franc is “highly valued” and that the situation on foreign exchange markets is still fragile.

Inflation forecasts were revised up. Importantly, the last data point (Q3 2020) was fixed at 2.1%, above SNB’s definition of price stability.

Given the improved outlook, we expect a window of opportunity for a first SNB rate hike to open in Q4 2018.