The Fed hiked rates 25bps at its 13 December meeting, as widely expected. We are keeping our scenario unchanged and we expect two rate hikes next year.The 13 December Fed decision – and Chair Yellen’s last press conference – was much as expected. The Fed hiked rates 25bps, bringing the interest rate on excess reserves to 1.5%. Meanwhile, Fed officials maintained their rate-hiking forecasts for next year: three rate increases, according to the ‘dot plot’.Chair Janet Yellen was cautious about the impact of Congress’s proposed tax cuts, which are close to enactment, saying the impact on growth would “not be gigantic”. The Fed expects growth of 2.5% next year, up from 2.1% previously.Our Fed scenario is unchanged. With incoming Fed Chair Jerome Powell, who takes over in February, likely to be

Topics:

Thomas Costerg considers the following as important: Fed December meeting, Fed rate hikes, Macroview, US Fed policy, US monetary policy

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The Fed hiked rates 25bps at its 13 December meeting, as widely expected. We are keeping our scenario unchanged and we expect two rate hikes next year.

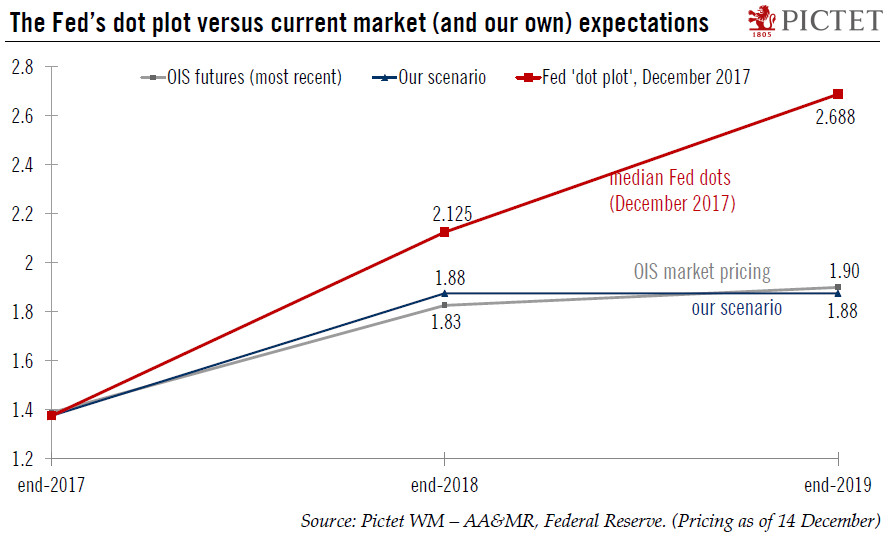

The 13 December Fed decision – and Chair Yellen’s last press conference – was much as expected. The Fed hiked rates 25bps, bringing the interest rate on excess reserves to 1.5%. Meanwhile, Fed officials maintained their rate-hiking forecasts for next year: three rate increases, according to the ‘dot plot’.

Chair Janet Yellen was cautious about the impact of Congress’s proposed tax cuts, which are close to enactment, saying the impact on growth would “not be gigantic”. The Fed expects growth of 2.5% next year, up from 2.1% previously.

Our Fed scenario is unchanged. With incoming Fed Chair Jerome Powell, who takes over in February, likely to be in the same vein of thought as Yellen, we think the Fed will continue hiking rates until they reach around 2%. This means hikes in March and June, in our view. Low core inflation could be a stumbling block for more rate hikes.

There is a risk that the Fed delivers an additional rate hike (in September), if the impact of the tax cuts on confidence and financial markets is stronger than we currently expect.