Summary:

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationEconomic and earnings growth continue to offer good momentum and the possibility of upside surprises for 2018, so we remain overweight DM equities.However, uncertainties over other key aspects of the outlook mean that investors may be unwise to lower their defences. We are keeping tail risk mitigation in portfolios.EM equities should continue to perform in 2018, but the leadership could shift from growth to value stocks. We continue to see selective opportunities in local-and hard-currency emerging-market debt.Declining intra-index correlations, rising volatility and a continued rise in disruptive M&A will favour active management and stock-picking in 2018.CommoditiesWhile a temporary surge in oil

Topics:

Perspectives Pictet considers the following as important: asset allocation, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationEconomic and earnings growth continue to offer good momentum and the possibility of upside surprises for 2018, so we remain overweight DM equities.However, uncertainties over other key aspects of the outlook mean that investors may be unwise to lower their defences. We are keeping tail risk mitigation in portfolios.EM equities should continue to perform in 2018, but the leadership could shift from growth to value stocks. We continue to see selective opportunities in local-and hard-currency emerging-market debt.Declining intra-index correlations, rising volatility and a continued rise in disruptive M&A will favour active management and stock-picking in 2018.CommoditiesWhile a temporary surge in oil

Topics:

Perspectives Pictet considers the following as important: asset allocation, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: The Cure For High Prices

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Pictet Wealth Management’s latest positioning in fast-evolving markets.

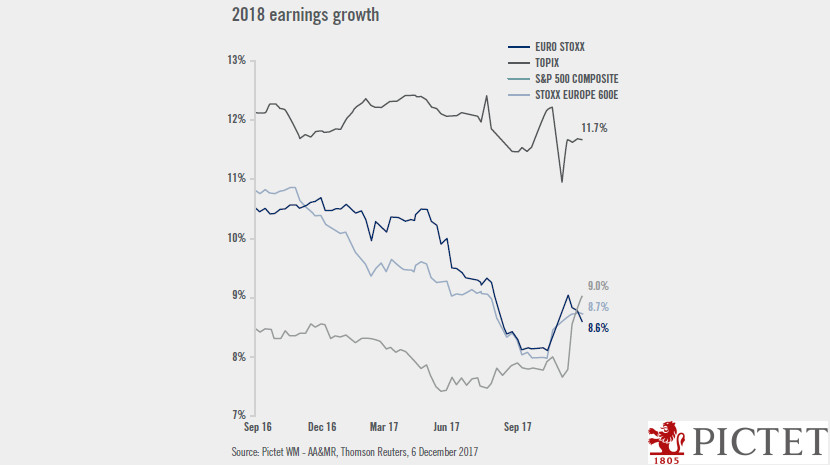

- Economic and earnings growth continue to offer good momentum and the possibility of upside surprises for 2018, so we remain overweight DM equities.

- However, uncertainties over other key aspects of the outlook mean that investors may be unwise to lower their defences. We are keeping tail risk mitigation in portfolios.

- EM equities should continue to perform in 2018, but the leadership could shift from growth to value stocks. We continue to see selective opportunities in local-and hard-currency emerging-market debt.

- Declining intra-index correlations, rising volatility and a continued rise in disruptive M&A will favour active management and stock-picking in 2018.

Commodities

- While a temporary surge in oil prices is possible on geopolitical risk, we see limited upward pressure based on fundamentals. We estimate an equilibrium price over the next 12 months of USD55-58 per barrel for WTI, close to current levels.

Equities

- We remain generally bullish on euro area and Japanese equities. We are less bullish on richly valued US equities, although that would change if there were positive surprises on tax reform.

- We favour value over growth stocks for 2018. Cyclicals need accelerating growth to keep outperforming.

- We are neutral on tech stocks. But while some high-profile tech stocks with an earnings deficit look overbought, good cash generation means we do not expect a tech bust.

Currencies

- We see limited further downside for the EUR against the USD. We continue to expect a gradual weakening of the dollar in 2018, and estimate an EUR/USD rate of 1.24 for end-2018.

- US 10-year Treasuries should yield around 2.6% by end-2018, up from around 2.4% in mid-December 2017. Our end-2018 target for 10-year German Bunds is 0.9%.

- As we expect yields to rise, we would stay underweight core sovereign bonds and short duration.

- As interest rates could rise gradually, we prefer quality in credit (investment grade). We are cautious on US high-yield, given tight spreads and the potential for default rates to rise.

Alternatives

- Our outlook for hedge funds remains positive, as monetary and political developments should work in favour of most strategies. We especially like long/short equity, relative value and merger arbitrage strategies.

- We expect private equity to keep its illiquidity premium to public equities, and despite high prices, we continue to see opportunities.

- Uncertainty and high valuations pose challenges for real estate in 2018. However, niche opportunities are set to remain in vogue.