Despite the length of the current expansion, we believe US growth still has some way to go. But there are signs the economy is becoming bubbly.The key debate right now among economists revolves around how further will the expansionary phase of the US business cycle go. We are already over 100 months into the current phase (it started in July 2009), making it the third-longest period of post-World War II expansion. The longest was 119 months, between April 1991 and February 2001. Our view is that the expansion could continue for a while yet, particularly as real GDP growth has been pedestrian so far, averaging only 2.2% since 2009, and as there are no particular signs of over-investment (a ‘low density’ expansion, in our in-house terminology).Aside from signs of over-investment, we need to

Topics:

Thomas Costerg considers the following as important: Macroview, US business cycles, US economy, US expansion

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Despite the length of the current expansion, we believe US growth still has some way to go. But there are signs the economy is becoming bubbly.

The key debate right now among economists revolves around how further will the expansionary phase of the US business cycle go. We are already over 100 months into the current phase (it started in July 2009), making it the third-longest period of post-World War II expansion. The longest was 119 months, between April 1991 and February 2001. Our view is that the expansion could continue for a while yet, particularly as real GDP growth has been pedestrian so far, averaging only 2.2% since 2009, and as there are no particular signs of over-investment (a ‘low density’ expansion, in our in-house terminology).

Aside from signs of over-investment, we need to be on the lookout for broader signs of unsustainability. Over-confidence tends to lead to poor investment decisions, with potential economic reverberations later on. Leverage tends to amplify asset cycles. The good news is that households’ balance sheets are in rather good shape at the aggregate level.

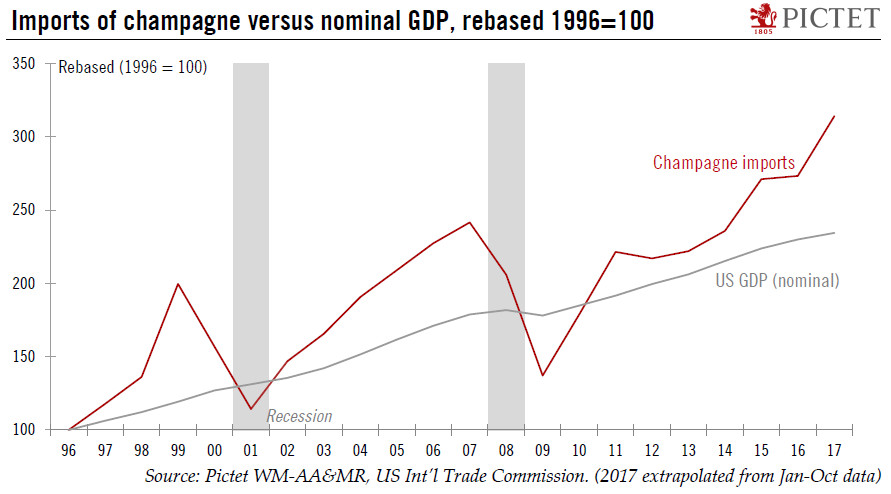

US champagne imports from France are a good place to look for potential signs of rising ‘effervescence’ in the US economy. Imports are up 15% so far this year (January-October versus the same period last year), and are on track to reach USD 700mn in 2017. Since 2010, the compounded annual growth rate in champagne imports has been 8.4%, versus 3.5% for nominal growth. While we would not extrapolate too much from this data, it is still a reminder that the US economy is starting to look frothy in some segments. No recession is in sight, but we are definitely in the advanced phase of the business cycle.