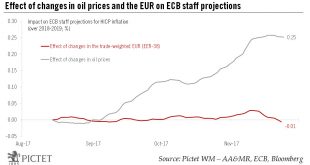

We also expect the ECB staff to revise higher its GDP growth forecast for the euro area in 2018 and 2019.This week was all about stellar euro area PMIs and hawkish nuances in the accounts of the October ECB meeting. However, the arrival at another deadline went unnoticed – the cut-off date for ECB staff projections, which implies that financial inputs will be derived from market expectations as at 23 November. Using elasticities derived from OECD and ECB models, the chart below shows the...

Read More »Banks: the outlook improves on both sides of the Atlantic

After facing serious challenges, banks in Europe and the US show signs of recovering. Earnings have been decent this year as a number of headwinds fade.Although third-quarter 2017 earnings results were mixed in Europe, compared with a better season in the US, 2017 is still set to be the first year of consistently decent earnings for banks after several years of disappointing results, especially in Europe. The market has noticed the improvement, and the sector has outperformed in recent...

Read More »Increasing growth visibility would reassure investors

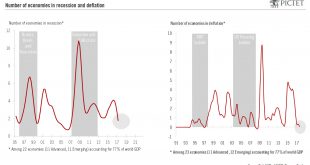

The world economy goes into 2018 with strong momentum, but policy makers could do more to improve visibility and risk asset valuations leave no room for disappointment.The current growth phase of the economic cycle started almost nine years ago in the U.S. and some emerging countries, making it the second-longest period of expansion in modern American history after the 1960s. But, increasingly, the question of whether a new recession is imminent or not has been coming up in discussions about...

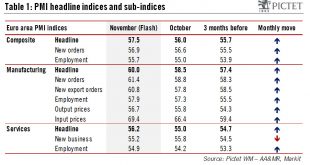

Read More »Another broad-based rise in PMI… a headache for the ECB?

The so-called ‘Euroboom’ is showing no sign of abating as euro area PMI indices rise to new highs, making it increasingly difficult for the ECB to justify its accommodative monetary stance.The euro area composite purchasing managers index (PMI) index surged well above expectations in November amid broad-based improvements across sectors and countries and the strongest pace of job creation in 17 years.At face value, November PMIs look consistent with real GDP growth accelerating further in...

Read More »How oil-rich Texas fares will be key for the US outlook

The US economy is increasingly reliant on activity in Texas, itself very dependent to oil.Texas, the second state by GDP after California, but better endowed than the latter with oil resources, has become a major driver of US growth, especially since the energy boom of the 2010s. What we’ve learned with the ups and downs of oil prices over the past few years is that high oil prices are great for Texas and therefore positive for the US economy, in spite of the hit to the individual US...

Read More »Watch out for a rebound in euro area core HICP in November

The surprising fall in euro area core inflation in October was largely driven by one-off factors we expect will be partly reversed.This week’s final euro area HICP report has provided us and the ECB with greater clarity over the drivers of the surprisingly large fall in core HICP inflation, from 1.11% to 0.89% year-on-year in October. The drop was largely led by one-off moves in Germany (airfares, package holidays) and by education prices in Italy. Although the latter will weigh on the...

Read More »China government may tolerate lower growth

The authorities are growing more tolerant of lower headline growth, which is already showing early signs of declining.The latest Chinese economic data for October indicate the moderate deceleration in growth already seen in Q3 is extending into Q4. Both exports and domestic demand have slowed, particularly in terms of fixed-asset investment. National fiscal spending has shown signs of slowing, and central government has cut off support for some regional infrastructure projects on concerns of...

Read More »Latest Japan GDP data point to moderate deceleration

The latest GDP data confirm the economy is expanding steadily. While we have slightly lowered our growth forecast for this year, our 2018 forecast remains unchanged.Japanese GDP for Q3 came in at JPY545.8 trillion annualised, rising 1.4% q-o-q and 1.7% y-o-y in real terms.The data are broadly consistent with our view of a moderate deceleration of the Japanese economy in H2 after a strong Q2. The positive growth in Q3 marks the seventh consecutive quarter of economic expansion in Japan, the...

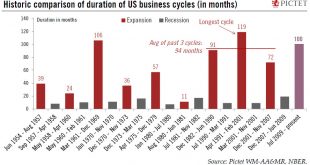

Read More »US business cycle celebrates its 100-month anniversary

The US expansion has crossed the 100-month mark. But while it has aged, the economy still has legs.The US expansion, which started in July 2009, just crossed its 100-month mark, making it – for now – the third longest in the National Bureau of Economic Research database, which stretches back to 1854. The longest growth was 119 months between April 1991 and February 2001.The exceptional length of this expansion, already well above the 94-month average for the three previous growth cycles,...

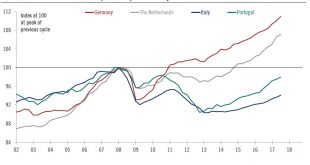

Read More »The euro area recovery is continuing to broaden out

Latest growth data indicate continuation of a strong and stable recovery. Our GDP forecasts remain unchanged.Euro area headline GDP growth was confirmed at 0.6% q-o-q in Q3.At the country level, Germany surprised to the upside, posting GDP growth of 0.8% q-o-q in Q3 and beating consensus expectations. The impressive performance was driven by exports and investment in equipment and machinery. Turning to Italy, economic activity strengthened in Q3. After a rise of 0.3% q-o-q in Q2, real GDP...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org