Signs of a certain loss of momentum may well fuel additional ECB dovishness in the near term, but is unlikely to compromise upcoming policy normalisation.Euro area industrial production (excluding construction) was weak in February (-0.8% m-o-m) and follows the recent release of other disappointing pieces of hard data such as retail sales, German factory orders and trade. Based on available ‘hard’ data, real GDP growth rate in the euro area is projected to be 0.1-0.2% q-o-q in Q1 2018, a...

Read More »US chart of the week – Car deflation

Pricing pressure on new cars suggests demand is weakening.March CPI inflation was relatively muted. Core inflation rose a relatively moderate 0.18% m-o-m, the same as in February, and below January’s 0.35% m-o-m rise. What this shows is that while core inflation is gradually improving – echoing the improvement in the US economy – fears of inflation getting out of hand are still proving unfounded.An interesting, and somewhat more alarming, aspect of the report is to be found in the sub-index...

Read More »US inflation worries prove unfounded

Momentum in core inflation remains modest and unlikely to spiral out of control in the near term.After a solid reading of 0.35% m-o-m in January – which scared some market participants – core consumer price inflation (CPI) proved tamer in February and again in March, posting a more moderate 0.18% m-o-m gain in both months. (That is not too far from the average since 2010 of 0.15% m-o-m). Due to base effects, the y-o-y reading rose to 2.1% from 1.8%.The relatively monotone core inflation...

Read More »House View, April 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationWhile macroeconomic and corporate fundamentals still favour risk assets, challenges have been steadily increasing and a lot of good news is already priced into valuations. We sold part of our equity overweight during the early March rally.Even though we have become more prudent about equities’ short-term prospects, we expect to be able to redeploy the cash generated from this sale as new...

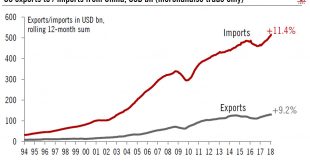

Read More »US-China trade tensions could last a while

While our central scenario remains unchanged, we still see downside risks increasing from recent trade escalation.Following on from President Trump’s announcement of a 25% tariff on USD50bn of unspecified imports from China, the US Trade Representative (USTR) last week detailed the list of China-made goods that will be targeted. China reacted swiftly by detailing its own list of counter-tariffs on USD50bn worth of imports from the US. Trump then escalated the rhetoric further when he...

Read More »Federal Reserve’s tightening still on track

The Fed has been reticent to become involved in the debate over trade tariffs and still looks like placing policy normalisation on ‘auto pilot’.Among the many questions posed by the recent more aggressive trade rhetoric from the Trump Administration is whether it will ‘scare’ Federal Reserve officials, and therefore interrupt the current US tightening cycle. But recent comments from Fed policymakers, including from Chair Jerome Powell, suggest that officials remain cool-headed about recent...

Read More »Europe has a lot to lose from trade wars

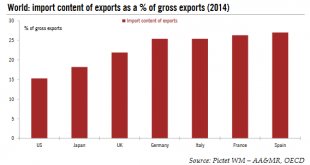

Any estimate of the economic costs of protectionist measures, let alone trade wars, is subject to uncertainty given the complexity of global supply chains. A common assumption is that new tariffs on exports will produce small direct effects on GDP growth but more significant indirect effects in the event of escalating trade conflicts, including on domestic investment. Europe looks particularly vulnerable to such...

Read More »Europe has a lot to lose from trade wars

Highly integrated into global value chains, the euro area is vulnerable to their disruption.Any estimate of the economic costs of protectionist measures, let alone trade wars, is subject to uncertainty given the complexity of global supply chains. A common assumption is that new tariffs on exports will produce small direct effects on GDP growth but more significant indirect effects in the event of escalating trade conflicts, including on domestic investment. Europe looks particularly...

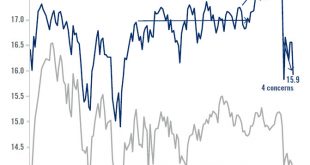

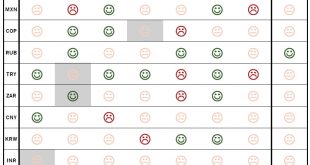

Read More »The Brazilian real and Russian rouble are still the most attractive EM currencies

Scorecard shows resilience of EM currencies in recent months.Our Emerging Market (EM) FX scorecard, designed to assess the attractiveness of a given currency over the coming 12 months, ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks.There have been few changes over the past month. EM currencies have been resilient thus far in 2018, despite higher risk aversion and higher US funding costs. However, taking into account the decline in carry,...

Read More »US chart of the week – Benefits vs wages

Subdued wage growth disguises rising cost of total compensation.The next US monthly employment report (published this Friday) will once again be scrutinised for signs that wage growth is on the rise. While wage growth has been improving in recent years, the pace has remained glacial. Average hourly earnings were up 2.6% y-o-y in February, a relatively subdued pace when taking into account near full employment (the unemployment rate was 4.1% in February).There are many factors explaining the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org