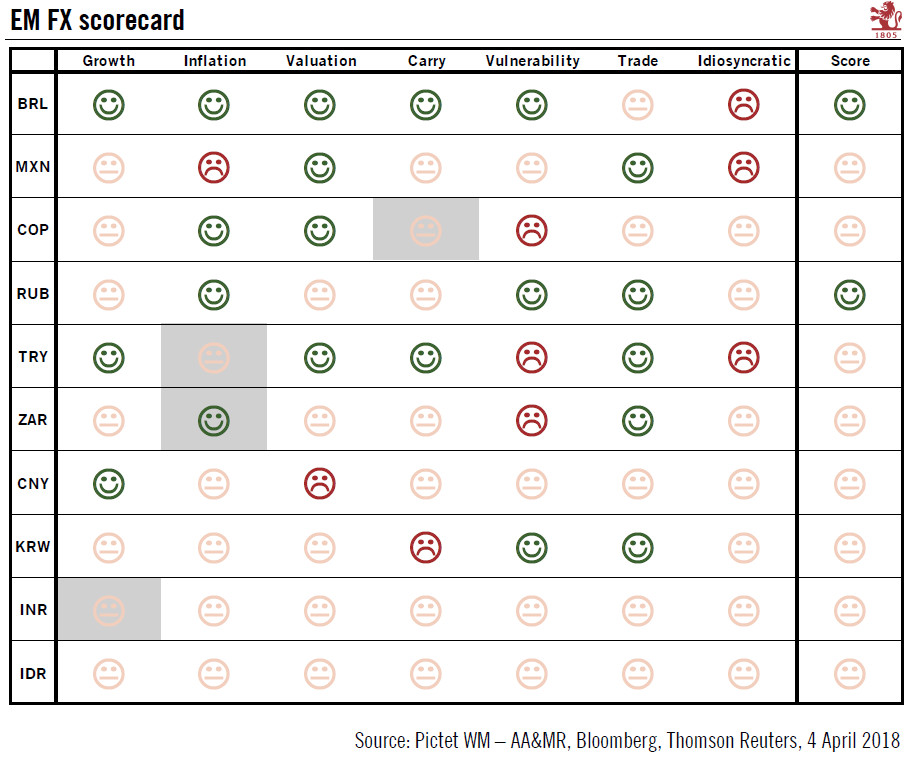

Scorecard shows resilience of EM currencies in recent months.Our Emerging Market (EM) FX scorecard, designed to assess the attractiveness of a given currency over the coming 12 months, ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks.There have been few changes over the past month. EM currencies have been resilient thus far in 2018, despite higher risk aversion and higher US funding costs. However, taking into account the decline in carry, the vulnerability of EM currencies has increased. The Brazilian real and the Russian rouble stand out in this regard as both currencies offer attractive real rates and have robust external buffers.Among notable changes, inflation signals from Turkey have turned neutral from negative. While it is true

Topics:

Luc Luyet considers the following as important: Brazilian real, Currency drivers, EM currencies, Macroview, rand, Russian rouble, Turkish lira

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: Oil Shock

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Scorecard shows resilience of EM currencies in recent months.

Our Emerging Market (EM) FX scorecard, designed to assess the attractiveness of a given currency over the coming 12 months, ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks.

There have been few changes over the past month. EM currencies have been resilient thus far in 2018, despite higher risk aversion and higher US funding costs. However, taking into account the decline in carry, the vulnerability of EM currencies has increased. The Brazilian real and the Russian rouble stand out in this regard as both currencies offer attractive real rates and have robust external buffers.

Among notable changes, inflation signals from Turkey have turned neutral from negative. While it is true that inflation there has recently moderated, headline inflation remained in double digit territory in March. Furthermore, despite the currency being already 20% undervalued in trade-weighted real terms compared to its 10-year average, the bar is high for the Turkish Central Bank (CBT) to raise rates at its next policy meeting on 25 April given President Recep Erdogan’s harsh criticism of high interest rates. Consequently, relatively high inflation should remain a key concern for the lira.

Meanwhile, inflation in South Africa is now giving a positive signal. Despite the scope for additional rate cuts seems limited, the central bank’s more accommodative monetary policy should provide a slight boost to a growth outlook that remains a challenge. Interestingly, the South Africa Reserve Bank sees the rand as somewhat overvalued. However, the likelihood of additional rate cuts or FX intervention remains low unless the rand appreciates significantly from current levels.