With further deterioration in the global manufacturing Purchasing Manager's Index (PMI) to 50.7 in January, the global economy is flirting with recession.January’s deterioration in sentiment was widespread, with the notable exception of the US. However, it is possible that January pessimism was largely caused by December’s poor financial markets. If this is indeed the case, it is likely that we will see a bounce in sentiment in the months ahead, following January’s rebound in markets.The...

Read More »Weekly View – May awaits her Valentine

The CIO office's view of the week aheadLast week’s State of the Union speech revealed little news, but President Trump’s conciliatory tone toward bipartisan deal making was apparent, particularly around infrastructure spending and drug prices. In contrast, he remained firm in his stance on China, although with an economic (i.e. trade), rather than geopolitical emphasis. While there is some uncertainty on the future of a US-China trade agreement, especially in the wake of Trump’s cancelled...

Read More »Taking account of regime shifts

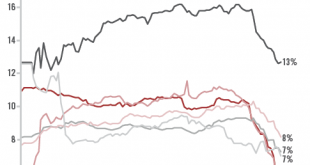

Understanding what economic regime we are in and for how long before we transition to a different one is vital for any strategic asset allocation.Predicting the returns for different asset classes is the Holy Grail of asset allocation. The problem is that risk premiums and returns are instable over time. According to our analysis, over the long term (our data stretches back 115 years) there is a 90 percent probability of achieving an annual average return of 8 percent with a 60/40 portfolio....

Read More »STAYING NEUTRAL ON US TREASURIES

With global recession risks on the rise and the US treasury yield curve still threatening to invert, we remain neutral on US Treasuries.Since our December note on the 2019 outlook for US Treasuries, the environment for US bonds has shifted dramatically. The 10-year US Treasury yield reached a low of 2.56% on 3 January, the day before Jay Powell, chairman of the US Federal Reserve (Fed), made a U-turn from a hawkish to a dovish stance. Taking note of this regime shift, we are revising our...

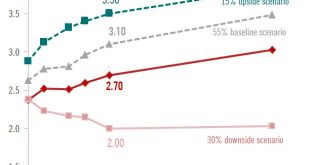

Read More »OPEC+ discipline will be key for oil prices in 2019

An extension of the December agreement to cut production, plus a slight increase in demand, could potentially bring the oil market into balance this year.Global oil supply is undergoing a structural shift. The US oil industry is growing in importance relative to the OPEC. As a result increased production from non-OPEC producers more than compensated for the output collapse among important OPEC producers such as Iran and Venezuela in 2018.Slowing global growth, and new US pipelines facilities...

Read More »Weekly View – Christmas in January

The CIO office’s view of the week ahead.US equities recorded their best January performance in over three decades, with the S&P 500 up close to 8%. The market has been helped by the decision by Fed chairman Jerome Powell to step back from ‘quantitative tightening’, putting rate hikes on hold and contemplating an early end to balance sheet reduction. A number of factors explain this new dovishness: fears about global growth, the absence of inflation pressure and evidence that financial...

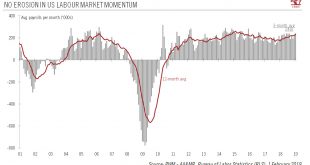

Read More »US jobs report shows recession risk is limited

In spite of the federal shutdown and the loss in growth momentum in other countries, the US continues to churn out jobs, while a dovish Fed may prolong the economic cycle.US employment rose by a solid 304,000 in January (+1.9% year on year, y-o-y), compared with 222,000 in December. The three-month average was a healthy 241,000/month. Meanwhile, the ISM manufacturing survey rose to a robust 56.6 in January from 54.3 in December.Overall, these two pieces of data suggest that US macro momentum...

Read More »House View, February 2019

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationWith expectations for earnings growth continuing to be ratcheted down, the recent rebound in equities owes a lot to the decline in valuations. We therefore remain neutral on equities overall. However, we believe central banks will be inclined to support financial markets this year and help ensure modest gains for risk assets. More than ever, an agile, tactical approach will be needed to...

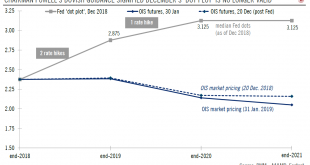

Read More »Review of the Federal Reserve’s January meeting

Fed signals end of rate hikes and that bank reserve liquidity tightening is near.Dovishness was on full display at the Fed meeting on 30 January. The Fed removed its rate tightening bias, and emphasised its “patience” until the next rate move.Chairman Powell seemed particularly anxious about the global growth backdrop and explained the more dovish stance is just “common sense risk management”.Another key focus was the balance sheet reduction as Powell hinted that a decision about ceasing the...

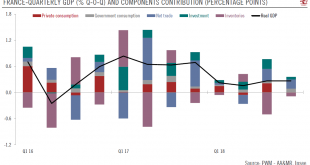

Read More »Exports save the day for French GDP growth

Prospects for French economic growth are looking up, but disruptions to consumption are possible. French GDP rose by 0.3% quarter-on-quarter (q-o-q) in Q4, the same pace as in Q3. The details reveal that Q4 exports surged significantly, while household consumption and investment slowed. This left growth for the year at +1.5%, following +2.3% in 2017. The breakdown of GDP data show that household consumption growth...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org