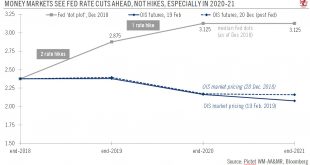

The Fed enters the 'acceptance stage' regarding its debt and market dominance monetary regime.The US Federal Reserve (Fed) is further reinforcing its stance on ceasing its balance sheet shrinkage before year end, essentially yielding to the demands of markets, which have been anxious about the potential for market liquidity shrinkage. Officially, the balance sheet question is still rooted primarily in the technical – commercial banks’ high demand for safe, liquid assets – rather than...

Read More »Gold to consolidate before further leg up

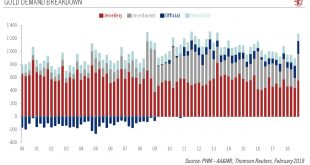

Some recent factors supporting gold are fading. However, while gold could sag in the short term, medium-term prospects look better. Last year ended on a very strong note for gold demand, with a significant increase in jewellery and investment demand in the fourth quarter (see chart), leading to strong price performance (7.7% in US dollar terms in Q4). There was also a sharp increase in central bank demand in 2018,...

Read More »Gold to consolidate before further leg up

Some recent factors supporting gold are fading. However, while gold could sag in the short term, medium-term prospects look better.Last year ended on a very strong note for gold demand, with a significant increase in jewellery and investment demand in the fourth quarter (see chart), leading to strong price performance (7.7% in US dollar terms in Q4). There was also a sharp increase in central bank demand in 2018, continuing a structural trend in place for the past decade.It is worth...

Read More »China: Credit surges in January

The PBoC's policy easing is gaining traction but growth deceleration may continue in H1.China’s credit numbers for January surprised on the upside. The figures show strong credit creation in the first month of the year, especially in corporate bonds and bank bill financing. The contraction in the shadow banking sector has also moderated. This suggests that the PBoC’s monetary easing measures, which started in Q2 2018, are gaining traction.Although this is an encouraging development, we...

Read More »Weekly View – US retail flash crash

The CIO office’s view of the week ahead.Last week we saw disappointing data across the board. In China, spending around the Lunar New Year Holiday grew at its lowest rate since 2011, reflecting the downward pressure burdening the Chinese consumer. Puzzlingly, December retail sales data in the US printed the biggest month-on-month decline since 2009, communicating a sharply contrasting message to the robust US jobs data. We suspect there could be a data error at play there. Meanwhile, with...

Read More »Euro area : What if car tariffs lie ahead ?

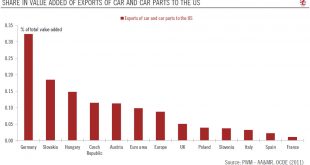

New US auto tariffs may impact the economy significantly more than the previous tariffs on steel and aluminium. Among the key risks for our euro area outlook, the threat of US auto tariffs is of major importance. The US Commerce Department’s investigation on national security threats posed by auto imports is due to be concluded on 17 February. Given the complexity of the global auto supply chain, it is very complicated...

Read More »Japan: Q4 GDP disappoints

Japanese economy expands below expectations, while external uncertainties weigh on outlook.Japanese GDP rebounded by 0.3% quarter-on-quarter (q-o-q) in Q4 (1.4% annualised) after contracting by 0.7% q-o-q in Q3 (-2.6% annualised) due to a series of natural disasters over the summer. In year-over-year (y-o-y) terms, output remained virtually unchanged.Domestic demand was the main driving force for the rebound in Q4, while external demand continued to be a drag.A fairly strong domestic capex...

Read More »Euro area : What if car tariffs lie ahead ?

New US auto tariffs may impact the economy significantly more than the previous tariffs on steel and aluminium.Among the key risks for our euro area outlook, the threat of US auto tariffs is of major importance.The US Commerce Department’s investigation on national security threats posed by auto imports is due to be concluded on 17 February.Given the complexity of the global auto supply chain, it is very complicated to isolate the effect of a one-off increase in US tariffs on European...

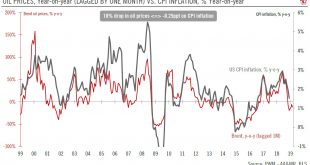

Read More »Still moderate US inflation

Latest data released confirm our expectations of modest US inflation this year.CPI inflation in January moderated to 1.6% y-o-y, from 1.9% in December (and versus 2.4% on average over the past twelve months).The biggest driver of this moderation was the sharp drop in global oil prices; given recent oil movements, we estimate that headline inflation could slide towards 1% y-o-y in coming months.Excluding energy and food, core CPI inflation remained at 2.2% y-o-y in January.There are signs...

Read More »Reserve Bank of Australia’s upbeat stance turns upside down

Dovish signals on monetary policy reduce upside for the Australian dollar.On 6 February, Philip Lowe, governor of the Reserve Bank of Australia (RBA), sent clear dovish signals, indicating that a rate cut was now as probable as a rate hike. This led to a significant decline in the Australian dollar. This change in the RBA’s stance highlights increasing concerns around the Australian economic outlook.This change in monetary stance mostly reflects increasing concerns over the accumulation of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org