In spite of the federal shutdown and the loss in growth momentum in other countries, the US continues to churn out jobs, while a dovish Fed may prolong the economic cycle.US employment rose by a solid 304,000 in January (+1.9% year on year, y-o-y), compared with 222,000 in December. The three-month average was a healthy 241,000/month. Meanwhile, the ISM manufacturing survey rose to a robust 56.6 in January from 54.3 in December.Overall, these two pieces of data suggest that US macro momentum remains strong and confirms our long-held view that the US business cycle is still rock solid despite the tightening in financial conditions in Q4 2018.The latest jobs report is consistent with our view that the risk of a near-term US growth slump is limited, despite the advanced phase of the US

Topics:

Thomas Costerg considers the following as important: Fed dovishness, Macroview, US jobs report, US recession, US wage growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

In spite of the federal shutdown and the loss in growth momentum in other countries, the US continues to churn out jobs, while a dovish Fed may prolong the economic cycle.

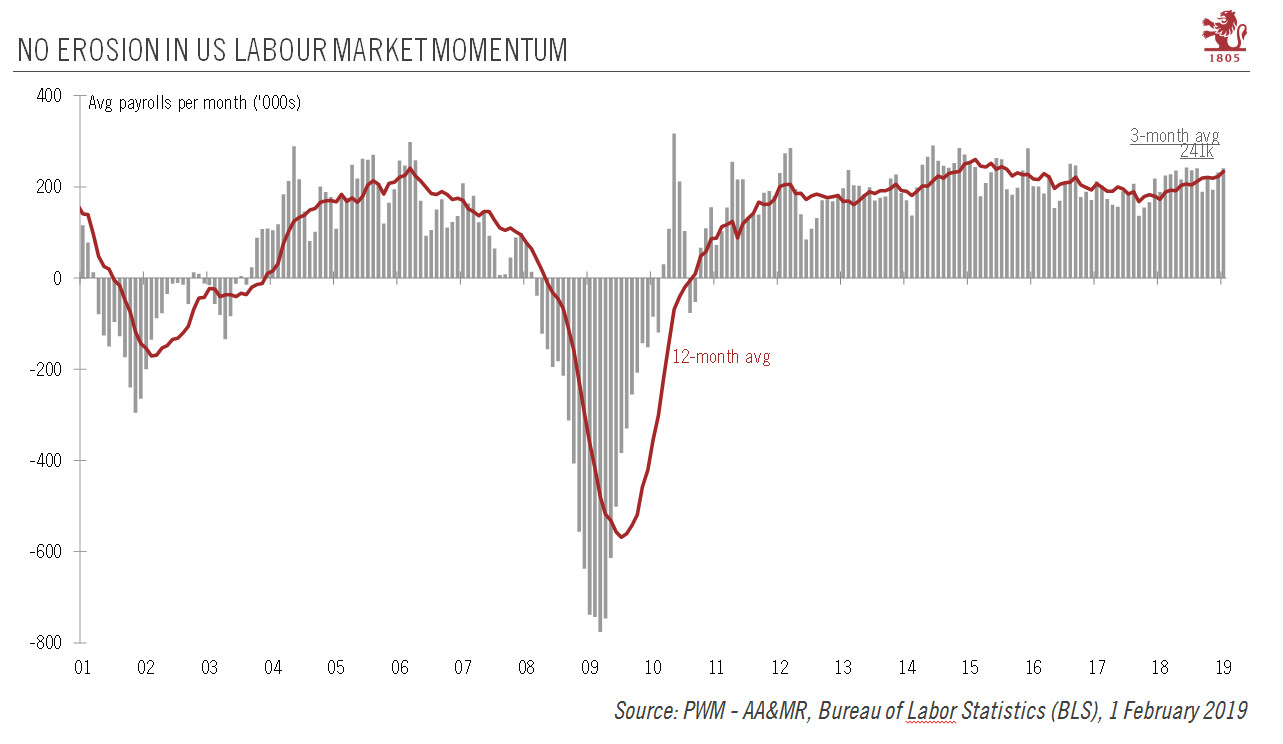

US employment rose by a solid 304,000 in January (+1.9% year on year, y-o-y), compared with 222,000 in December. The three-month average was a healthy 241,000/month. Meanwhile, the ISM manufacturing survey rose to a robust 56.6 in January from 54.3 in December.

Overall, these two pieces of data suggest that US macro momentum remains strong and confirms our long-held view that the US business cycle is still rock solid despite the tightening in financial conditions in Q4 2018.

The latest jobs report is consistent with our view that the risk of a near-term US growth slump is limited, despite the advanced phase of the US business cycle and the recent tightening in financial conditions (both of which partly reversed in January). Most of the forward-looking signals in the employment report, including the ongoing strength in temporary employment (which we see as a good leading index for future job growth), remain positive. By easing financial conditions, recent Fed dovishness could prolong the business cycle further.

The job report does not change much from the Fed’s perspective, since it has already de facto committed not to hike rates for a while. Still, the ongoing health of the US economy would tend to suggest that Fed chairman Jerome Powell has been putting too much emphasis on bad news (the political shenanigans in Washington, poor macro momentum abroad), and not enough on good news.

Some Fed doves could start to become anxious that demand-led inflationary pressures will reawaken soon (we note that average hourly earnings rose 3.2% y-o-y, after +3.3% y-o-y in December). By contrast, some market participants expecting a near-term rate cut may have gotten ahead of themselves. The strength of US data (which contrasts with the picture elsewhere in the world) suggests a cut would be premature.