Summary:

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationWith expectations for earnings growth continuing to be ratcheted down, the recent rebound in equities owes a lot to the decline in valuations. We therefore remain neutral on equities overall. However, we believe central banks will be inclined to support financial markets this year and help ensure modest gains for risk assets. More than ever, an agile, tactical approach will be needed to investing.While we have moved to an overweight stance on emerging-market (EM) government bonds in local currencies, we remain negative on developed-market (DM) credits given the late stage we are in the economic cycle.Our currency strategy is posited on expectations that US dollar strength will fade

Topics:

Perspectives Pictet considers the following as important: Macroview

This could be interesting, too:

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationWith expectations for earnings growth continuing to be ratcheted down, the recent rebound in equities owes a lot to the decline in valuations. We therefore remain neutral on equities overall. However, we believe central banks will be inclined to support financial markets this year and help ensure modest gains for risk assets. More than ever, an agile, tactical approach will be needed to investing.While we have moved to an overweight stance on emerging-market (EM) government bonds in local currencies, we remain negative on developed-market (DM) credits given the late stage we are in the economic cycle.Our currency strategy is posited on expectations that US dollar strength will fade

Topics:

Perspectives Pictet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Pictet Wealth Management's latest positioning across asset classes and investment themes.

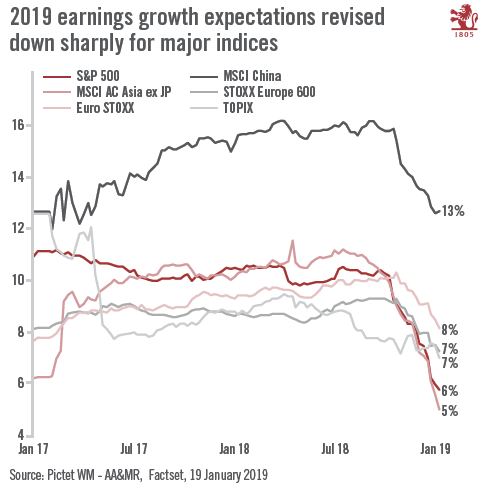

- With expectations for earnings growth continuing to be ratcheted down, the recent rebound in equities owes a lot to the decline in valuations. We therefore remain neutral on equities overall.

- However, we believe central banks will be inclined to support financial markets this year and help ensure modest gains for risk assets. More than ever, an agile, tactical approach will be needed to investing.

- While we have moved to an overweight stance on emerging-market (EM) government bonds in local currencies, we remain negative on developed-market (DM) credits given the late stage we are in the economic cycle.

- Our currency strategy is posited on expectations that US dollar strength will fade against other major DM and EM currencies.

Commodities

- After the collapse of crude oil prices in Q4 2018, oil now appears correctly valued. Our oil price forecast for the end of 2019 remains unchanged, at USD70 for Brent and USD60 for West Texas Intermediate (WTI).

Currencies

- Growth and interest rates are unlikely to help the US dollar much against the euro in 2019. The interest-rate differential has already turned less supportive. For the moment, however, weak economic momentum is limiting the euro’s upside potential.

Equities

- The rebound in equities in January was driven by improving market sentiment (thus expanding valuation ratios) rather than positive earnings revisions. Indeed, the latter have been continuously revised downwards of late. But as oil prices stabilise, earnings revisions could improve in the coming weeks, providing further support for equities.

- While we are positive on select Asian markets, recent negative earnings revisions in several countries also call for caution, meaning we remain neutral on emerging-market equities overall.

- We believe positive momentum for select US semiconductor companies may continue for a while thanks to relatively low valuations and despite the risk of further bouts of volatility.

- As we see the uncertainty surrounding Brexit diminishing this year, the forces keeping gilt yields down could retreat. The prospect of a positive total return is rather limited in this scenario, so we have turned underweight on UK sovereign bonds.

- EM bonds still offer more attractive real yields than core developed-market equivalents, especially in light of limited inflation and our expectation for a subdued US dollar this year.

Alternatives

- In hedge funds, we believe this year will be marked by structurally higher volatility, providing temporary and liquidity-driven dislocations that will drive arbitrage opportunities.