Fed signals end of rate hikes and that bank reserve liquidity tightening is near.Dovishness was on full display at the Fed meeting on 30 January. The Fed removed its rate tightening bias, and emphasised its “patience” until the next rate move.Chairman Powell seemed particularly anxious about the global growth backdrop and explained the more dovish stance is just “common sense risk management”.Another key focus was the balance sheet reduction as Powell hinted that a decision about ceasing the Fed’s balance sheet run-off – a key concern for markets in recent weeks – would be taken “soon”.This dovish view is in sharp contrast to Powell’s ebullient optimism about US growth a few months ago, when he expressed wariness about accelerating wage growth and the possibility of the Fed having to

Topics:

Thomas Costerg considers the following as important: FED, fed balance sheet, Macroview, US Fed hike

This could be interesting, too:

investrends.ch writes Trump deutet Powell-Nachfolge bis Jahresende an

investrends.ch writes Jerome Powell schürt Hoffnungen auf tiefere Zinsen

investrends.ch writes Jerome Powell: «Es gibt keinen risikolosen Weg»

investrends.ch writes Fed senkt Leitzins wie erwartet

Fed signals end of rate hikes and that bank reserve liquidity tightening is near.

Dovishness was on full display at the Fed meeting on 30 January. The Fed removed its rate tightening bias, and emphasised its “patience” until the next rate move.

Chairman Powell seemed particularly anxious about the global growth backdrop and explained the more dovish stance is just “common sense risk management”.

Another key focus was the balance sheet reduction as Powell hinted that a decision about ceasing the Fed’s balance sheet run-off – a key concern for markets in recent weeks – would be taken “soon”.

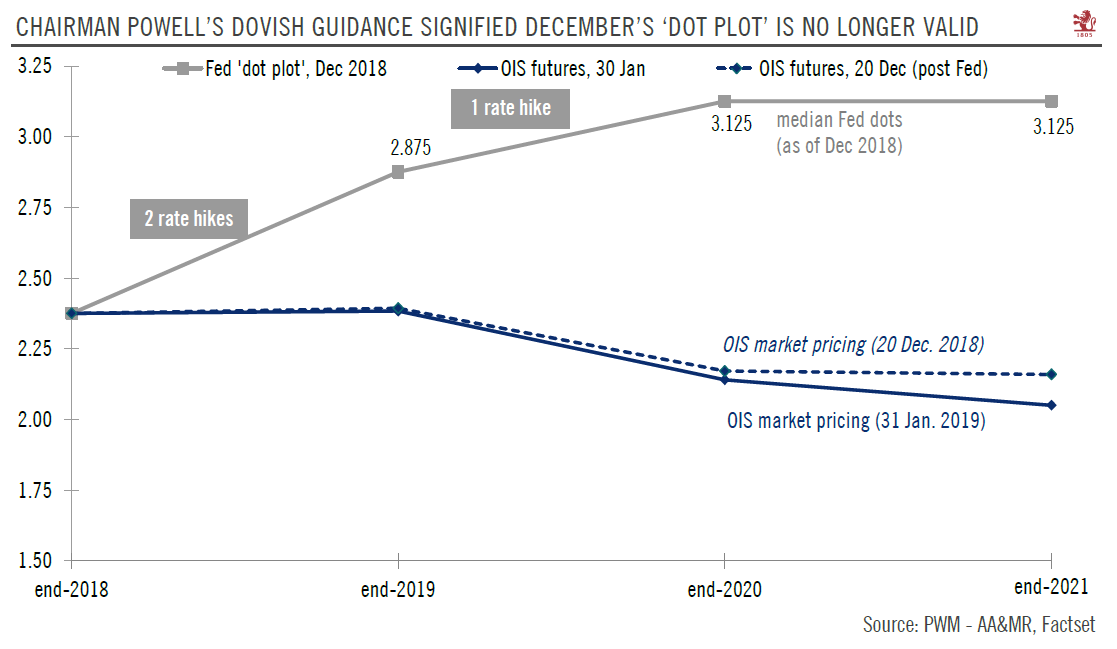

This dovish view is in sharp contrast to Powell’s ebullient optimism about US growth a few months ago, when he expressed wariness about accelerating wage growth and the possibility of the Fed having to overshoot the ‘neutral rate’.

Our big picture view has long been that 2019 would mark the end of the Fed tightening cycle and Powell’s comments only reinforce this view.

In more detail, our rate scenario this year has been for one final, and mostly symbolic rate hike in June with the risk of no rate hike at all; the risk of no move is rising.

That said, our still constructive view on the US outlook in coming months makes it difficult to contemplate a rate cut at this stage, especially if there is no recession.

In fact, the Fed is helping to sustain the US growth cycle with its dovish rhetoric. This is one reason why we see the near-term risk of recession as still moderate; for this reason as well, we see the possibility of a rate cut as premature.

Regarding the balance sheet, we would have expected a decision in the second half of this year, for a balance sheet plateau from the first half of 2020, but Powell’s comments suggest the decision could come earlier, perhaps as soon as next summer.