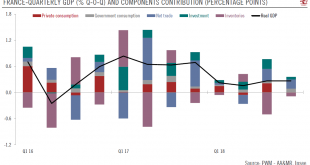

Prospects for French economic growth are looking up, but disruptions to consumption are possible.French GDP rose by 0.3% quarter-on-quarter (q-o-q) in Q4, the same pace as in Q3. The details reveal that Q4 exports surged significantly, while household consumption and investment slowed. This left growth for the year at +1.5%, following +2.3% in 2017.The breakdown of GDP data shows that household consumption growth decelerated significantly, to 0.0% from +0.4%, with the disruption to Christmas...

Read More »Brexit update – UK Parliament spins its wheels

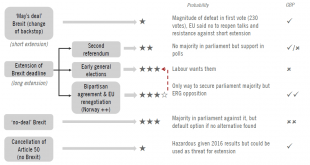

'Wake up call' yet to happen as the clock ticks on.A series of votes in the British parliament resulted in little new progress on the Brexit front; the outcome being that Theresa May will return to Brussels to attempt to improve her ‘deal’, which a new parliamentary vote scheduled for mid-February.However, Brussels has rejected the idea of reopening negotiations and it is not clear that mere tweaks will be enough to overcome the intense opposition in parliament to May’s initial deal.Bottom...

Read More »Cycling in the city

High-tech bicycle lights are making cycling safer and helping authorities to design cities that work better for two-wheeled commuters.While it is an oft-repeated truism that biking is as good for your health as for the environment, only a very small proportion of the population has embraced a two-wheel lifestyle. In the EU for example, on average just 12% of people cycle every day, while 50% go by car and 16% use public transport. Walking rates are high, but most journeys are too far to be...

Read More »Weekly View – Temporary open ahead of a crucial week

The CIO office’s view of the week ahead.President Trump put a temporary end to the shutdown on Friday after signing a funding package that reopens the US government for business until 15 February. Federal workers will receive their back pay, but the president continues to hold firm on his demand for funding for a border wall, threatening to resume the shutdown if a deal with Congress is not reached in three weeks. His disapproval ratings have reached their highest in a year due to the...

Read More »Update on euro area economic activity

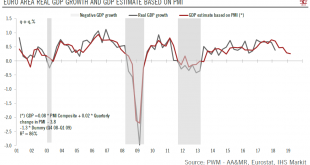

The balance of risks to growth in the region is still tilted to the downside. The big question about the euro area economy is when the bottom of the slowdown will be reached. A rebound was already expected in Q4 2018, but at the start of this year there are still few signs of recovery. Flash composite PMI numbers for the region declined by 0.4 points to 50.7 in January, the weakest level since July 2013. New orders and...

Read More »Update on euro area economic activity

The balance of risks to growth in the region is still tilted to the downside.The big question about the euro area economy is when the bottom of the slowdown will be reached. A rebound was already expected in Q4 2018, but at the start of this year there are still few signs of recovery. Flash composite PMI numbers for the region declined by 0.4 points to 50.7 in January, the weakest level since July 2013. New orders and new export orders remained weak and below the economic expansion threshold...

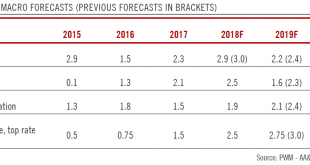

Read More »US macro and Federal reserve forecast update

Near-term recession risks remain limited, and a dovish Fed offers supportWe are reducing our 2019 US growth forecast to 2.2%, from 2.4% previously, mostly to account for the partial government shutdown. New York Fed president John Williams has stated that the impact of the shutdown could reach 1% of Q1 GDP.Despite the lower forecast, we remain confident about the underlying fundamentals of the US economy and still regard near-term recession risks as limited. Furthermore, US GDP tends to be...

Read More »Emerging market fixed income outlook

Selectiveness will be key to navigating between 2019 tailwinds and headwinds.Overall, we think there are reasons for investors to be more optimistic on emerging market (EM) debt in 2019. A Fed pause, a limited rise in US Treasury yields, a weaker US dollar and an eventual US-China trade truce could all be tailwinds for EM debt after poor returns in 2018.Furthermore, monetary and fiscal stimulus should help put a floor on the recent Chinese growth slowdown. Along with some policy relaxation...

Read More »Weekly View – Still ‘closed’ for business

The CIO office’s view of the week ahead.The US government shutdown marched into its fifth week, making it the longest in US history, with 800,000 ‘nonessential’ federal workers and even more contractors affected. While it is concerning that there seems to be no end in sight, there are also some potential positive effects that could play out in the economy. Any damage to economic growth is likely to be minimal and confined to the period of the shutdown. Once it ends, there will be a fresh...

Read More »European Central Bank likely to stick to script

The ECB is comfortable with current market expectations for rate hikes. At its latest meeting in December, the ECB turned more cautious, lowering its growth forecasts but showing no sign of panic regarding the loss in euro area economic momentum. Risks were considered as “broadly balanced”, but moving to the downside. Since the December monetary policy meeting, data (PMI and national surveys, industrial production) have...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org