Macroview There is an ongoing debate about whether the world is facing secular stagnation and deflation. In the inflation/deflation debate, we are in the deflationist camp. If economic mechanisms are left unchecked, deflationary forces will rise. DM central banks will struggle to hit their 2% inflation targets. The inflation targeting monetary policy style of the 1990s and early 2000s was followed by the quantitative easing (QE) style after the 2008-11 US subprime and euro area debt crises. Uncertainty prevails over the next monetary policy style that central banks, led by the Fed, will adopt. In the meantime, central banks target implicitly asset prices. In the secular stagnation/growth debate, we are in the growth camp. We believe a radical innovation shock will sustain growth. Seven key sectors have the potential to play a leading role in the next wave of radical innovation: the internet, IT/information and dataprocessing, automation, transport, energy, life sciences and smart materials. Emerging economies are increasingly heterogeneous. Their common characteristic is a process of transition, over several years, from an export-based model to one driven by domestic demand. During this phase, emerging markets will be a source of economic and financial risks, rather than growth. Expected returns of asset classes are low by historical standards.

Topics:

Christophe Donay considers the following as important: Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

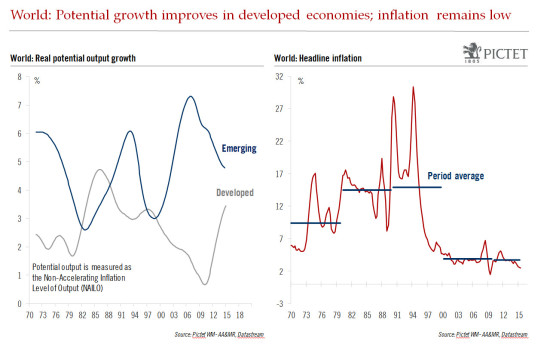

There is an ongoing debate about whether the world is facing secular stagnation and deflation.

In the inflation/deflation debate, we are in the deflationist camp. If economic mechanisms are left unchecked, deflationary forces will rise. DM central banks will struggle to hit their 2% inflation targets.

- The inflation targeting monetary policy style of the 1990s and early 2000s was followed by the quantitative easing (QE) style after the 2008-11 US subprime and euro area debt crises.

- Uncertainty prevails over the next monetary policy style that central banks, led by the Fed, will adopt. In the meantime, central banks target implicitly asset prices.

In the secular stagnation/growth debate, we are in the growth camp.

- We believe a radical innovation shock will sustain growth.

- Seven key sectors have the potential to play a leading role in the next wave of radical innovation: the internet, IT/information and dataprocessing, automation, transport, energy, life sciences and smart materials.

Emerging economies are increasingly heterogeneous. Their common characteristic is a process of transition, over several years, from an export-based model to one driven by domestic demand.

- During this phase, emerging markets will be a source of economic and financial risks, rather than growth.

Expected returns of asset classes are low by historical standards.

- With an innovation shock, we expect average nominal annual returns on US equities of 10.3% over the next decade (see our Autumn 2015 “Horizon” publication for further details). Without an innovation shock, these returns are projected at 6.0%, compared with 8.9% historically.

- With returns from US Treasuries expected at 1.8% annually, a 60/40 portfolio would return 4.0% annually on average without an innovation shock and 9% with an innovation shock.

Concluding remarks:

Active (tactical) asset allocation and stock-picking (thematic approach) is a sensible approach, as expected returns are low with a buy-and-hold strategy.

Quality stocks, with higher than average sales and profit growth linked to the new innovation shock, are likely candidates for market outperformance.