November’s upside surprises in surveys (PMI and IFO in particular) are unlikely to dissuade ECB policymakers that more needs to be done at their December 3 meeting. November’s euro area business surveys highlighted that the recovery continues to be largely led by domestic strength. In terms of countries, German surveys (PMI, IFO) surprised on the upside, whereas in France, surveys (PMI, INSEE) were less upbeat than in the previous month, partly reflecting the loss of confidence after the Paris attacks. Composite PMI at its highest level since May 2011 In detail, the euro area Flash composite PMI was up from 53.9 in October to 54.4 in November, against expectations for no change. The improvement was underpinned by an improvement in both sectors: manufacturing (+0.5 points to 52.8) and services (+0.5 points to 54.6), with the latter rising to its strongest level since May 2011. It is worth pointing out that job creation in the services sector was at its highest level since November 2010. However, despite the upturn in hiring, the survey showed that deflationary pressures remain present, with the output prices index remaining in contraction territory and the input prices index falling slightly in November. Assuming no change in December, the average composite PMI suggests that euro area GDP growth will be close to 0.5% q-o-q in Q4, a touch above our forecast (0.4%).

Topics:

Nadia Gharbi considers the following as important: Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

November’s upside surprises in surveys (PMI and IFO in particular) are unlikely to dissuade ECB policymakers that more needs to be done at their December 3 meeting.

November’s euro area business surveys highlighted that the recovery continues to be largely led by domestic strength. In terms of countries, German surveys (PMI, IFO) surprised on the upside, whereas in France, surveys (PMI, INSEE) were less upbeat than in the previous month, partly reflecting the loss of confidence after the Paris attacks.

Composite PMI at its highest level since May 2011

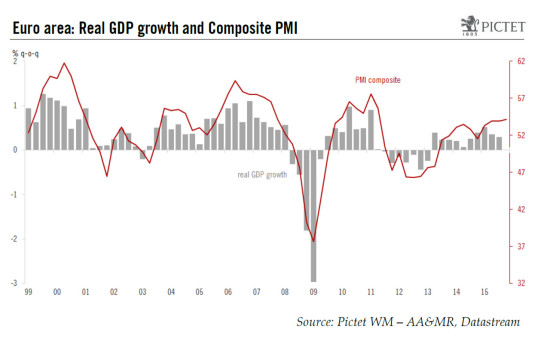

In detail, the euro area Flash composite PMI was up from 53.9 in October to 54.4 in November, against expectations for no change. The improvement was underpinned by an improvement in both sectors: manufacturing (+0.5 points to 52.8) and services (+0.5 points to 54.6), with the latter rising to its strongest level since May 2011. It is worth pointing out that job creation in the services sector was at its highest level since November 2010. However, despite the upturn in hiring, the survey showed that deflationary pressures remain present, with the output prices index remaining in contraction territory and the input prices index falling slightly in November.

Assuming no change in December, the average composite PMI suggests that euro area GDP growth will be close to 0.5% q-o-q in Q4, a touch above our forecast (0.4%). Nevertheless, over the past few months, PMI surveys have tended to be more optimistic than hard data, as shown in the graphic above. Thus, we leave our growth scenario unchanged. We continue to forecast a gradual pick-up in the pace of economic expansion, largely led by domestic strength. External sectors entail some downside risk. As a result, we expect the euro area economy to speed up from 1.5% in 2015 to 1.8% in 2016.

German growth largely led by domestic strength

The Flash composite PMI increased by 0.7 points to 54.9 in November, above consensus expectations (54.0). The IFO business survey mirrored the upside surprise in the PMI. Indeed, the headline business climate index surged up from 108.2 in October to 109 in November, better than consensus expectations (108.2). November’s increase was driven by an improvement in both components: current assessment (+0.7 points to 113.4) and business expectations (+0.8 points to 104.7), with the latter increasing for the third consecutive month.

On the sector front, Germany continues to be led by domestic strength. The index in services sectors (IFO and Services PMI) posted marked increases, with the IFO business climate indicator for the services sector exceeding its record high (see graphic below).

Meanwhile, after three and two months of declines respectively, the IFO manufacturing index and the manufacturing PMI posted a rise in November. The breakdown by components showed some improvement in forward-looking components (in particular in manufacturing new exports orders and IFO manufacturing business expectations).

Overall, German surveys (IFO and PMI) suggest that the German economy remains in good health and driven by domestic strength. The rises in some forward-looking manufacturing components (IFO business expectations, manufacturing new export orders) are encouraging signs given the challenges and risks (in particular EM slowdown and VW scandal) that the German manufacturing sector is currently facing.

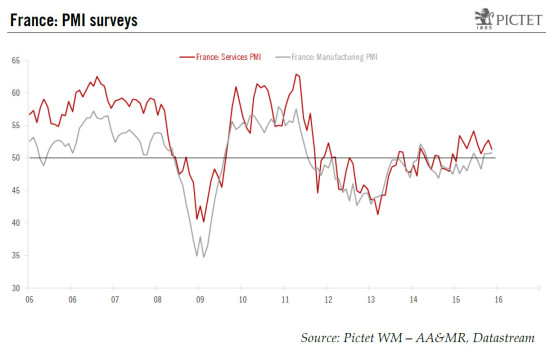

Subdued activity in French services sector

In France, by contrast, surveys (PMI and INSEE) were less upbeat than last month. The Flash composite PMI surprised on the downside, falling by 1.3 points to 51.3 in November (expected: 52.5). The monthly drop was due to the services sector, which declined from 52.7 in October to 51.3 in November, much lower than expected by the consensus (52.5). However, the weakness partly reflects the Paris attacks on 13 November (survey responses were collected between the 12 and 20 November). Markit noted that the Paris attacks “hit activity among some service providers”. The manufacturing sector increased marginally, at odd with the manufacturing INSEE index.

Overall, November’s surveys suggest that the French economy is on course to post another modest expansion in Q4 after the 0.3% GDP growth reported in the third quarter.

Acceleration in peripheral countries

In other euro area countries, where no flash estimates are provided, Markit indicated that “strongest rate of expansion was seen outside the euro area’s two largest economies, where the survey recorded the second-steepest rise in output since the global financial crisis”.

Positive surprises unlikely to dissuade the ECB

November’s upside surprises in surveys (PMI and IFO in particular) are unlikely to dissuade ECB policymakers that more needs to be done at their December 3 meeting. Last week, the dovish rhetoric was even more intensified by Draghi’s speech and by the account of the monetary policy meeting in October, highlighting that the ECB remains disappointed with the strength of the recovery and inflation dynamics. Thus, we continue to think that the most likely scenario is that QE will be extended another six months and the deposit rate will be cut by 10bp, with risks skewed towards a more aggressive policy package.