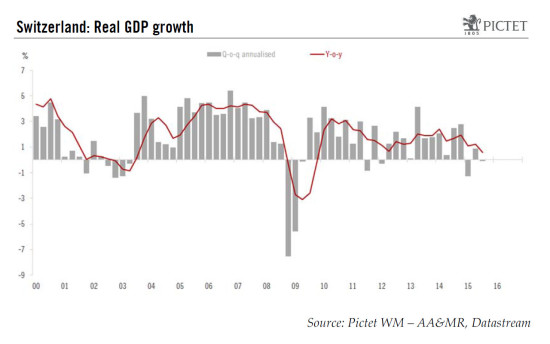

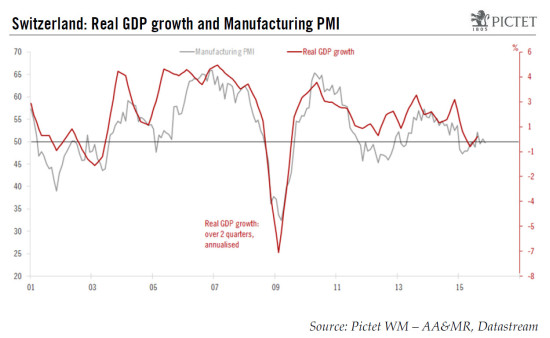

We expect Swiss real GDP growth to slightly pick up from an estimated 0.7% for 2015 to 1.1% in 2016. According to SECO’s estimate, Swiss real GDP stagnated q-o-q in Q3 (-0.1% q-o-q annualised; 0.8% y-o-y), below consensus expectations (0.2%). It came after GDP growth of 0.2% q-o-q in Q2 and a downwardly revised Q1 figure of -0.3% q-o-q. Although we cannot say that the Swiss economy is in a technical recession, it is worth highlighting that the economy is 0.1% below its level in Q4 2014 and has posted average quarterly growth of -0.04% q-o-q so far this year. The breakdown by expenditure components should be taken with a pinch of salt as GDP components are particularly volatile in Switzerland. Nevertheless, several observations can be drawn from Q3’s expenditure breakdown. Private and public consumption were the main sources of growth. In contrast, investment development was mixed, with investment in equipment posting positive growth whereas construction fell. A bit surprising given monthly data, exports of goods (excluding non-monetary gold, valuables and merchanting) increased in Q3. Subdued with a slight acceleration in 2016 Looking ahead, the latest key Swiss sentiment indicators such as the KOF surveys and the manufacturing PMI (see the chart below) showed some signs of stabilisation for Q4.

Topics:

Nadia Gharbi considers the following as important: Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

We expect Swiss real GDP growth to slightly pick up from an estimated 0.7% for 2015 to 1.1% in 2016.

According to SECO’s estimate, Swiss real GDP stagnated q-o-q in Q3 (-0.1% q-o-q annualised; 0.8% y-o-y), below consensus expectations (0.2%). It came after GDP growth of 0.2% q-o-q in Q2 and a downwardly revised Q1 figure of -0.3% q-o-q. Although we cannot say that the Swiss economy is in a technical recession, it is worth highlighting that the economy is 0.1% below its level in Q4 2014 and has posted average quarterly growth of -0.04% q-o-q so far this year.

The breakdown by expenditure components should be taken with a pinch of salt as GDP components are particularly volatile in Switzerland. Nevertheless, several observations can be drawn from Q3’s expenditure breakdown. Private and public consumption were the main sources of growth. In contrast, investment development was mixed, with investment in equipment posting positive growth whereas construction fell. A bit surprising given monthly data, exports of goods (excluding non-monetary gold, valuables and merchanting) increased in Q3.

Subdued with a slight acceleration in 2016

Looking ahead, the latest key Swiss sentiment indicators such as the KOF surveys and the manufacturing PMI (see the chart below) showed some signs of stabilisation for Q4.

For 2016 as a whole, domestic demand is likely to remain an important driver of economic activity. Private consumption, which accounts for 55% of GDP, should continue to grow healthily on the back of continued population growth and rising real disposable income. However, the fading effect from lower energy prices and the slight deterioration in the labour market due to restrained economic activity might dent consumption somewhat. As for investment, prospects are mixed. Given the subdued economic outlook, there is little hope for acceleration in the pace of expansion in investment.

The strength of the Swiss franc will to continue weigh on exports, although its effect is likely to ease somewhat next year. The slight acceleration expected in the euro area, which accounts for 37% of total Swiss exports, and decent growth in the US (10% of total Swiss exports) could partly compensate for the impact of the Swiss franc.

As a result, we expect Swiss real GDP growth to pick up slightly from an estimated 0.7% for 2015 to 1.1% in 2016. This comes after GDP growth rates of 1.9% and 1.8% respectively in 2013 and 2014.

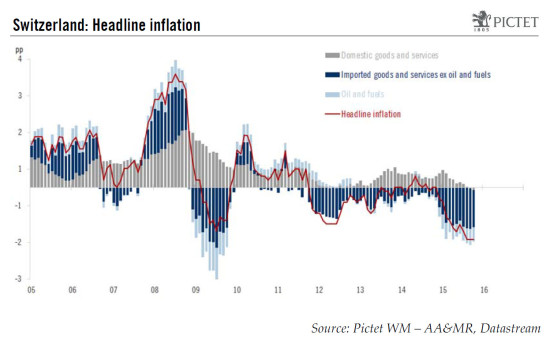

What can be expected in terms of price dynamics?

Over the past 14 months, Swiss headline inflation has settled in negative territory. In October (latest data published), headline inflation has stabilised at -1.4% y-o-y, which is the lowest rate since 1959. Core inflation inched down from -0.7% y-o-y in September to -0.8% y-o-y in October. Weaknesses in Swiss inflation reflect mainly two factors: the appreciation of the Swiss franc and lower energy prices (see the chart below).

Looking ahead, we expect inflation to return close to zero in 2016, due to an upward base effect from the energy price component and the slight easing of the exchange rate environment. As a result, headline inflation is likely to average -0.2% in 2016, after an estimated -1.1% in 2015.

Swiss National Bank under pressure

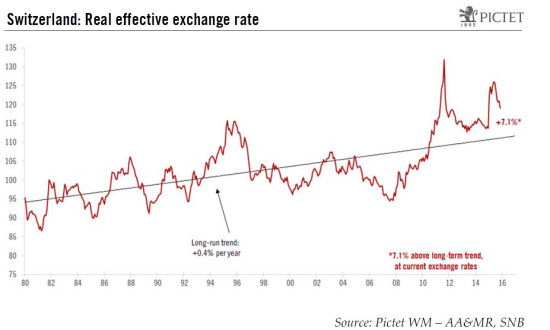

Following the surge in the exchange rate after the Swiss National Bank abandoned its minimum target of CHF1.20 per euro on 15 January 2015, the Swiss franc has weakened a little over recent months. However, it still remains significantly overvalued (see the chart below).

As the euro area is the largest export market for Switzerland, fluctuations against the euro will remain the SNB’s primary concern. On 3 December, the ECB is expected to ease further its monetary policy. In order to curb any significant Swiss franc appreciation, the SNB may either intervene in the FX markets and/or lower the 3-month CHF Libor target rate (currently at -0.75%) further into negative territory.

Another consideration is that US Fed rate hikes should cause the Swiss franc to depreciate against the dollar. The SNB might tolerate a slightly stronger exchange rate against the euro if the effective exchange rate is little changed.