December core retail sales came in below consensus expectations. Nevertheless, we remain sanguine about the prospects for consumption in 2016. Today’s retail sales report was without a doubt quite disappointing. Although consumption growth seems to have slowed noticeably in Q4 (probably to slightly less than 2.0%, after 3.0% in Q3), we remain sanguine on consumption growth in 2016. Nominal total retail sales fell by 0.1% m-o-m in December, in line with consensus expectations. Total...

Read More »China: policy mis-steps fuel sell-offs, but little change in fundamentals

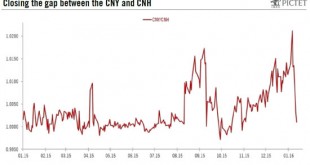

A major turnaround in market sentiment appears unlikely in the short term, given continued concerns over growth and policy, as well as a likely poor corporate results season. Chinese equity markets experienced a substantial sell-off in early January, with the CSI 300 losing 7% on both 4 and 7 January. This sent jitters across global financial markets. The latest bout of market instability in China does not appear to have been related to any change in the country’s economic fundamentals....

Read More »United States: strong job creation, disappointing wage numbers

Job creation was strong in December. However, wage statistics were disappointing and most other economic data released recently were rather soft. December’s employment report showed strong job gains, with noticeable upward revisions for the previous two months. However, the unemployment rate remained stable at 5.0% for the third month in a row and wage increases were surprisingly soft (+0.0% m-o-m). Non-farm payroll employment rose by a strong 292,000 m-o-m in December 2015, well above...

Read More »Chinese equities new sell-off sends jitters across global financial markets

Macroview In our 2016 and secular outlook scenarios, we stressed that emerging markets are a source of risks for global markets as they transition over several years from an export-based model to one with a greater role for domestic demand. The recent Chinese equity market jitters are a new manifestation of the uncertainty surrounding the shift in China’s economic model, which implies a slowdown in growth and volatility in economic and financial data. The fear of a rise in these risks...

Read More »United States: December ISM surveys below expectations

We revise our forecast for Q4 GDP growth from 2.0% to 1.5% as both ISM indices dropped further m-o-m in December. Both ISM indices dropped further m-o-m in December. However, while the Manufacturing index fell to a fresh cycle-low, its Non-Manufacturing counterpart remained pitched at a still relatively healthy level. Nevertheless, most other economic data published recently were surprisingly soft. We revise our forecast for Q4 GDP growth from 2.0% to 1.5%. ISM Manufacturing index fell...

Read More »Financial markets, volatility and asset allocation

Macroview On the very first trading day of 2016, a seven per cent selloff in the CSI 300 Index sparked jitters across global financial markets. Lacklustre dynamics in the global economic cycle are having a knock-on effect on corporate profits and generating increased volatility in financial markets. Volatility is likely to settle at higher levels in 2016. That has prompted us to employ a balanced strategic allocation – roughly half and half, on average, in equities and bonds. Tactical...

Read More »Spain: political fragmentation leads to a hung parliament

The 2015 general elections marked one of the major changes in Spanish political history. For the first time since Spain embraced democracy in the late 1970s, the two parties that have dominated the political landscape (the Socialist Party, or PSOE, and the Popular Party, PP) have been challenged by two emerging groups: Ciudadanos (liberal-reformist) and Podemos (radical left). General elections held yesterday yielded a highly fragmented Congress with no absolute majority for a single...

Read More »Euro area – Consumer prices: the core of the problem (2/2)

In this note we look at the drivers of the ECB's staff upbeat inflation projections. We find that the ECB relies to a large extent on a further pass-through from unconventional measures. In a previous note focusing on euro area consumer prices, we looked at recent trends in core inflation and came to the following conclusions: Most indicators are consistent with a gradual increase in underlying inflation in 2016, albeit with a weak momentum and downside risks. The ECB will monitor core...

Read More »The US Federal Reserve brings an end to a seven-year period of virtually zero interest rates

At yesterday’s FOMC meeting, the Fed finally decided to hike rates by 25bp, adding that the path of future rate hikes would be gradual. We continue to expect a very slow pace of tightening next year (only two additional 25bp hikes). In line with what almost every forecaster was expecting, at its meeting yesterday, the Federal Open Market Committee (FOMC) decided to hike interest rates, and raised the target range for the Fed funds rate by 25bp from 0%-0.25% to 0.25%-0.5%. The Fed fund...

Read More »Euro area: positive signal from forward-looking indices

In December, euro area business surveys (PMIs and IFO) slightly softened on the back of a weaker services sector, in particular in France, whereas the manufacturing sector held up again. According to Markit’s preliminary estimates, the euro area composite PMI eased slightly from 54.2 in November to 54.0 in December against expectations for no change. December’s decline was due to the services sector (-0.3 point to 53.9), whereas the manufacturing index (+0.3 point to 53.1) edged up for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org