Our 2016 scenario reaffirmed our preference for developed equities over emerging equities. Overall our total return expectation in Japan is similar to expectations in the US and Europe in a 7%-10% range. A number of concerns hang over the outlook for Japanese equities in 2016. The first phase of Abenomics had only mixed success, and plans for the second phase are still vague. Although there are some encouraging signs, the economy’s trajectory remains weak. Earnings have been resilient, but this may not be sustained. Japanese equities saw an especially sharp sell-off in the global market turmoil of August-September as external investors, who play a key role in the market, sold. Japan remains an attractive market overall, but probably less so than in recent years – and risks have increased. From Abenomics 1.0 to 2.0 Prime Minister Abe was elected at the end of 2012 and launched a massive programme to revive the Japanese economy after two decades of deflation. The programme was based on the so-called ‘three arrows’: loose monetary policy, fiscal stimulus and structural reforms. The most important element to date has been monetary policy: the quantitative easing (QE) that was launched in April 2013 and extended in October 2014. Since 2013, Japanese CPI has moved into positive territory and currently stands at 0.9% excluding fresh food and energy.

Topics:

Jacques Henry considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Our 2016 scenario reaffirmed our preference for developed equities over emerging equities. Overall our total return expectation in Japan is similar to expectations in the US and Europe in a 7%-10% range.

A number of concerns hang over the outlook for Japanese equities in 2016. The first phase of Abenomics had only mixed success, and plans for the second phase are still vague. Although there are some encouraging signs, the economy’s trajectory remains weak. Earnings have been resilient, but this may not be sustained. Japanese equities saw an especially sharp sell-off in the global market turmoil of August-September as external investors, who play a key role in the market, sold. Japan remains an attractive market overall, but probably less so than in recent years – and risks have increased.

From Abenomics 1.0 to 2.0

Prime Minister Abe was elected at the end of 2012 and launched a massive programme to revive the Japanese economy after two decades of deflation. The programme was based on the so-called ‘three arrows’: loose monetary policy, fiscal stimulus and structural reforms. The most important element to date has been monetary policy: the quantitative easing (QE) that was launched in April 2013 and extended in October 2014. Since 2013, Japanese CPI has moved into positive territory and currently stands at 0.9% excluding fresh food and energy. Following weak commodity prices, the 2% inflation target was pushed forward to the end of 2016, but the BoJ is still committed to buying Y80trn of assets annually, mainly Japanese Government Bonds. On the fiscal consolidation front, Japanese consumers struggled to digest the 2014 VAT tax hike from 5% to 8%, and the next hike, to 10%, was postponed to April 2017. Structural reforms are lagging, but the recent agreement of the Trans-Pacific Partnership, a free-trade zone in the Pacific including the US and Japan, is an important step in the right direction.

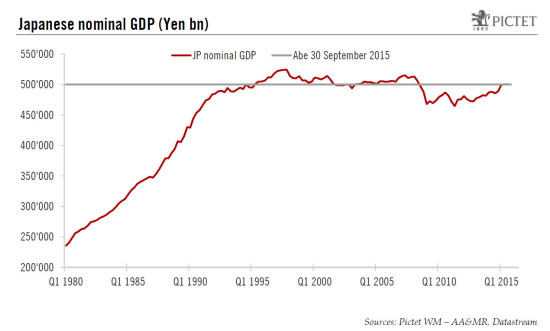

A new set of measures, stage two of Abenomics, was announced in September, with a more detailed plan expected by spring 2016. There are now three main targets: boost nominal GDP to Y600trn, increase the fertility rate from 1.4 to 1.8 and promote elderly care. A 20% increase in nominal GDP by 2020, i.e. an annual increase of 3.7%, looks challenging: GDP has been in a range centred around Y500trn since 1995. The government expects to boost growth thanks to increased R&D, lower corporate tax rates and a productivity revolution, but its plans are still too vague at this stage to properly assess likely progress.

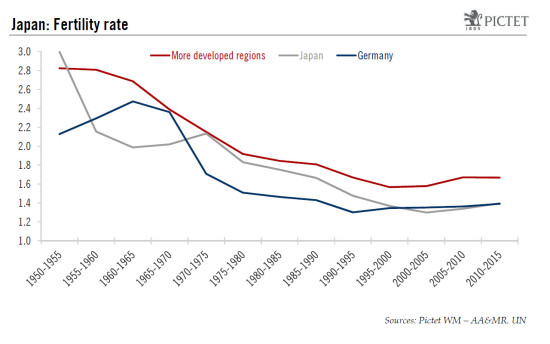

The last two new targets are linked to Japan’s demographic challenges. Raising the fertility rate to 1.8 is necessary just to keep the population from falling below 100 million by 2050, from 127m currently. With the population ageing, improving nursing facilities and enhancing wages for nursing care workers makes sense. However, Japan also realistically needs progress on immigration to stem population decline. Germany, another major exporter with a similar fertility rate, has managed to stabilise and even slightly increase its population, thanks to immigration. But Japan remains reluctant to make a bold move in this area, which raises concerns over its long-term economic growth prospects.

Economic achievements: a mixed bag

Success in reviving the economy has been mixed. Real GDP growth in Q3 2015 was negative at -0.8% y-o-y, following -0.7% in Q2. The latest poor showing was heavily impacted by inventory adjustment, at -2.1% y-o-y. Nevertheless, the economy’s trajectory remains poor. Despite the weak yen, exports from Japan have contracted in 2015, and industrial production has not bounced back in the year-to-date. Lower oil prices helped this year, as soft imports counterbalanced weak exports, but this is unlikely to repeat in 2016. However, Japan has at least started to tackle its dependence on energy imports. Two nuclear plants have been restarted since August, another reactor has also received approval to restart, and a further 25 reactors at ten nuclear power plants are in process of being approved.

Japan’s economy is increasingly relying on consumption. Since December 2012 the unemployment rate has decreased from 4.3% to 3.4%, and the jobs-to-applicants ratio is at 1.24, its highest level since 1992. Further strength in consumption requires wage growth. Wages have been fairly stable over the past few years, yet there are green shoots: real wages rose in Q3, including by 0.5% in September. Wages are particularly important in Japan, since wealth effects are small. First, although real estate prices are picking up, the increase is not huge and is mainly in the Tokyo area. Second, Japanese retail investors have low exposure to equities and so did not benefit much from the stock market surge since 2012.

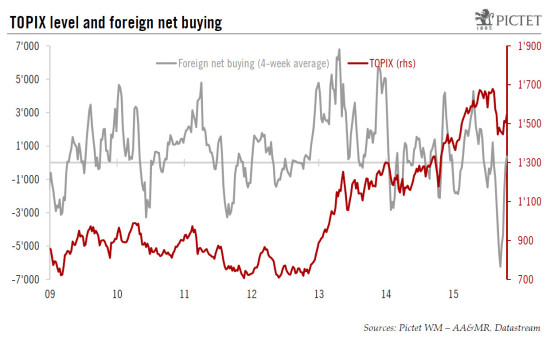

External investors play a key role

After performing well in H1 2015, Japanese equity markets experienced a massive 16% drawdown (TOPIX total return) between 10 August and 30 September, whereas Europe and the US were a bit more resilient at -12.8% (Stoxx 600 total return) and -8.4% (S&P 500 total return) respectively. The sharper fall in Japan resulted from a massive sell-off by external investors, almost twice as large as the amount sold off in market troughs since 2009.

The impact of external investors will continue to be a problem. Due to the absence of Japanese retail investors, pension funds are the sole meaningful domestic investor in Japanese equities. The Government Pension Investment Fund (GPIF) reform launched in October 2014 aimed at decreasing its allocation to domestic bonds and increasing allocation to domestic equities, as well as international assets. The target allocation to domestic equities now stands at 25%, compared with 23.4% at the end of June. Unless the GPIF moves quickly to the upper bound of its domestic equity allocation, it is unlikely to provide much support to Japanese equities in the coming year.

Earnings recovery is largely over

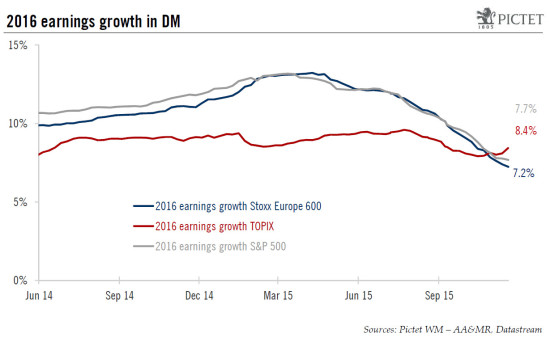

Since the disasters of 2011, TOPIX earnings have bounced back considerably, by 174% using current 2015 earnings expectations. Earnings growth expectations for 2015 have been extremely resilient at 18.5%, at a time when they have been slashed globally: to 4.7% for the Stoxx Europe 600, 2.5% for the MSCI Asia ex Japan, and a meagre 0.6% for the S&P 500 at present. A key reason is that the TOPIX’s exposure to the oil and gas and raw materials sectors is marginal; the weak yen has also helped.

Japan has also been much more resilient for 2016 earnings — although these are curbing. Expectations are now at 8.4%, above 7.2% in Europe and 7.7% in the US. Some 60% of expected 2016 earnings growth in Japan is driven by cyclical sectors, up from 43% in 2015. With three-quarters of TOPIX sales in Asia, earnings growth in Japan will depend on positive developments in emerging markets, especially in Asia — risks to earnings growth have therefore increased.

The yen is a concern

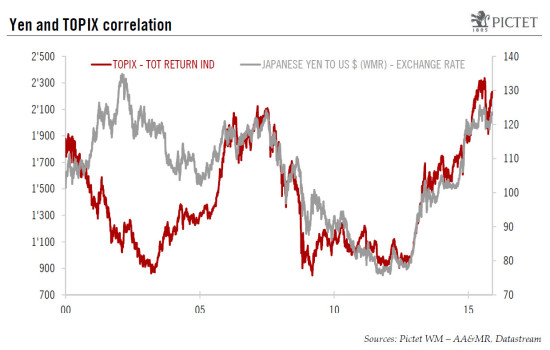

Implied risk has also increased. Implied volatility on the Nikkei index has been level with or above the European risk level since October. The term structure of Nikkei volatility has remained flat, meaning that investors are still discounting elevated risk in the short term. Yen and TOPIX correlation is also a source of concern. Since 2013 there has been a strong correlation between yen weakness and TOPIX strength. Despite disappointing macroeconomic data, the BoJ has not so far gone further in terms of QE. The yen is already weak relative to the USD, even on a trade-weighted basis. Our FX strategist does not expect much further yen weakening, which is worrying for Japanese equities.

Returning retail investors and buybacks bode well

Nevertheless, the Japanese equity market should continue to revive. There are signs of retail investors, who have hitherto been reluctant to invest again in Japanese equities, returning to the market. The Japan Post IPO – the biggest worldwide this year, raising Y1.44trn ($12bn), and the largest asset sale in Japan since the bubble burst in the 1990s – was, reassuringly, mostly subscribed by retail investors.

Corporate governance is another positive factor for Japanese equities. The Japanese corporate governance code implemented in June 2015 urges companies to both appoint at least two independent directors and explain the rationale of cross-shareholdings. Japanese equities are therefore gradually becoming more shareholder-friendly. As earnings have surged and ROE is lagging other DM equities, share buyback is an attractive way for Japanese companies to return cash to shareholders. Buyback announcements have surged over the past few years from around 30 in 2013 to around 40 in 2014 and around 90 in the year-to-date. For the first time, buyback yield has been positive in Japan, and we expect this trend to go further. At 14.7x forward earnings, valuation of Japanese equities is neither cheap nor demanding, and has converged to levels seen in Europe.

Decreasing risk-reward, but still an attractive equity market

Our 2016 scenario reaffirmed our preference for developed equities over emerging equities. Overall, our total return expectation in Japan is similar to expectations in the US and Europe in a 7%-10% range. This should be mainly driven by earnings growth, as dividend yield is relatively small in Japan and buyback yield will take time to reach a meaningful level. Yet risk has increased, especially surrounding earnings growth. Moreover, even if the yen is not expected to depreciate much further, equity investors may still find it wise to hedge the currency.