The minutes of October’s FOMC meeting confirmed that a December hike is firmly on the table. Although monetary conditions have tightened noticeably so far in November, the most likely scenario remains that the Fed will hike rates in December. Conditions for a hike “could well be met” in December The FOMC statement published after the 27-28 October meeting has sounded more hawkish than expected, as it put a December hike more firmly on the table. The minutes of this same meeting, published yesterday, broadly confirmed this impression. They indicated that most participants anticipated that conditions for a hike “could well be met by the time of the next meeting”. There were also interesting comments on why the FOMC should avoid delaying the tightening of monetary policy. Concerns were that a delay “could increase uncertainty in financial markets and unduly magnify the perceived importance of the beginning of the policy normalization process” and that it “could be interpreted as signaling lack of confidence in the strength of the U.S. economy or erode the Committee’s credibility”. The minutes also reinforced the messages Janet Yellen sent a week after the October FOMC meeting in an important speech (see our November 6th post).

Topics:

Bernard Lambert considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The minutes of October’s FOMC meeting confirmed that a December hike is firmly on the table.

Although monetary conditions have tightened noticeably so far in November, the most likely scenario remains that the Fed will hike rates in December.

Conditions for a hike “could well be met” in December

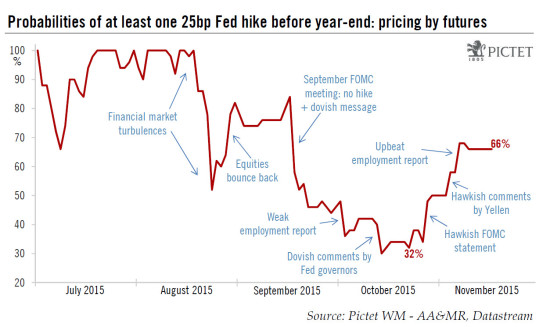

The FOMC statement published after the 27-28 October meeting has sounded more hawkish than expected, as it put a December hike more firmly on the table. The minutes of this same meeting, published yesterday, broadly confirmed this impression. They indicated that most participants anticipated that conditions for a hike “could well be met by the time of the next meeting”.

There were also interesting comments on why the FOMC should avoid delaying the tightening of monetary policy. Concerns were that a delay “could increase uncertainty in financial markets and unduly magnify the perceived importance of the beginning of the policy normalization process” and that it “could be interpreted as signaling lack of confidence in the strength of the U.S. economy or erode the Committee’s credibility”.

The minutes also reinforced the messages Janet Yellen sent a week after the October FOMC meeting in an important speech (see our November 6th post). The minutes mentioned that “it was noted that the expected path of the federal funds rate, rather than the exact timing of the initial increase, was most important in influencing financial conditions and thus in affecting the outlook for the economy and inflation” and that “beginning the normalization process relatively soon would make it more likely that the policy trajectory after liftoff could be shallow”.

Although the FOMC minutes provided some interesting details, it is worth remembering that they refer to a meeting that happened more than three weeks ago. So, what has happened since then? On the plus side, the most important development was without doubt an October employment report that appeared quite robust on all fronts, with solid job creation, the unemployment rate touching 5.0% and higher wage increases. That was of particular importance as the minutes also showed that at the time of October’s FOMC meeting quite a few members were worried by the soft August and September employment reports.

Meanwhile, the Q3 GDP growth rate was in line with expectations (+1.5%), with strong final demand. And, on the back of higher inventories, Q3 growth may well be revised up to around 2.0%. Moreover, Tuesday’s core CPI data for October showed a solid 0.2% monthly increase. However, other economic data for October and November were rather mixed, with notably disappointing retail sales numbers. And November’s Michigan sentiment survey confirmed that survey measures of inflation expectations have dropped further over the past few months. According to this survey, consumer inflation expectations for the next 5-10 years remained unchanged at the low level recorded in October. On a 3-month moving average basis, this measure of long-term inflation expectations has reached a fresh historical low.

Noticeable tightening of monetary conditions

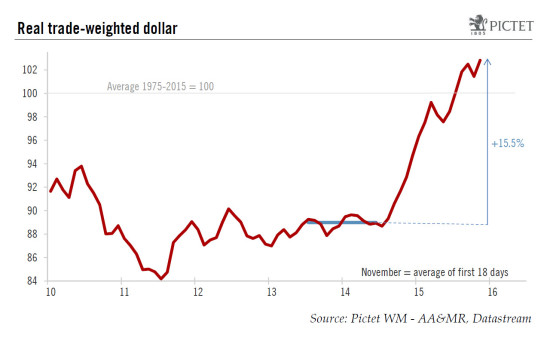

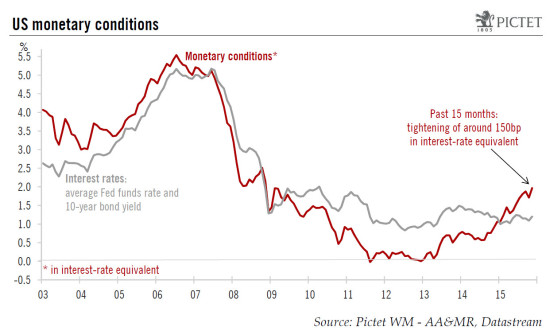

Moreover, monetary and financial conditions have tightened noticeably so far in November. Since the FOMC met on 27-28 October, the trade-weighted dollar has risen by a further 1.5%, reaching a new 12-year high. And 2-year Treasury yields increased by around 25bp, whereas 10-year yields rose by some 20bp. As a result, monetary conditions, according to our estimates and expressed in terms of interest rate equivalence, are currently 25bp tighter than when the Fed met in October and around 150bp tighter than 15 months ago. In a way, the rise in the dollar’s value (and in long-term rates) is doing the tightening job for the Fed. Moreover, it is pushing inflation prospects lower. Importantly as well, since the Fed met in October, crude oil prices have fallen back by some 5%. However, although they moved sharply down and then up, US equities are roughly at the same level as they were on 27-28 October.

A December hike still appears the most likely scenario

A December hike is not a done deal. If the Fed is confronted with a weak November’s employment report (due to be published on 4 December) and/or a further sharp tightening in financial conditions, it may choose to wait until next year before hiking rates. However, the bar for not hiking in December is probably quite high. And most recent comments from Fed officials tended to confirm this. This is even more the case as another delay would probably mean a noticeable loss of credibility for the Fed and, as mentioned above, could be paradoxically disruptive for financial markets. Therefore, we continue to believe the most likely scenario is that the Fed will start hiking rates next month.

We also stick to our view that, as monetary conditions will probably tighten further, the pace of rate tightening after the initial hike will be particularly pedestrian. A lengthy pause after lift-off is even possible if the reaction on markets (FX, bonds and/or equities) is too adverse. Our forecast that the target range on the Fed funds rate will end 2016 at 0.75%-1.00% (three 25bp hikes from now to end-2016) remains unchanged. In any event, the trajectory of monetary policy will be highly data-dependent, and the Fed will act very carefully in trying to avoid any unwanted tightening of monetary conditions. One consequence of the latter is that the FOMC will likely continue to reinvest principal payments on its securities portfolio in 2016. We expect the tapering of reinvestment to start at the beginning of 2017.