Swiss Franc EUR/CHF - Euro Swiss Franc, April 12(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Markets are calmer today. The significant movers yesterday have stabilized. The dollar has been unable to resurface above JPY110, but after plumbing to new lows near JPY109.35 in Asia, the dollar has recovered back levels since in North America late yesterday. The decline in the US 10-year yield was...

Read More »FOMC Minutes Suggest Balance Sheet May Begin Shrinking This Year

Summary: FOMC minutes increased likelihood that Fed will begin reducing its balance sheet late this year. There does not seem to be a consensus on other issues. The strength of the ADP report contrasts with softness seen in the ISM and PMI non-manufacturing surveys. The FOMC minutes were clear that officials are contemplating beginning address the balance sheet, which is another sign of confidence in the...

Read More »FX Daily, April 11: Dollar Pushed Lower in Subdued Activity

Swiss Franc EUR/CHF - Euro Swiss Franc, April 11(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The Swiss Franc could be in for a particularly volatile with the recent developments in Syria and now North Korea. Both the Swiss Franc and US dollar generally perform very well in times of global economic and political uncertainty as their status as safe haven currencies becomes apparent once again. The...

Read More »Impressive Japanese Flows at the end of the Fiscal Year

Summary: Japanese investors bought foreign bonds in the last week of March for the first time in nine weeks. Foreigners bought the most Japanese stocks since last April. The pain trade is for a break of JPY110. Japan’s Ministry of Finance reports portfolio flows on a weekly basis with a week lag. The data just reported covers the last week in March, as the Japanese fiscal year was drawing to a close. Japanese...

Read More »Weekly Speculative Positions (April 4 Data): Reduction in CHF Net Shorts

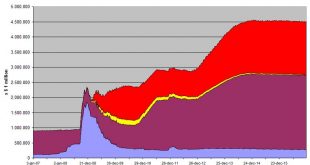

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Daily, April 10: Dollar Narrowly Mixed at Start of Holiday Week

Swiss Franc EUR/CHF - Euro Swiss Franc, April 10(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The Pound and the Swiss Franc have had a strange relationship since the missile strike by the US on a Syrian Government airbase last week. Pound to Swiss Franc exchange rates plummeted before recovering and then exceeding expectations as we entered into the weekend. The ‘anomaly’ as some are now calling it,...

Read More »FX Weekly Preview: A New Phase Begins

There were no celebrations; no horn or trumpets, nary a sound, but an important shift took place last week. The shift was signaled by two events. The first was the US strike on Syria, and the second was investors’ willingness to look past Q1 economic data. The US missile strike on Syria was significant even if it fails to change the dynamics on the ground. It undermines the Trump Administration’s ability to “reset” the...

Read More »FX Weekly Review, April 03-08: Dollar Recovery Can Continue, 10-year Yield Set to Rise

Swiss Franc Currency Index In the last week, the Swiss Franc index lost a little territory as compared to the dollar index. Finally it ended, where it started one month ago. Trade-weighted index Swiss Franc, April 08(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the...

Read More »US Jobs Growth Disappoints

The US jobs growth slowed considerably more than expected in March and the disappointment pushed the dollar and equities initially lower. United States Nonfarm payrolls The US created 98k jobs in March, well below market expectations for around 175k jobs. Adding insult to injury, revisions to the January and February data took off another 38k job. U.S. Nonfarm Payrolls, March 2017(see more posts on U.S. Nonfarm...

Read More »Short Note on US Employment Report

The US jobs data is notoriously difficult to accurately forecast consistently. I do not claim to do so now. My intent is more modest. It is simply to point out why I there is risk that the jobs data is disappointing, especially after the stronger than expected ADP estimate. U.S. Nonfarm Payrolls, March 2017(see more posts on U.S. Nonfarm Payrolls, ) Source: investing.com - Click to enlarge The same forces that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org