Swiss Franc EUR/CHF - Euro Swiss Franc, April 11(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The Swiss Franc could be in for a particularly volatile with the recent developments in Syria and now North Korea. Both the Swiss Franc and US dollar generally perform very well in times of global economic and political uncertainty as their status as safe haven currencies becomes apparent once again. The crisis in Syria does appear to be reaching boiling point with pressure mounting not just from the US but also leaders in Europe and notably Germany. With US warships heading towards North Korea rather than Australia where they were supposed to be heading it is not clear where all of this will end up but the Swiss Franc could make some considerable gains if tensions build and if things do escalate. With meetings in full force this week by global leaders there could be an agreement and new action taken which could see the Swiss Franc move. Similarly on the political front the French elections are rapidly approaching with the first round being held 23rd April 2017. A Marine le pen win cannot be ruled out and the Swiss Franc in my view is likely to see major volatility on this particular outcome.

Topics:

Marc Chandler considers the following as important: Featured, France, FX Trends, Interest rates, Korea, newslettersent, Oil, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

EUR/CHF - Euro Swiss Franc, April 11(see more posts on EUR/CHF, ) |

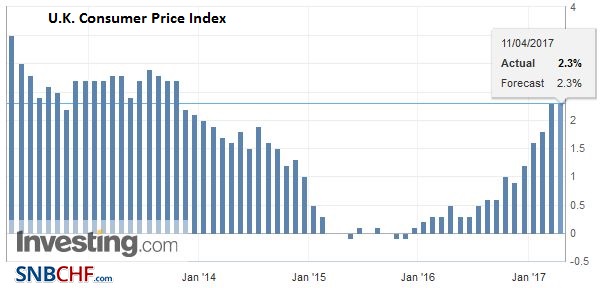

GBP/CHFThe Swiss Franc could be in for a particularly volatile with the recent developments in Syria and now North Korea. Both the Swiss Franc and US dollar generally perform very well in times of global economic and political uncertainty as their status as safe haven currencies becomes apparent once again. The crisis in Syria does appear to be reaching boiling point with pressure mounting not just from the US but also leaders in Europe and notably Germany. Similarly on the political front the French elections are rapidly approaching with the first round being held 23rd April 2017. A Marine le pen win cannot be ruled out and the Swiss Franc in my view is likely to see major volatility on this particular outcome. Clients looking to buy or sell Swiss Francs would be wise to get in touch and look at the options available in what could be a very volatile period. Economic data from Switzerland is very light this week with just producer and import prices for March released on Thursday. As far as GBP CHF is concerned UK inflation data is released this morning which could see the pound rally. Any sharp increase in inflation could see the pound strengthen as it may force the bank of England to raise interest rates, something it would be reluctant to do at this point in time with remaining uncertainties surrounding Brexit. |

GBP/CHF - British Pound Swiss Franc, April 11(see more posts on GBP/CHF, ) |

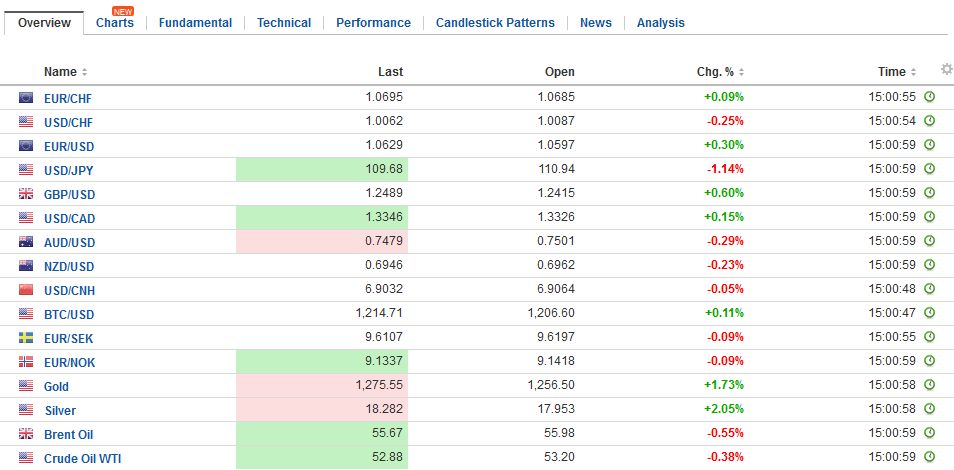

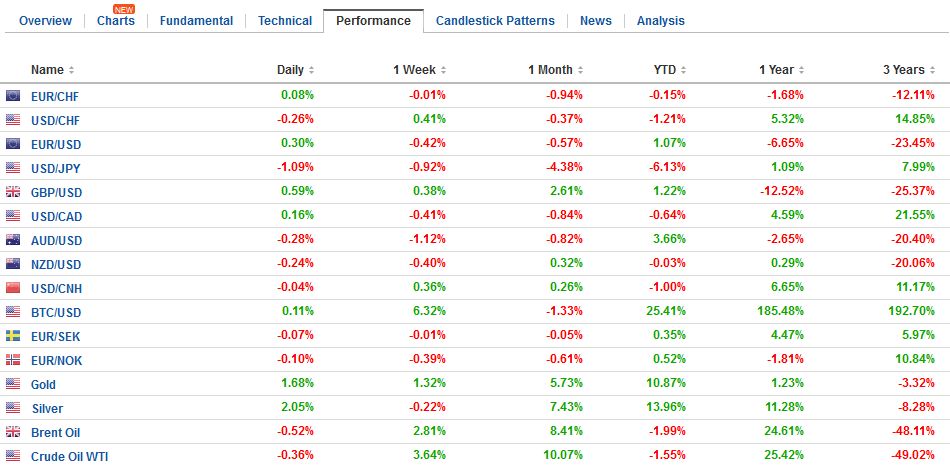

FX RatesThe US dollar has a slight downside bias today through the European morning. The market does not seem particularly focused on high frequency data, though sterling traded higher after an unchanged year-over-year reading of 2.3%, and the euro traded higher after a stronger Germany ZEW survey. Geopolitical concerns continued to be elevated. The South Korean won’s slide has been extended for the sixth consecutive session and ten of the past 11 sessions. Its 0.3% decline today brings this week’s loss to 1.0% after around a 1.4% loss last week. Korea’s Kospi’s nearly 0.5% loss today is also its sixth consecutive loss and also was among the larger losers in today’s session that saw the MSCI Asia Pacific Index slipped 0.1%. |

FX Daily Rates, April 11 |

| European shares are also trading with a slight downside bias. Information technology and financials are leading the way lower, while consumer discretionary and real estate are doing better. With the tightening in the French polls ahead of the election in a couple of weeks, pressure is staying on France, where bonds are under pressure and the 10-year premium over Germany continues to trend back to the high seen in February.

Since the end of March, the French premium on 10-year yields has risen a little more than 10 bp to 75 bp. The late February high was 79 bp. The 2-year premium investors are demanding to hold French paper is making new multi-year highs today near 56 bp. It has more than doubled since the late-March. The February high was 45 bp. It has been nearly five years since the 2-year premium was this large. |

FX Performance, April 11 |

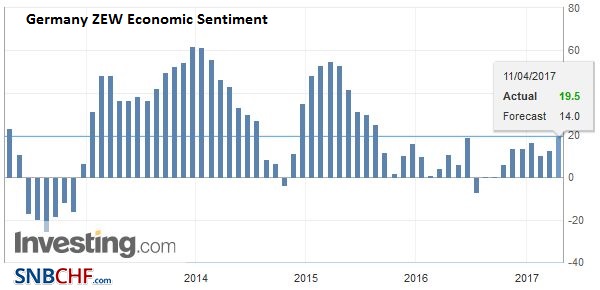

GermanyThe German investor survey, ZEW, rose more than expected. The assessment of the current situation rose to 80.1 from 77.3. This is a new six-year high. The expectations component rose to 19.5 from 12.8. This is the highest since August 2015. With the DAX up four consecutive months through March, a euro that makes German businesses extremely competitive and low yields, it is hardly surprising that investor confidence is buoyant in Germany. That said sentiment is running ahead of real sector data. Earlier today, the German 10-year yield slipped briefly below 20 bp for the first time since late February. It is trading a little above there near midday in Europe. |

Germany ZEW Economic Sentiment, March 2017(see more posts on Germany ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

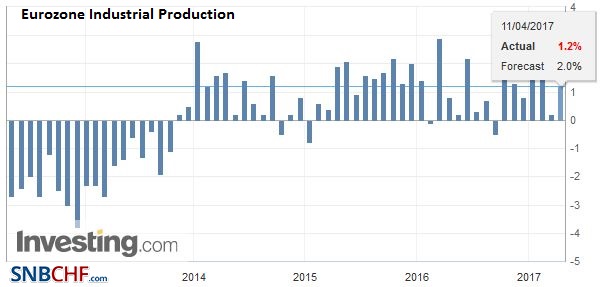

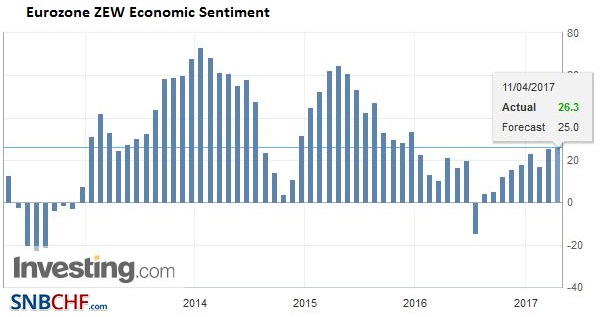

EurozoneAs we noted yesterday, after seeing the large states report national figures, the risk on the eurozone aggregate industrial output was on the downside, despite relatively upbeat PMI data. Industrial output in February fell 0.3%. The Bloomberg consensus was for a 0.1% gain. Adding insult to injury, and underscoring the gap between real sector data and the surveys, the January gain was slashed to 0.3% from 0.9%. |

Eurozone Industrial Production YoY, March 2017(see more posts on Eurozone Industrial Production, ) Source: Investing.com - Click to enlarge |

Eurozone ZEW Economic Sentiment, March 2017(see more posts on Eurozone ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

|

United KingdomBRC like-for-like UK retail sales in March fell 1.0%. This matches the largest decline in since April 2015. The 0.8% decline in non-food sales was the worst in nearly six years. Part of the reason for weaker sales may be higher inflation. Separately, the UK reported March CPI was flat at 2.3% year-over-year, rising 0.4% on the month. Many look for UK inflation to push toward 3.0% before peaking later this year as last year’s oil rally and sterling’s slide drop out of year-over-year calculations. The UK’s core rate slipped to 1.8% from 2.0%, but also probably has not peaked. Producer prices were a little firmer than expected. Input prices (17.9% year-over-year) continues to outstrip output prices (3.6% year-over-year), which is often seen as pressure on profits. Tomorrow the UK reports the latest employment figures. |

U.K. Consumer Price Index (CPI) YoY, March 2017(see more posts on U.K. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Oil is threatening to snap a five-day rally. The May light sweet crude oil futures contract rallied more than a dollar a day over the past three sessions and four of the past five. Disruptions in Libya and reports that Russia is considering extending its cuts helped fuel the last gains. We note that the May contract is running into a technical area that may give the bulls a pause. The 61.8% correction of this year’s decline is found near $53.50, which also corresponds to trend line resistance off of the early January and late February highs. The upper Bollinger Band is just above $53.20.

Oil prices have done little to lend support to the US Treasuries. The yield, near 2.33% is six basis point below yesterday’s high. Yellen’s comments yesterday failed to inspire the bears despite saying nothing to deter the expectations of a June hike. She did acknowledge that the Fed has a different posture now. Previously, the Fed was concerned about ensuring the economy was recovering from the financial crisis. Now it is engaged in trying to extend the expansion.

There is little concession built for today’s $20 bln auction of 10-year notes. This maturity is the fourth most popular among foreign investors and central banks, behind the 10 and 30-year TIPS and the 7-year note. Foreign official demand is often picked up in the indirect bids. In the last dozen auctions, the indirect bids took almost 2/3 of the 10-year sale.

The US economic calendar is light, featuring the JOLTS report on job openings. The Minneapolis Fed President Kashkari, the lone dissent to the last month’s decision to hike rates, speaks late in the session.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Featured,France,Interest rates,Korea,newslettersent,OIL,U.K.