Source: cnbc.com - Click to enlarge I had time this afternoon, as I prepare for my TMA presentation tomorrow night here in Hong Kong, to find my clip from yesterday on CNBC, where I suggested the risk of a dollar recovery after it lost downside momentum in North America on Monday. There has not been much follow through today, though the euro broke below $1.08 in late-Asia and is maintaining the break in early...

Read More »Cool Video: Brexit, Europe and EU Challenges

Earlier today, I had the opportunity to discuss the outlook for sterling and the US dollar on Bloomberg TV with Rishaad Salamat and Haidi Lun. It is a momentous day with Article 50 of the Lisbon Treaty being formally triggered by UK Prime Minister May, nine months after what was, at least initially, a non-binding referendum. European Council President Tusk is expected formally to respond for the EU before the...

Read More »FX Daily, March 28: Prospects for Turnaround Tuesday?

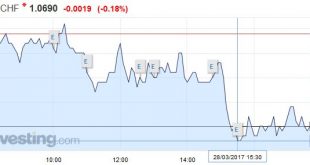

Swiss Franc EUR/CHF - Euro Swiss Franc, March 28(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The Swiss Franc continues to hold the higher ground as global uncertainty continues to dominate the markets. UBS Consumption Indicator is released tomorrow morning which should give some further clues to as the health of the Swiss economy. The numbers are important as the consumption is the most important...

Read More »Weekly Speculative Positions: Continued reduction of Euro Shorts

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »Weekly Speculative Position:

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Weekly Preview: After US Health Care, Now What?

United States The first quarter winds down. The dollar moved lower against all the major currencies. The best performer in the first three months of the year has been the Australian dollar’s whose 5.8% rally includes last week’s 1% drop. The worst performing major currency has been the Canadian dollar. It often underperforms in a weak US dollar environment. It’s almost 0.5.% gain is less than half the appreciation...

Read More »FX Weekly Review, March 20 – March 25: Dollar Bottom Near?

Swiss Franc Currency Index In the last week, the Swiss Franc index recovered and gained about 2%. The dollar index lost 1.5%, Trade-weighted index Swiss Franc, March 25(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket)On a three years interval, the...

Read More »FX Daily, March 24: Dollar Trying to Stabilize Ahead of the Weekend

Swiss Franc EUR/CHF - Euro Swiss Franc, March 24(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF With just a few days to go before Article 50 is triggered the currency markets are waiting with baited breath for what may happen to the value of the Pound against all major currencies including against the Swiss Franc. Yesterday we saw a brief respite for the Pound vs the Swiss Franc with the release of...

Read More »FX Daily, March 23: Some Thoughts about the Recent Price Action

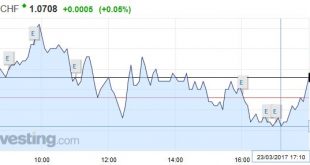

Swiss Franc EUR/CHF - Euro Swiss Franc, March 23(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The gains the US dollar scored last month have been largely unwound against the major currencies. The dollar’s losses against the yen are a bit greater, and it returned to levels not seen late last November. The down draft in the dollar appears part of a larger development in the capital markets that has...

Read More »Status of US Pivot To Asia

Summary: Pivot still taking place, but without TPP, more militaristic. President Trump seems a little less confrontational toward China. China is unlikely to be cited as a currency manipulator in next month’s Treasury report. The Obama Administration tried restarting US-Russian relations with little success. The inability to secure the European flank weakened the pivot to Asia. The Trans-Pacific Partnership...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org