Summary: Sterling has given up 50% of the gains score since late August’s lows. Rate hike expectations are running high. Speculative market positioning has adjusted, and for the first time in a couple of years, speculators in the futures market are net long. Sterling peaked on September 20 near $1.3660. It traded to nearly $1.3220 today. It has fallen in nine of the past dozen sessions. The main culprits are...

Read More »FX Daily, October 05: Sterling and Aussie Weakness Featured in the Otherwise Becalmed FX Market

Swiss Franc The Euro has fallen by 0.03% to 1.1461 CHF. EUR/CHF and USD/CHF, October 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is mostly little changed as the broad consolidation that has emerged this week continues. The two powerful forces that have emerged–expectation of a Fed hike at the end of the year and European political challenges–appear to...

Read More »Weekly Technical Analysis: 02/10/2017 – USDJPY, EURUSD, GBPUSD, USDCAD

USD/CHF EUR/CHF EUR/CHF and USD/CHF, October 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge USD/JPY [embedded content] USD/JPY with Technical Indicators, October 2 - Click to enlarge EUR/USD [embedded content] EUR/USD with Technical Indicators, October 2 - Click to enlarge GBP/USD [embedded content] GBP/USD with Technical Indicators, October 2 - Click to...

Read More »FX Daily, October 04: Consolidative Tone in FX Continues

Swiss Franc The Euro has risen by 0.10% to 1.1443 CHF. EUR/CHF and USD/CHF, October 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has a softer tone today, and it was that way even for the European PMI. The greenback eased further after the upside momentum faded yesterday. The heavier tone in Asia seemed spurred by a hedge fund manager’s call that...

Read More »FX Daily, October 03: Dollar Retains Firm Tone, Spanish Markets Stabilize

Swiss Franc The Euro has risen by 0.17% to 1.1452 CHF EUR/CHF and USD/CHF, October 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Firm US interest rates and a strong manufacturing ISM yesterday help support the greenback, while disappointing construction PMI in the UK weighs on sterling. The euro briefly slipped below $1.17 in Asia for the first time in six weeks. It...

Read More »Another Look at Why the Return to Capital is Low

(summary of presentation based on my book, Political Economy of Tomorrow, delivered to Bank Credit Analyst conference yesterday) Alice laughed. There is no use trying; she said, “one can’t believe impossible things.” I dare say you haven’t had much practice, said the queen. When I was younger, I always did it for half an hour a day. Why sometimes I’ve believed as many as six impossible things before breakfast. — Lewis...

Read More »FX Daily, October 02: Dollar Upbeat to Start Fourth Quarter

Swiss Franc The Euro has fallen by 0.30% to 1.1404 CHF EUR/CHF and USD/CHF, October 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is broadly higher as the quarter-end positioning losses seen at the end of last week area reversed. Developments in the US are seen as dollar positive, while the Catalonia-Madrid conflict, and slightly softer EMU...

Read More »FX Weekly Preview: Changing Dynamics

We agree with the consensus that the markets are in a transition phase. The consensus sees this transition phase as a new economic convergence. European and Japanese economic growth continues above trend. Large emerging markets, including BRICs, are also expanding. Central banks are gradually moving away from the extreme accommodation. We recognize the robust economic growth, but we do not see this economic convergence...

Read More »Great Graphic: Potential Head and Shoulders Bottom in the Dollar Index

This Great Graphic was composed on Bloomberg. It shows the recent price action of the Dollar Index. There seems to be a head and shoulders bottoming pattern that has been traced out over the last few weeks. The right shoulder was carved last week, and today, the Dollar Index is pushing through the neckline, which is found by connecting the bounces after the shoulders were formed. One of the important contributions of...

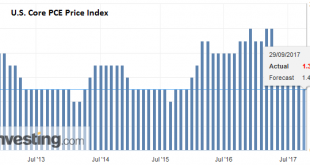

Read More »Evolving Thoughts on Inflation

In early 2005, Greenspan said that the fact that long-term rates were lower despite the Fed’s campaign to raise short-term rates was a “conundrum.” Many rushed to offer the Fed Chair an explanation of the conundrum, which given past cycles may not have been such an enigma in the first place. Be it as it may, at last week’s press conference, Yellen admitted that the decline in inflation was a “mystery.” She said, “I...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org