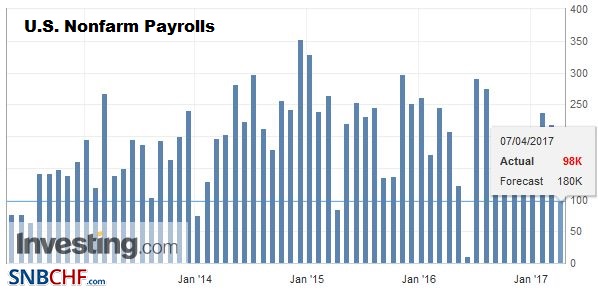

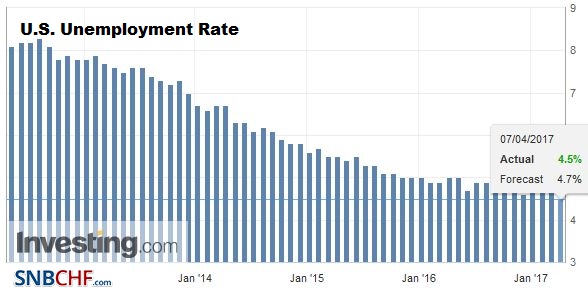

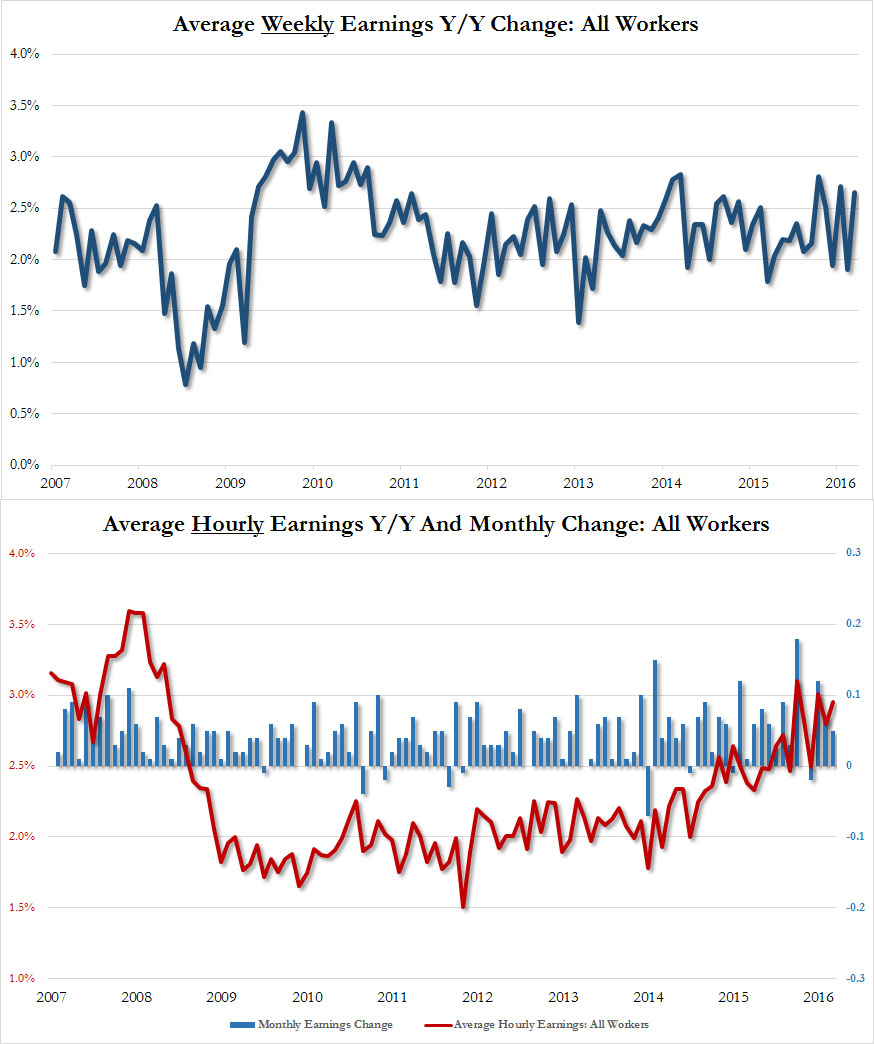

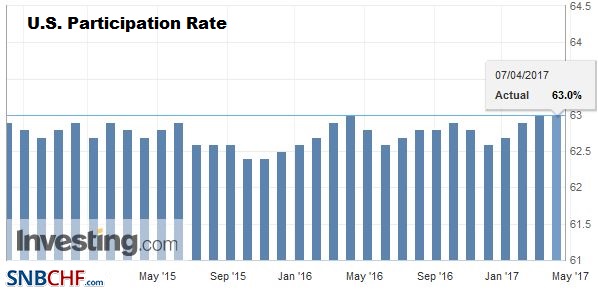

The US jobs growth slowed considerably more than expected in March and the disappointment pushed the dollar and equities initially lower. United States Nonfarm payrolls The US created 98k jobs in March, well below market expectations for around 175k jobs. Adding insult to injury, revisions to the January and February data took off another 38k job. U.S. Nonfarm Payrolls, March 2017(see more posts on U.S. Nonfarm Payrolls, ) Source: investing.com - Click to enlarge Unemployment Rate However, there were a couple of bright spots. First, the unemployment unexpectedly fell to 4.5% from 4.7%. This is a new cyclical low. U.S. Unemployment Rate, March 2017(see more posts on U.S. Unemployment Rate, ) Source: investing.com - Click to enlarge Average Hourly Earnings Wage growth also failed to meet expectations as the year-over-year pace slowed to 2.7% from 2.8%. U.S. Average Hourly Earnings, March 2017(see more posts on U.S. Average Earnings, ) Source: zerohedge.com - Click to enlarge Participation Rate Most importantly, the decline in the unemployment rate was recorded even though the participation rate was unchanged at 63%. Also, the underemployment rate fell to 8.9%, which is also a new cyclical low. Those taking part-time work, even though full-time work is desired, fell by 151k. U.S.

Topics:

Marc Chandler considers the following as important: CAD, Canada, Canada Employment Change, Canada participation rate, Canada unemployment rate, EUR, Featured, FX Trends, jobs, JPY, newsletter, U.S. Average Earnings, U.S. Nonfarm Payrolls, U.S. participation rate, U.S. unemployment rate, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The US jobs growth slowed considerably more than expected in March and the disappointment pushed the dollar and equities initially lower.

United StatesNonfarm payrollsThe US created 98k jobs in March, well below market expectations for around 175k jobs. Adding insult to injury, revisions to the January and February data took off another 38k job. |

U.S. Nonfarm Payrolls, March 2017(see more posts on U.S. Nonfarm Payrolls, ) Source: investing.com - Click to enlarge |

Unemployment RateHowever, there were a couple of bright spots. First, the unemployment unexpectedly fell to 4.5% from 4.7%. This is a new cyclical low.

|

U.S. Unemployment Rate, March 2017(see more posts on U.S. Unemployment Rate, ) Source: investing.com - Click to enlarge |

Average Hourly EarningsWage growth also failed to meet expectations as the year-over-year pace slowed to 2.7% from 2.8%. |

U.S. Average Hourly Earnings, March 2017(see more posts on U.S. Average Earnings, ) Source: zerohedge.com - Click to enlarge |

Participation RateMost importantly, the decline in the unemployment rate was recorded even though the participation rate was unchanged at 63%. Also, the underemployment rate fell to 8.9%, which is also a new cyclical low. Those taking part-time work, even though full-time work is desired, fell by 151k. |

U.S. Participation Rate, March 2017(see more posts on U.S. Participation Rate, ) Source: investing.com - Click to enlarge |

There are two drivers of the slower job growth. First, jobs growth in January and February exaggerated the underlying of hiring. Second, the weather seemed to skew the data. February was the second warmest February on record, and then the winter storm that struck East Coast in March. Both elements seemed evident in the construction sector. After a 59k hiring spree in February, job growth slowed to a mere 6k. Retailers also seemed to be similarly impacted. A combination of macro considerations (slower consumption in Q1 after a robust Q4 16) and weather led to a 30k job loss.

US yields have softened, and the 10-year yield is holding a little above the 2.30% level that has represented a floor. The dollar initially fell on the news but has recovered those initial losses. The JPY110 continues to limit the greenback’s losses against the yen. The euro spiked to about $1.0665 before returning to the session lows near $1.0610. The Canadian dollar is the strongest of the majors, gaining about 0.35% against the US dollar, and is trading at new highs for the week.

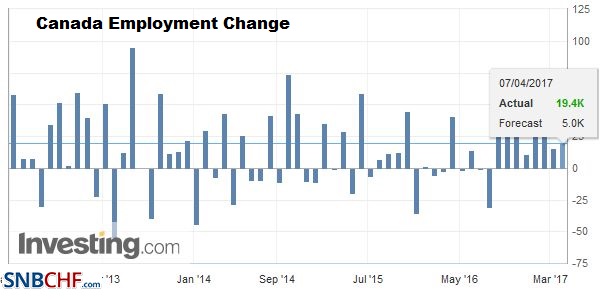

CanadaMeanwhile, Canada reported stronger jobs growth than expected in March, continuing the string of robust reports. Canada created 19.4k jobs in March, more than three times the median expectation of the Bloomberg survey and more than the 15.3k jobs grown in February. These were nearly all full-time positions. |

Canada Employment Change, March 2017(see more posts on Canada Employment Change, ) Source: investing.com - Click to enlarge |

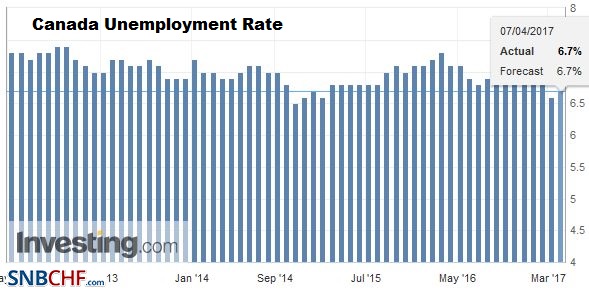

| The cloud in the silver lining was the unemployment rate, which ticked up to 6.7% from 6.6%. |

Canada Unemployment Rate, March 2017(see more posts on Canada Unemployment Rate, ) Source: Investing.com - Click to enlarge |

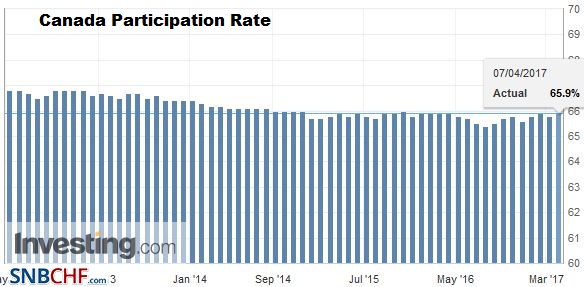

| As the participation rate rose to 65.9% from 65.8.%. |

Canada Participation Rate, March 2017(see more posts on Canada Participation Rate, ) Source: Investing.com - Click to enlarge |

Tags: #USD,$CAD,$EUR,$JPY,Canada,Canada Employment Change,Canada Participation Rate,Canada Unemployment Rate,Featured,jobs,newsletter,U.S. Average Earnings,U.S. Nonfarm Payrolls,U.S. Participation Rate,U.S. Unemployment Rate