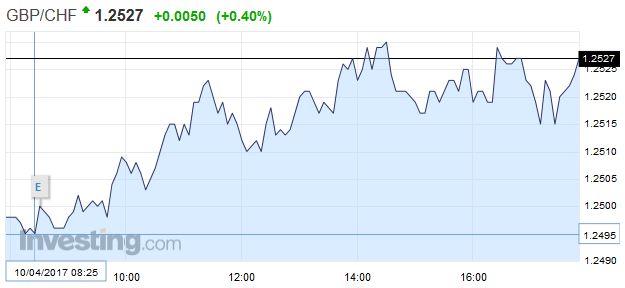

Swiss Franc EUR/CHF - Euro Swiss Franc, April 10(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The Pound and the Swiss Franc have had a strange relationship since the missile strike by the US on a Syrian Government airbase last week. Pound to Swiss Franc exchange rates plummeted before recovering and then exceeding expectations as we entered into the weekend. The ‘anomaly’ as some are now calling it, was a surge in Swiss Franc strength for a few hours in the initial reaction to the strike, but then the markets corrected themselves back to pre-strike levels once it was concluded that this was a single strike, and not an long-term escalation in the US’s involvement in the conflict. The Swiss Franc is a safe-haven currency, so tends to benefit heavily in reaction to events which spark strong market concern. So this blip created great, short-lived and sudden opportunities for Swiss Franc sellers. However, Sterling exchange rates rallied throughout the rest of the day with strong service sector confidence data. Given that this is the engine room of the British economy, it is no surprise the Pound’s value reacted in a positive manner to the news. This has continued into today, with GBP/CHF now trading just above 1.25.

Topics:

Marc Chandler considers the following as important: EUR, Featured, France, FX Trends, JPY, Korea, newslettersent, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

EUR/CHF - Euro Swiss Franc, April 10(see more posts on EUR/CHF, ) |

GBP/CHFThe Pound and the Swiss Franc have had a strange relationship since the missile strike by the US on a Syrian Government airbase last week. Pound to Swiss Franc exchange rates plummeted before recovering and then exceeding expectations as we entered into the weekend. The ‘anomaly’ as some are now calling it, was a surge in Swiss Franc strength for a few hours in the initial reaction to the strike, but then the markets corrected themselves back to pre-strike levels once it was concluded that this was a single strike, and not an long-term escalation in the US’s involvement in the conflict. The Swiss Franc is a safe-haven currency, so tends to benefit heavily in reaction to events which spark strong market concern. So this blip created great, short-lived and sudden opportunities for Swiss Franc sellers. However, Sterling exchange rates rallied throughout the rest of the day with strong service sector confidence data. Given that this is the engine room of the British economy, it is no surprise the Pound’s value reacted in a positive manner to the news. This has continued into today, with GBP/CHF now trading just above 1.25. The next hurdle governing the pair will be UK inflation data to be released tomorrow, and if the reading suggests an imminent interest rate hike in the UK, then it is likely this rally will continue. |

GBP/CHF - British Pound Swiss Franc, April 10(see more posts on GBP/CHF, ) |

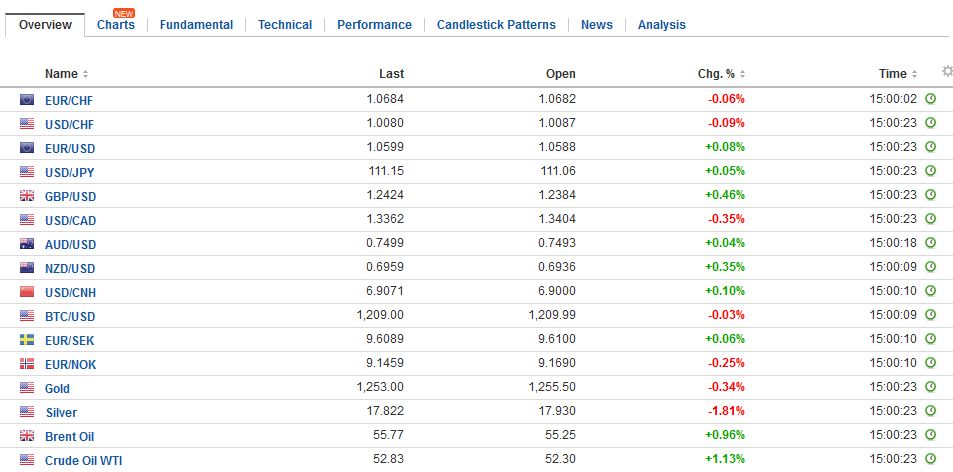

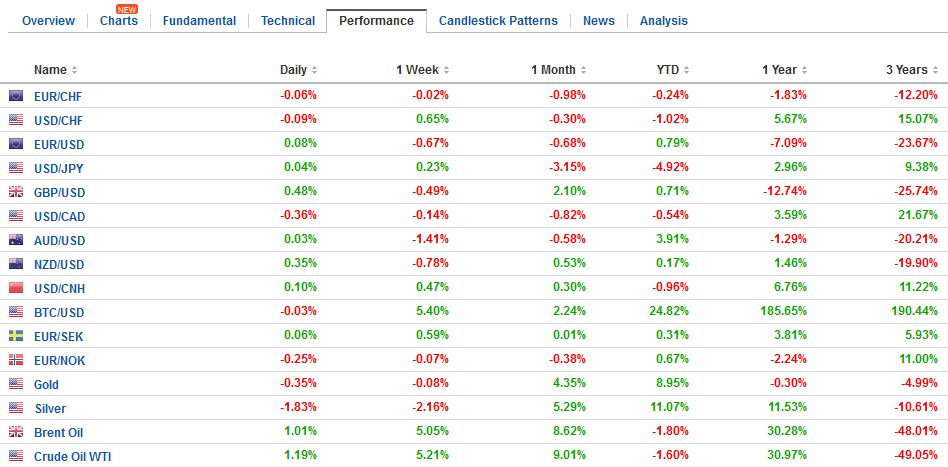

FX RatesThe US dollar is narrowly mixed after a brief attempt in Asia to extend its pre-weekend gains fizzled, and a consolidative tone has emerged. The news stream is light and largely limited to the current Japanese account and the Sentix survey from Europe. Geopolitical anxiety is still running high, and the South Korean won and Kospi bore the brunt. The Korean won is the weakest of the Asian currencies, losing 0.7%, only “bested” by the South African rand, which is off nearly 1%. The won has fallen for five consecutive sessions and nine of the past 10 sessions. The Kospi is off nearly 0.9%, while small-cap stocks were hit even harder. It is the fifth consecutive decline as well. The yen, which is often seen as a safe haven, is the weakest of the major currencies today, losing about 0.2% to reach its lowest level this month. The US dollar approached the 20-day moving average(~JPY111.70). The greenback had not closed above this moving average since the day before the Fed hiked rates in the middle of last month. The recovery in US yields before the weekend seems like the most important driver. It is the third consecutive session of dollar gains against the yen. The Nikkei advanced 0.7%, the most since March 28, led by financials, consumer discretionary, and information technology sectors. |

FX Daily Rates, April 10 |

| The euro was sold through $1.06 before the weekend, and outside of early Asian-Pacific activity, has been unable to resurface that level. It is now pushing through a trend line connecting the January and early March lows which held after the US jobs data. It is seen near $1.0585 today. The $1.0555 area corresponds to the 61.8% of the Q1 rally. The $1.05 area held in late February and early March. European Sentix survey was stronger than expected at 23.9 in April, which represents a new cyclical high (since 2007). The impact was marginal as surveys and sentiment have been running ahead of the real sector.

News that the latest polls show left Melenchon surpassed Fillon in the latest polls to move into third place has spooked investors. This has seen the French premium jump over Germany. The French 2-year yield is up nearly four basis points. Italy’s 2-year yield is up nearly as much after disappointing industrial output figures. The French 10-year yield is up two basis points, and Italy is up three. German yields are off a single basis point across the curve. Yellen’s speech at the University of Michigan which will be followed by a question and answer session (live and on Twitter) is the US highlight. However, it is not until after the market’s close. US yields are a touch softer. The trend line off the year’s high and the mid-March high is found near 101.55, which may be tested today or tomorrow. |

FX Performance, April 10 |

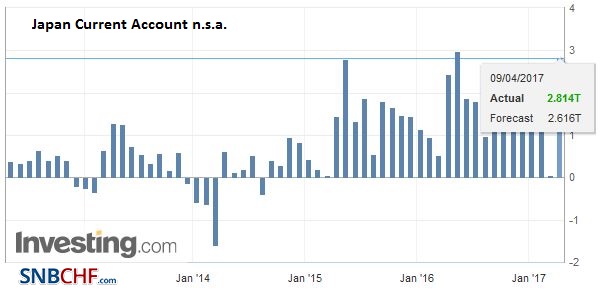

JapanThe current account surplus was largest than expected at JPY 2.81 trillion. The trade surplus of JPY1.08 trillion was larger than expected by JPY100 bln, but the other 2/3 of the surprise comes from the primary income balance (interest and dividends from past foreign investment). Although Japan does not export much more than the US as a percentage of GDP, its external sector provides what impetus there is for growth with a shrinking population. The better performing external sector should underpin capex and industrial output, both of which will be reported later this week. |

Japan Current Account n.s.a. March 2017(see more posts on Japan Current Account n.s.a., ) Source: Investing.com - Click to enlarge |

Tags: #USD,$EUR,$JPY,Featured,France,Korea,newslettersent