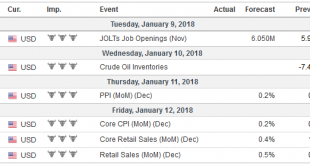

The investment climate is being shaped by two powerful forces. First is the very accommodative policy stance. This includes the United States, where despite delivering the fifth rate hike in the cycle, adjusted by headline CPI, remains negative. The balance sheet has begun being reduced, financial conditions in the US are easier now than a year ago. The ECB’s bond purchase program, which has been cut in half to 30 bln...

Read More »Italian Election–Two Months and Counting

- Click to enlarge Germany does not have a government, though the election was more than three months ago. Spain, Portugal, and Ireland have minority governments. Austria is the first government since the financial crisis to include the populist right. The EU is trying to press the Visegrad group of central European countries to conform to the values of Western European members. And yet it is Italian politics...

Read More »FX Daily, January 05: Dollar Given Reprieve Ahead of Employment Report

Swiss Franc The Euro has risen by 0.04% to 1.1753 CHF. EUR/CHF and USD/CHF, January 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates As the US dollar finished last year, so too did it begin the New Year, and after extending its losses, the bears have paused. Technical factors had been stretched, but it appears to have been old-fashioned macroeconomic considerations to...

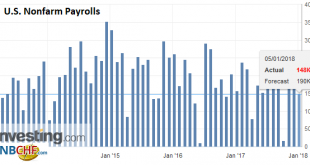

Read More »Headline US Jobs Disappoint, but Earnings as Expected

United States The headline US non-farm payrolls disappointed, rising by 148k instead of the consensus of 180k-200k. However, the other details were largely as expected and are unlikely to change views about the trajectory of Fed policy or the general direction of markets. It is a very much steady as she goes story. The headline miss is not really made up for by the upward revision in the November series from 228k to...

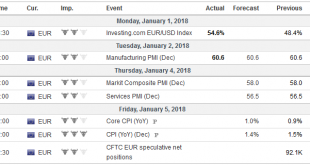

Read More »FX Daily, January 04: Greenback Continues to Consolidate Recent Losses

Swiss Franc The Euro has risen by 0.37% to 1.1755 CHF. EUR/CHF and USD/CHF, January 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is sporting a softer profile across the board, though remaining largely in the ranges seen over the past couple of sessions. At the same time, the news stream suggests that the global synchronized growth cycle strengthened...

Read More »Cool Video: Is the Third Major Dollar Rally Since Bretton Woods Over?

- Click to enlarge To many, the question about the fate of the third major dollar rally since the end of Bretton Woods was resolved last year. The dollar fell broadly. It marked the end the greenback’s ride higher. However, I remain less convinced that this is really the case. And that is what I discuss in this three-minute clip from Bloomberg’s What’d You Miss. What I focused on (here) was two-fold. First, that...

Read More »FX Daily, January 03: Dollar Stabilizes, but Sees Little Recovery

Swiss Franc The Euro has risen by 0.37% to 1.1755 CHF. EUR/CHF and USD/CHF, January 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is stabilizing but the tone remains fragile. The euro, which has advanced for five consecutive sessions coming into today is slightly lower. The euro had stalled yesterday as it approached last year’s high set in September...

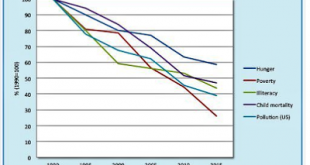

Read More »Great Graphic: Progress

The world looks like a mess. While the economy appears to be doing better, disparity of wealth and income has grown. Debt levels are rising. Protectionism appears on the rise. Global flash points, like Korea, Middle East, Pakistan, Venezuela are unaddressed. At the same time, this Great Graphic tweeted by @DinaPomeranz, with a hat tip to @bill_easterly is a helpful corrective. The clear decline in hunger, poverty,...

Read More »Great Graphic: Progress

The world looks like a mess. While the economy appears to be doing better, disparity of wealth and income has grown. Debt levels are rising. Protectionism appears on the rise. Global flash points, like Korea, Middle East, Pakistan, Venezuela are unaddressed. At the same time, this Great Graphic tweeted by @DinaPomeranz, with a hat tip to @bill_easterly is a helpful corrective. The clear decline in hunger, poverty,...

Read More »The Past is Not Passed: 2017 Spills into 2018

The New Year may have begun in fact, but in practice, full participation may return only after the release of US employment data on January 5. The macroeconomic and policy tables have been set, though interpolating from the Overnight Index Swaps market, there is 45% chance the Bank of Canada hikes rates at its policy meeting near the middle of the month. In the currency markets, sentiment appears to be as uniformly...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org