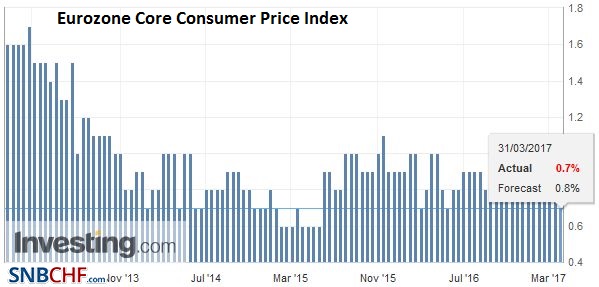

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The reverse carry trade in form of the Long CHF started and lasted - without some interruptions - until the peg introduction in September 2011. In mid 2011, the long CHF trade became a proper carry trade - and not a reverse carry trade anymore - because investors thought that the SNB would hike rates earlier than the Fed. CHF Speculative Positions Last data as of April 4: Speculators reduced their net short euro exposure until March 21. Apparently they do not understand the difference between core inflation and the headline figure. Speculative Positions Choose Currency[embedded content] source: Oanda After March 28, Eurozone inflation data was released. Core inflation has even fallen from 0.9 to 0.7%; therefore a ECB rate hike will not come soon. For the next weeks, we expect a move into euro shorts. In the last week, speculators reduced their CHF net short position to 13K contracts (against USD).

Topics:

George Dorgan considers the following as important: Commitment of Traders, Featured, FX Trends, newslettersent, Speculative Positions

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancSpeculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts.The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The reverse carry trade in form of the Long CHF started and lasted - without some interruptions - until the peg introduction in September 2011. In mid 2011, the long CHF trade became a proper carry trade - and not a reverse carry trade anymore - because investors thought that the SNB would hike rates earlier than the Fed. CHF Speculative PositionsLast data as of April 4: Speculators reduced their net short euro exposure until March 21. Apparently they do not understand the difference between core inflation and the headline figure. |

Speculative PositionsChoose Currency source: Oanda |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| After March 28, Eurozone inflation data was released. Core inflation has even fallen from 0.9 to 0.7%; therefore a ECB rate hike will not come soon. For the next weeks, we expect a move into euro shorts.

In the last week, speculators reduced their CHF net short position to 13K contracts (against USD). |

As European Core Inflation Remains Low, EUR/CHF May Tend Towards Parity(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The traditional focus of speculative activity in the futures market has been the net positioning between the outstanding open long and short positions. While acknowledging that the net position provides useful information, we find the changes in gross positions to be significant. The gross positions are what needs to be adjusted on a short move, not the net position. This observation seems particularly relevant when reviewing the speculative positioning in the CFTC reporting week ending April 4. A clear pattern is evident. Speculators reduced gross long and gross short positions in the euro, yen, sterling and Swiss franc. They mostly added to positions among the dollar-bloc currencies and the Mexican peso. There was one exception. The gross long Australian dollar position was trimmed by 600 contracts to 90.2k. The bears were consistently more aggressive than the bulls. There were two gross position adjustment that reached the 10k contract threshold. They were both among the dollar-bloc currencies and both were adding to gross shorts. The bears increased their gross short Canadian dollar position by 10.1k contracts to 68.8k. The bears raised their gross short peso position to 90.7k contracts, a 13.2k contract increase. The position adjusting among the dollar-bloc currencies resulting in an increase in the net short position, or in the Australian dollar’s case, a smaller net long position. Among the majors, the net short position was reduced, except in the euro, where the net short position rose to 11.4k contracts from 7.9k. Speculators continued to unwind the record net short position that peaked at the end of February near 410k contacts. The bears covered nearly 32k contracts to reduce the gross short position to 669.5k contracts. The bulls took some profits and liquidated 18.0k contracts, leaving 613.7k. These adjustments caused the net short position to fall to 55.8k contracts from 69.7k. |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tags: Commitment of Traders,Featured,newslettersent,Speculative Positions