The step away from the edge of the abyss may have stirred the animal spirits, but it remains precarious at best. The formal withdrawal of the extradition bill in Hong Kong is too late and too little at this juncture. The ambitions of the protests have evolved well beyond that. Italy has a new government, but a prolonged honeymoon is unlikely for this unlikely union. Face-to-face talks between the US and China are better than no talks but hardly indicates an end to...

Read More »FX Daily, August 28: Optimism about Italy Creeps Back in but Sterling Heads the Opposite Way on Brexit Realities

Swiss Franc The Euro has fallen to 1.0872 or by 0.09%. EUR/CHF and USD/CHF, August 28(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets have turned quiet. There have been no more headline bombs about trade, and China set the dollar’s reference rate much lower than projected. Asia Pacific equities were mixed. Hong Kong, China, India, and Singapore were on the downside, while Taiwan,...

Read More »THE FED’S CAPITULATION: WHAT IT MEANS FOR GOLD INVESTORS

“Perhaps they think that they will exercise power for the generall good, but that is what all those with power have believed. Power is evil in itself, regardless of who exercises it.” – Ludwig von Mises, Nation, State, and Economy After the Federal Reserve’s monetary policy U-turn earlier this year and the central bank’s decision to cut interest rates for the first time in a decade, mainstream investors and analysts believe that holding rates lower and for...

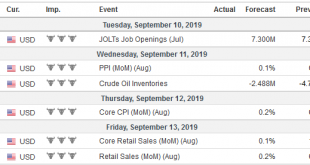

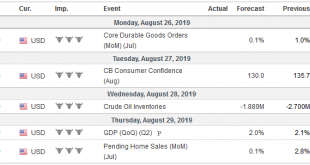

Read More »FX Weekly Preview: The Week Ahead is not about the Week Ahead

It’s the last week of August. Several economic reports will be released in the coming days. They include the US deflator of consumer expenditures that the Federal Reserve targets, China’s PMI, and the eurozone’s preliminary August CPI. It is not that the data do not matter, but investors realize the die is cast. They are looking further afield. The next US tax increase on Chinese imports goes into effect on September 1, and Beijing has threatened to retaliate. The...

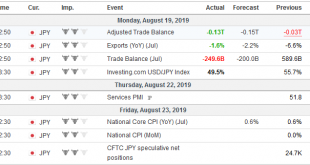

Read More »FX Daily, August 23: Market has Second Thoughts on Magnitude of Fed Cuts Ahead of Powell

Swiss Franc The Euro has fallen by 0.07% to 1.0887 EUR/CHF and USD/CHF, August 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Powell speech at Jackson Hole stands before the weekend. Equities in Asia and Europe are finishing the week on a firm tone. Most markets in the Asia Pacific region closed higher today, and the MSCI Asia Pacific Index snapped a four-week slide. European bourses are edging higher, and...

Read More »FX Daily, August 21: European Stocks Snap Back, Market Hopeful Italian Election can be Delayed

Swiss Franc The Euro has risen by 0.27% to 1.0882 FX Rates The end of the US equity three-day advance yesterday weighed on Asia Pacific shares today. Most benchmarks fell. Better than expected trade data helped Thailand buck the trend. A firmer tone emerged in the European morning, and the Dow Jones Stoxx 600 has recouped yesterday’s losses and more. It was led higher by consumer discretionary, energy, and industrials. US shares are also trading firmer today,...

Read More »FX Weekly Preview: A Vicious Cycle Grips Markets

The capital markets are in their own doom loop. Poor data from Germany and China, coupled with the escalation of the US-China trade dispute and rising tensions in Hong Kong spur concerns about the risks of a global recession. Interest rates are driven lower, and curves flatten or go inverted, spurring more concern about the outlook. The problem is that it is not clear how this vicious cycle ends. To be sure, the end is conceivable but it seems beyond which the...

Read More »FX Weekly Preview: Macro Deterioration

The US-China tensions remain the dominant driver of investor risk appetites. President Trump has repeatedly accused China of manipulating its currency on twitter, and finally Treasury Secretary Mnuchiin acquiesced after China failed to prevent the dollar from rising above CNY7.0. China set the reference rate for the dollar lower than models based on the basket the PBOC uses implied for the past three sessions, and this...

Read More »FedNow and Fedwire

The Federal Reserve Banks will develop a round-the-clock real-time payment and settlement service, FedNow. The objective is to support faster payments in the United States. From the FAQs (my emphasis): … there are some faster payment services offered by banks and fintech companies in the United States, their functionality can be limited. In particular, due to the lack of a universal infrastructure to conduct faster payments, most of these services rely on “closed-loop” approaches, meaning...

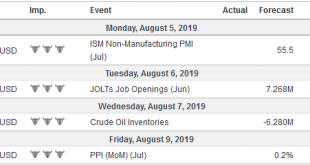

Read More »FX Weekly Preview: The Dog Days of August are Upon Us

The die is cast. To defend the uneven expansion and ward off disinflationary forces, monetary authorities will provide more accommodation. The Federal Reserve delivered its first rate cut in more than a decade and stopped unwinding its balance sheet two months earlier than it previously indicated (worth $100 bln of additional buying of Treasuries and Agencies). Following the end of the tariff truce, and after the July...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org