Many high-income countries experienced little growth but strong price pressures in the 1970s. Since the mainstream economics said the two were mutually exclusive, a new term had to be created, hence stagflation. Fast forward almost half a century later, and mainstream economists are still having a problem deciphering the linkages between prices and economic activity, such as inflation and employment. Theory needs to accommodate the new facts. Theory is being...

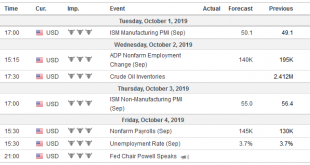

Read More »FX Daily, October 2: Greenback Shows Resiliency, Stocks Don’t

Swiss Franc The Euro has risen by 0.66% to 1.0928 EUR/CHF and USD/CHF, October 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Shockingly poor ISM data sent shivers through the market on Tuesday and hand the S&P 500 its biggest loss in five weeks and took the shine off the greenback. The S&P 500 reached a five-day high before reversing course and cast a pall over today’s activity. All the markets were...

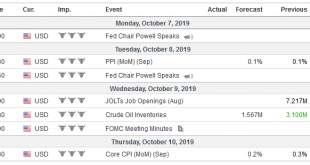

Read More »FX Weekly Preview: Forces of Movement at the Start of Q4 19

United States The world’s largest economy appears to have grown by about 2% in Q3 at an annualized pace, the same as in Q2, and in line with what many Fed officials understand to be trend growth. The strength of the US labor market underpins consumption, the powerful engine of the US economy. The latest readings of both the labor market and consumption will highlight the economic data in the week ahead. The strength of the recent housing data (starts and sales)...

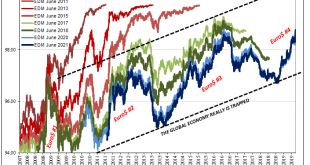

Read More »Treasury Bond Backwardation, Report 22 Sep

Something happened in the credit market this week. A Barron’s article about it began: “There have been disruptions in the plumbing of U.S. markets this week. While the process of fixing them was bumpy, it was more of a technical mishap than a cause for investor concern.” Keep Calm and Carry On So, before they tell us what happened, they tell us it’s just plumbing, it’s been fixed, and that we should not be concerned. The article asserts that the reasons for the...

Read More »FX Daily, September 20: UK and India Provide Excitement Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.25% to 1.0932 EUR/CHF and USD/CHF, September 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A word of optimism on a Brexit deal has sent sterling to its best level in two months. Corporate tax cuts sparked a more than 5% rally in Indian stocks as the week draws to a close. The MSCI Asia Pacific Index snapped a four-day losing streak to pare this week’s decline. Europe’s...

Read More »FX Daily, September 19: Investors Looking for New Focus

Swiss Franc The Euro has fallen by 0.22% to 1.0975 EUR/CHF and USD/CHF, September 19(see more posts on EUR/CHF, USD/CHF, ) - Click to enlarge FX Rates Overview: Central bank activity is still very much the flavor of the day, but investors are looking for the next focus. The Bank of Japan and the Swiss National Bank stood pat, while Indonesia cut for the third consecutive time and the Hong Kong Monetary Authority and Saudi Arabia quickly followed the Fed. Brazil...

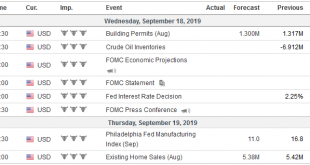

Read More »FX Daily, September 18: FOMC Meets Amid Money Market Pressures

Swiss Franc The Euro has risen by 0.05% to 1.10 EUR/CHF and USD/CHF, September 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: News that Saudi Arabia was able to restore 40%-50% of the oil capacity lost by the weekend strike coupled with the Fed’s efforts to offset the squeeze in the money markets are allowing the global capital markets to trade quietly ahead of the conclusion of the FOMC meeting. Equities...

Read More »FX Weekly Preview: Six Things to Watch in the Week Ahead

The prospect of a third trade truce between the US and China helped underpin the optimism that extended the rally in equities. Bond yields continued to back-up after dropping precipitously in August, led by a more than 30 bp increase in the US yield benchmark. The Dollar Index fell for the second consecutive week, something it had not done this quarter. United States The Federal Reserve’s meeting on September 18 is the most important calendar event in the week...

Read More »Your Unofficial Europe QE Preview

The thing about R* is mostly that it doesn’t really make much sense when you stop and think about it; which you aren’t meant to do. It is a reaction to unanticipated reality, a world that has turned out very differently than it “should” have. Central bankers are our best and brightest, allegedly, they certainly feel that way about themselves, yet the evidence is clearly lacking. When Ben Bernanke wrote for the Washington Post in November 2010 announcing somehow the...

Read More »FX Daily, September 13: Bonds and the Dollar Remain Heavy Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.19% to 1.0932 EUR/CHF and USD/CHF, September 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets are digesting ECB’s actions and an easing in US-Chinese rhetoric. Next week features the FOMC meeting and three other major central banks (Japan, Switzerland, and Norway). The US equity rally that saw the S&P 500 edge closer to the record high set in late July...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org