Overview: The fire that burnt through the capital markets before the weekend, triggered by the new Covid mutation, burned itself out in the Asian Pacific equity trading earlier today. A semblance of stability, albeit fragile and tentative, has emerged. Europe's Stoxx 600 is up about 1%, led by real estate, information technology, and energy. US index futures are trading higher, with the NASDAQ leading. Benchmark 10-year yields are firmer. The US 10-year Treasury...

Read More »Jobs (US) and Inflation (EMU) Highlight the Week Ahead

The new covid variant and quick imposition of travel restrictions on several countries in southern Africa have injected a new dynamic into the mix. It may take the better part of the next couple of weeks for scientists to get a handle on what the new mutation means and the efficacy of the current vaccination and pill regime.The initial net impact has been to reduce risk, as seen in the sharp sell-off of stocks. Emerging market currencies extended their losses. ...

Read More »“CBDC: Considerations, Projects, Outlook,” CEPR/VoxEU, 2021

CEPR eBook, November 24, 2021. HTML. VoxEU, November 24, 2021. HTML. Retail central bank digital currency has morphed from an obscure fascination of technophiles and monetary theorists into a major preoccupation of central bankers. Pilot projects abound and research on the topic has exploded as private sector initiatives such as Libra/Diem have focused policymakers’ minds and taken the status quo option off the table. In this eBook, academics and policymakers review what we know...

Read More »FX Daily, November 9: Falling Yields Give the Yen a Boost

Swiss Franc The Euro has risen by 0.09% to 1.0587 EUR/CHF and USD/CHF, November 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Reports that the Fed’s Brainard was interviewed for the Chair helped soften yields a bit, not that they needed extra pressure, on ideas she is more dovish than Powell. In turn, the lower yields saw the yen rise to its best level in nearly a month and led the major currencies higher...

Read More »Bill Issuance Has Absolutely Surged, So Why *Haven’t* Yields, Reflation, And Other Good Things?

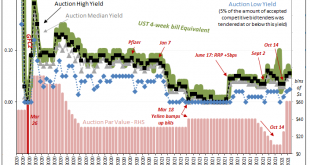

Treasury Secretary Janet Yellen hasn’t just been busy hawking cash management bills, her department has also been filling back up with the usual stuff, too. Regular T-bills. Going back to October 14, at the same time the CMB’s have been revived, so, too, have the 4-week and 13-week (3-month). Not the 8-week, though. Of the first, it’s been a real tsunami at this tenor, too. Up to early August, Treasury had regularly (weekly) sold $40 billion in one-month paper. From...

Read More »A Short Note on the Pricing of the Fed Funds Futures: Aggressive

In assessing the trajectory of Fed policy the market is discounting, we prefer using the Fed funds futures contracts over the Eurodollar futures. The Fed funds settle at the average effective rate, while the Eurodollar futures contracts are three-month deposit rates. The Fed funds futures seem to be implying aggressive tightening by the Federal Reserve, which as of less than a month ago, half of whom did not expect a rate hike would be appropriate next year. The...

Read More »The Inflation Tide is Turning!

In our post on January 28, 2021 “Gold, The Tried-and-True Inflation Hedge for What’s Coming!” we outlined four reasons that we expect higher inflation over the next several years. The brief bullet points are: Money Supplies have risen dramatically Commodity Prices are rising again Reduced Globalization as ‘Made at Home’ policies are proliferating Pent up demand Headlines such as this one last week from Bloomberg “Inflation gauge Hits Highest Since 1991 as Americans...

Read More »Soaring Energy Prices Lift Yields, Weigh on Equities and the Greenback Pops

Overview: Rising energy prices and yields are helping lift the US dollar and weighing on equities. November WTI has pushed above $76, while Brent traded above $80, and natural gas is up for the fourth consecutive session, during which time it has risen by about 25%. The US 10-year yield has surged to almost 1.53%, up more than 20 bp since the middle of last week. Near 32 bp, the US 2-year yield is at a new 18-month high. European yields are 3-5 bp higher, with...

Read More »Taper, No Tantrum

Overview: The market's reaction to the FOMC statement was going according to our script, with the dollar backing off on a buy rumor sell the fact type of activity until Powell provided an end date for the tapering (mid-2022) before providing a start date (maybe next month). This spurred a dollar rally. Equities pulled back but recovered. The dollar is paring its gains today. It is lower against the other major currencies, but the yen, and the euro, which had...

Read More »50 years since the closure of the “gold window”

Part II of IV by Claudio Grass The lasting impact of the Nixon Shock The economic and monetary consequences of Nixon’s decision to end the convertibility of the US dollar to gold are as numerous as they are severe. It marked the start of five decades of monetary and fiscal insanity and it unleashed unprecedented borrowing and deficit spending sprees. Debt-fueled “growth” became the name of the game and currency manipulation came to define both political strategies and central...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org